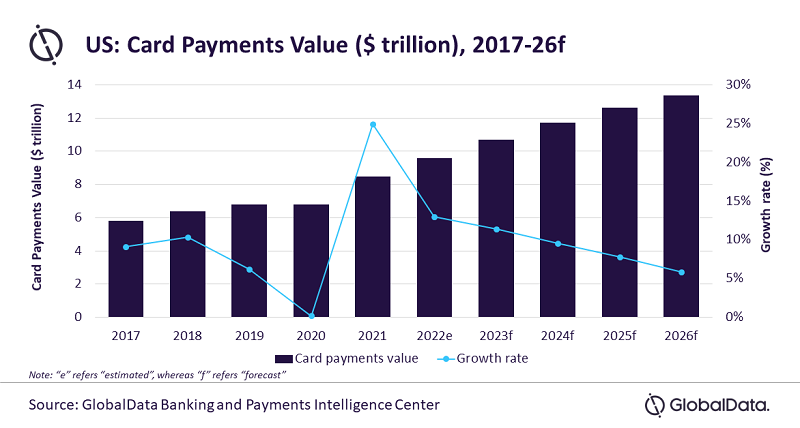

Driven by consumers’ increasing preferences for electronic payments and a rise in consumer spending, the US card payments market is expected to register a compound annual growth rate (CAGR) of 8.6% between 2022 and 2026 reaching $13.4 trillion by 2026, forecasts GlobalData, a leading data and analytics company.

GlobalData’s report, ‘US Cards and Payments: Opportunities and Risks to 2026,’ notes that the country’s card payment value registered a growth of 24.9% in 2021. This was accelerated due to the pandemic where consumer preferences shifted towards cashless methods of payment. Going forward, card payments will continue to rise in the US, with the card payment market value expected to grow by 13% in 2022 reaching $9.6 trillion.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “The US has a highly developed payment card market, meaning that the average American has four debit/credit cards. This is supported by a high level of awareness of electronic payments, combined with a well-developed payment acceptance infrastructure. Ready access to formal financial services has resulted in a population that is comfortable with credit and debit cards both in-store and online.

“In addition to high card penetration, the amount of times cards are used for payments is also high among US consumers with the frequency expected to reach 120 times per card per year in 2022 compared to the average of 102.2 uses in 2018.”

Throughout the pandemic, US consumers were increasingly using contactless debit cards. To capitalize on this trend, banks are rolling out debit cards with contactless functionality. According to a study by Discover Financial Services’ PULSE, the number of debit cards with contactless functionality in the US rose from 11% in 2019 to 30% in 2020.

With consumers becoming more comfortable shopping online, the rise in ecommerce payments also helped support market growth. Payment cards are the most preferred payment tools for ecommerce payments with GlobalData’s 2022 Financial Services Consumer Survey finding that debit, credit and charge cards collectively accounted for around one-third of total ecommerce payment value in 2022.

Traditionally, due to value-added services such as reward points, discounts and installment payment options, credit cards have always been popular in the US. However, the pandemic and the resultant economic uncertainty forced many consumers to cut down on spending, thus impacting the credit and charge card market.

Sharma concludes: “With the country’s economy now recovering and consumer spending rising, credit and charge card payment value is on the rise. The US is also seeing a real GDP growth rate of 5.7%. Growing employment has translated to steadily increasing consumer spending, which in turn is supporting card market growth. However, rising inflation and the increased interest rates have led to higher borrowing and living costs, thereby posing new challenges for card payment growth.”

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: