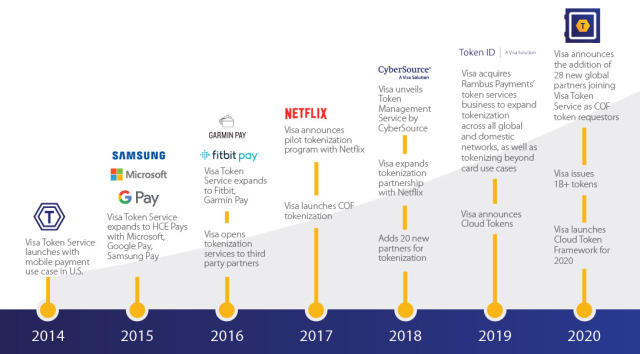

Visa today announced that the company has now issued more than 1 billion tokens worldwide through Visa Token Service (VTS), marking a major milestone in its proprietary offering to help accelerate eCommerce innovation and make payments more secure. Visa Token Service replaces a cardholder’s 16-digit Visa account number with a secure token that protects the underlying card number from fraudsters.

The rapid adoption of Visa’s tokenisation technology comes as the world’s massive shift to digital has changed the way we live, work and buy. In Asia Pacific, 41% of consumers made five or more eCommerce transactions in the past three months[1]. Three quarters of consumers in the region have said they will keep using digital payments instead of going back to cash, even after the global pandemic has subsided[2]. With digital buyers expected to hit 2.1 billion worldwide by 2021[3], Visa’s tokenisation technology will play a vital role in strengthening digital payment security globally which, is more critical now than ever before.

“As more people in Asia Pacific make their purchases online or via connected devices, there is a greater need for secure digital payments, which is why we have seen an increase in the number of tokens issued by Visa,” said Previn Pillay, Head of Digital Solutions, Asia Pacific, Visa. “Merchants who have embraced tokens tell us they see improvements in their payment success rates, which is great for both merchants and consumers. We look forward to enabling safer payment experiences for everyone, everywhere with the use of tokens.”

The 1 billion tokens milestone is another key moment in this drive to innovate, and comes on the heels of Visa naming 28 new partners to VTS as COF token requestors, set to make digital transactions more secure by tokenising both one-time and recurring payments made with Visa credentials.

###

[1] YouGov survey of 4,770 consumers in Australia, New Zealand, Hong Kong, Singapore & Malaysia from 21 to 25 May 2020, commissioned by Visa

[2]Kantar COVID-19 Barometer, fieldwork 27-31 March 2020. The study collated consumer data across 40 markets globally and 11 markets in Asia-Pacific

[3] Statista, Number of digital buyers worldwide from 2014 to 2021

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: