Without banking licence, Mondo app reached £20 million customer spend in just four months

Digital challenger bank, Mondo, has reached a £20 million spend on its mobile app just four months after moving in to a public Beta phase. Mondo launched the app to a 52,000-strong waiting list when it moved into a public Beta in March this year.

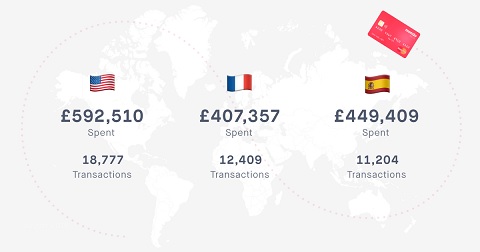

The UK new entrant reports that out of the total £20 million spend so far, around a quarter has been applied to purchases abroad, with USA, France, and Spain as the most common destinations.

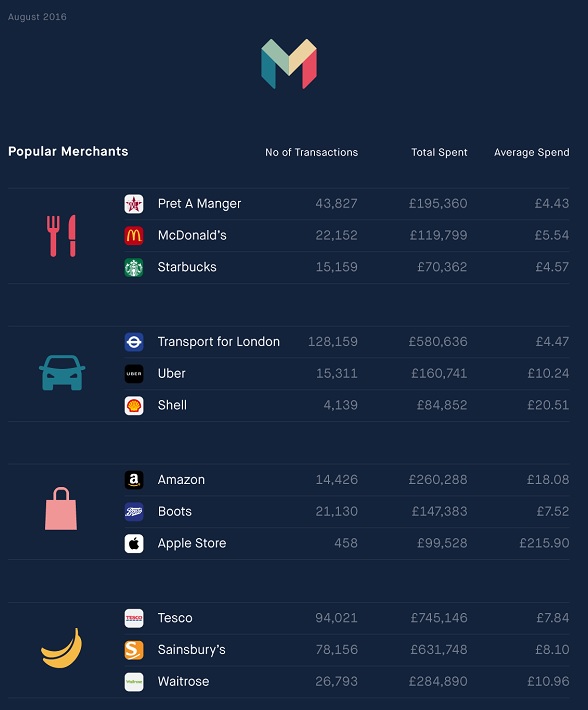

Since April, the daily spend has more than doubled, from £80,000 to £200,000, with the most popular merchants being TFL, Tesco, Amazon, and sandwich chain Pret A Manger. The platform shows personal breakdown of merchants and categories to monitor where money is being directed. Looking at the most popular merchants in each of the biggest spending categories, we’ve now seen almost £750,000 spent at Tesco alone, and over half a million spent through TfL, according to a blog post on Mondo website.

What is Mondo?

A bank for people who hate banks.

„Built for your smartphone, this is banking like never before. One that updates your balance instantly, gives intelligent notifications, and is easy to use. We’re trying to build the best bank on the planet and we want you on board. We are building a bank for people who live their lives on their smartphones. For people who want to get things done in a click and who don’t see the need for branches and cheque books. We’re focussed on building the best current account in the world and ultimately working with a range of other providers so that Mondo can be an intelligent hub for your entire financial life.”

When do you launch?

„Until we get our full banking licence later this year, we’re live with limited-edition Alpha and Beta cards (Mondo MasterCard® Prepaid Debit cards). These cards can be topped up and used at cash machines, in-store, online and at contactless terminals. They will allow us to test features with real users like you and iron out early bugs. We’ve written in more detail about what that means in practice in our blog post.

For now, your Mondo account will not have a sort code or account number which means no access to Faster Payments, Direct Debit or Standing Orders. We’re working on making these available as we move towards securing a banking licence.”

Is my money safe with Mondo?

„During our Alpha and subsequent Beta testing periods, your money will be held in a separate, protected account by Wirecard, our issuing bank. In the unlikely event Wirecard were to become insolvent, your funds would be protected against any claims made by creditors. All card transactions are processed by the MasterCard network and are protected by MasterCard rules.

Once we have our banking licence, your money will be protected by the Financial Services Compensation Scheme (FSCS) meaning that all your money up to £75,000 is guaranteed by the British Government.”

Source: getmondo.co.uk

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: