COFACE: CEE countries witnesses „a dramatic surge” in company insolvencies throughout 2023. The economic performance in the region will remain below its potential in 2024.

Nine countries experienced a higher number of insolvencies (Czech Republic, Estonia, Hungary, Lithuania, Poland, Serbia, Slovakia, Slovenia and three countries recorded a decrease (Bulgaria, Croatia and Latvia). In Romania insolvencies in 2023 remained at the same level of 2022.

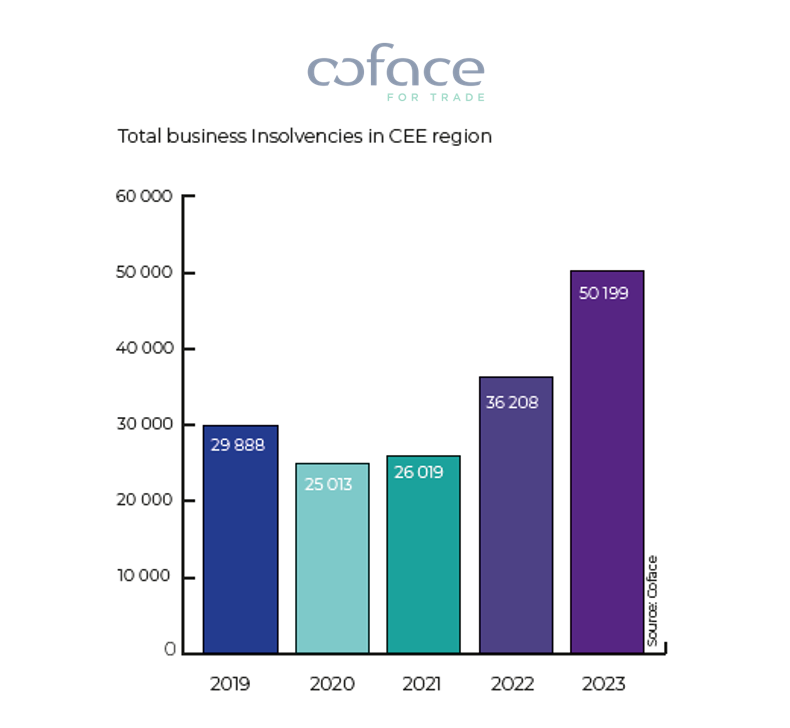

In the wake of an economic downturn, Central and Eastern European (CEE) countries witnessed a dramatic surge in company insolvencies throughout 2023. While businesses initially weathered the storm with government support measures during the pandemic, the subsequent withdrawal of these initiatives combined with macroeconomic pressures drove insolvency rates to new heights.

The economic downturn resulted in a drop of the region´s average GDP growth from 4.0% in 2022 to only 0.5% in 2023, resulting in the lowest rate this century (excluding the 2009 global financial crisis and the Covid-19 pandemic in 2020). Czechia, Estonia, Hungary, Latvia and Lithuania even recorded negative growth rates in 2023.

Insolvencies in Romania

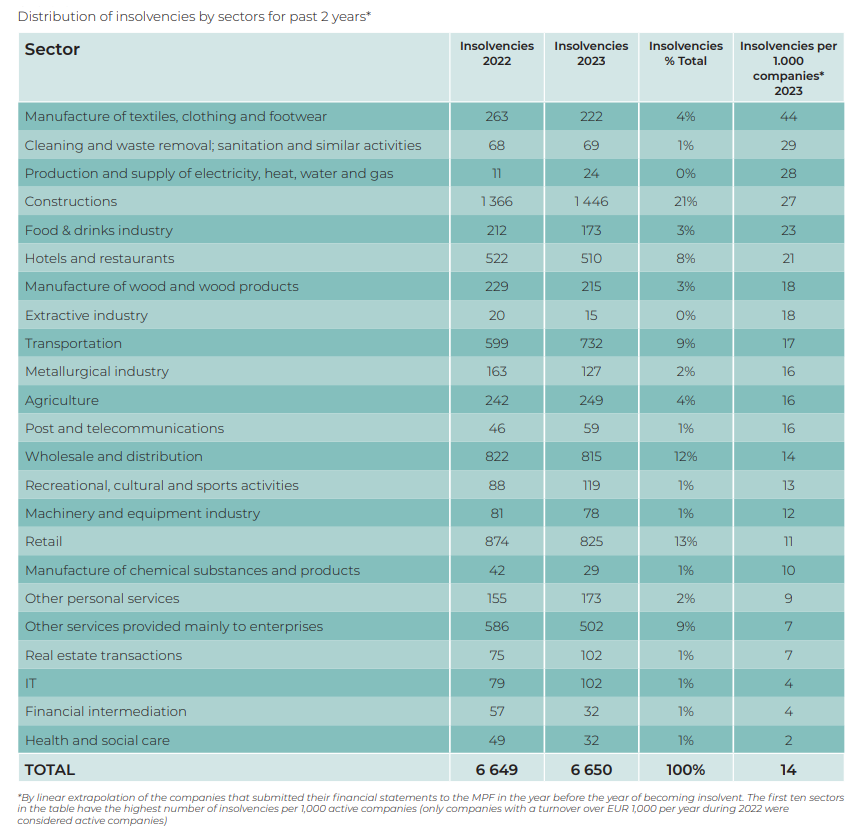

According to the data published by the Romanian National Trade Register Office (NTRO), insolvency procedures were initiated for 6,650 trade companies in 2023. It is a result that reflects a 0% increase as compared to 2022 (6,649 insolvencies) and 2% as compared to 2019, when insolvency procedures were initiated for 6,524 companies .It can be noticed that over the past 5 years, the number of insolvencies has been relatively constant, and the quarterly dynamics over the past 2 years has almost equalled 0%, which shows a certain stability of the Romanian entrepreneurial sector.

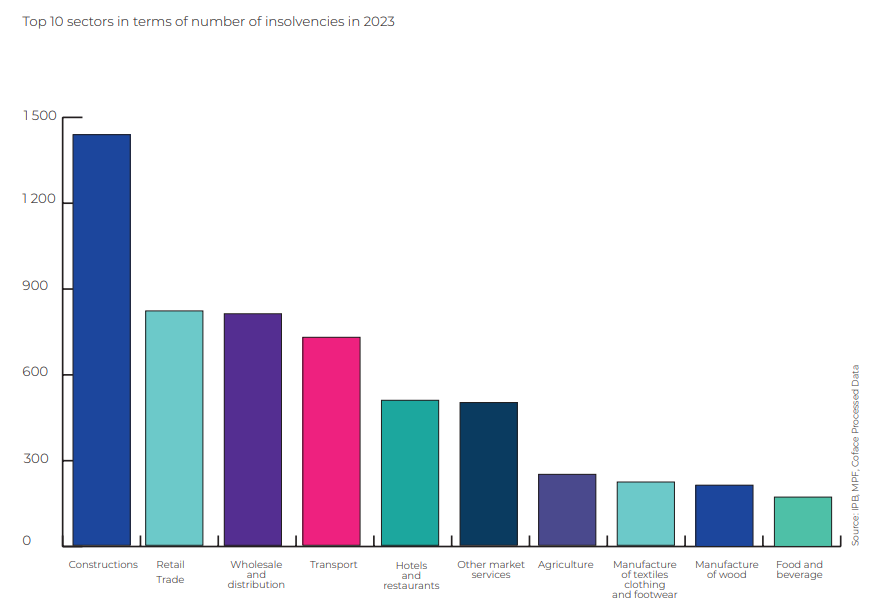

Just as in the past few years, the first 3 sectors by the number of companies filing for insolvency (constructions, retail sales, wholesales, and distribution) sum up approximately 46% of the total number of insolvencies recorded in 2023. This evolution is justified by the fact that these 3 sectors account for approximately 39% of the total number of Romanian companies and thisis precisely why, for each insolvency research study carried out by Coface, we also highlight the first 10 business sectors from the perspective of the number of insolvencies/1,000 active companies.

Increase in insolvency proceedings reflects the weak economic growth

The CEE region saw a 38.6% increase in insolvency proceedings from 2022 to 2023, marking another year of double-digit growth. “This rise was fuelled by a combination of internal and external factors that amplified the challenges facing companies in the region, especially Geopolitical tensions and inflationary pressures that led companies into troubled waters”, explains Grzegorz Sielewicz, Coface’s Head of Economic Research for Central and Eastern Europe.

The consequences of Russia’s invasion of Ukraine, not least due to its geographical proximity, resonated throughout the region, disrupting supply chains and contributing to a surge in energy commodity prices. These external shocks, coupled with internal challenges such as labor shortages and escalating input costs, have weighed heavily on businesses, leading to a significant increase in insolvencies. The construction and trade sectors, in particular, bore the brunt of the insolvency wave, grappling with labor shortages, wage pressures, and slowing demand.

Looking ahead, the road to recovery appears difficult. „We expect a further increase in insolvencies in 2024, albeit at a lower rate than the previous year,” and globally, companies will still not reach their full economic growth potential as a result of challenges they face in the day-to-day running of their businesses.” adds Jarosław Jaworski, CEO of Coface in the Central & Eastern Europe Region.

„The business environment in 2024 will be marked by limited turnover growth, declining margins, and ongoing challenges for export companies due to sluggish foreign demand, particularly from Germany, which remains the main trading partner for the majority of CEE economies. However, there are signs of consumer-driven rebound, especially when it comes to daily necessities, supporting economic activity in the CEE region. Nonetheless, companies face mounting pressure from rising commodity prices and labour costs, including minimum wage hikes in CEE countries.„

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: