Study: 12% of young Europeans intentionally buy counterfeits online – Romania has a higher score

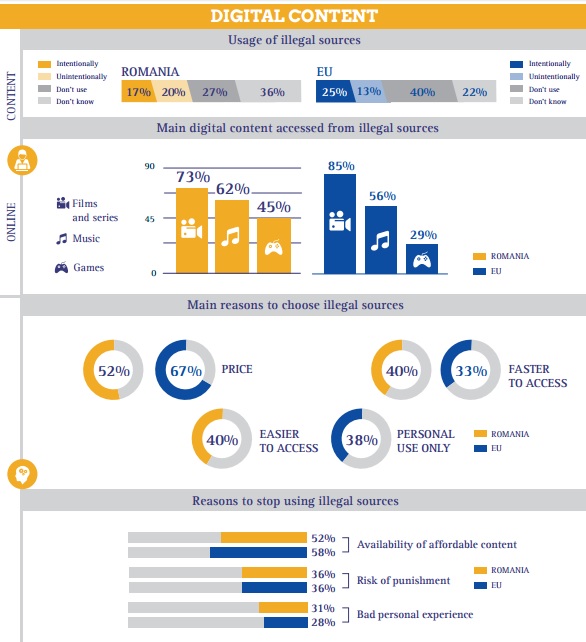

A quarter of EU citizens aged between 15 and 24 admit to intentionally using illegal sources to access online content in the past 12 months. Most say they do this because it is free, or cheaper than accessing content from legal sources, according to a new report (INSERT LINK) from the European Union Intellectual Property Office (EUIPO), which surveyed young people in each of the 28 EU Member States.

Films and series were the most accessed types of content from illegal sources, followed by music and games.

Nearly one in four believed that they were doing nothing wrong in accessing digital content from illegal sources for personal use, and a third considered that content from illegal sources was easier to find and quicker to access than content from legal sources. Six out of ten young Europeans say they would stop using illegal sources to access digital content if more affordable content from legal sources was available.

The report also shows a sharp difference in attitudes among young people between illegally accessing digital content and buying counterfeit goods online.

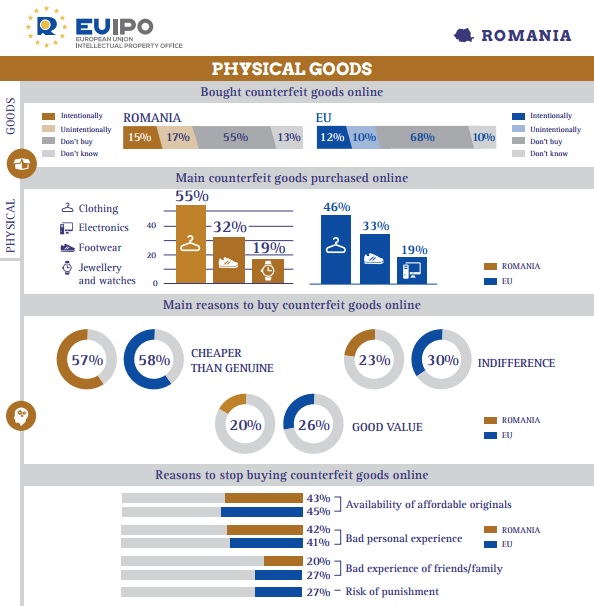

„Only 12% of those questioned said they have intentionally bought counterfeit products online in the past 12 months, mostly counterfeit clothes, accessories and footwear, with over half saying they did so because it was cheaper than buying the real thing.

However, the vast majority of young people do not buy counterfeit products online. Over half of all those questioned say they do not trust the sites which sell counterfeit goods, and 20% say they are afraid of their data being misused if they make a purchase.”, according to the press release.

Overall, 93% of the young people say they have purchased a product online in the last 12 months. 64% bought clothes or accessories online, the most popular category.

António Campinos, EUIPO Executive Director said:

“This study helps us to understand young digital natives, to explore how they behave online and to measure the scale of the challenge in changing their attitudes. I trust it will support our collective efforts to develop IP education and awareness initiatives which can connect with young Europeans, as well as providing valuable information for policy makers.”

According to the results of the report:

In France, 11% of young people have intentionally bought counterfeit goods online in the past 12 months, while 34% intentionally used illegal sources to access online content.

In the UK, 10% of young people have intentionally bought counterfeit goods online in the past 12 months, while 19% intentionally used illegal sources to access online content.

In Italy, 9% of young people have intentionally bought counterfeit goods online in the past 12 months, while 21% intentionally used illegal sources to access online content.

In Spain, 19% of young people have intentionally bought counterfeit goods online in the past 12 months, while 33% intentionally used illegal sources to access online content.

In Germany, 8% of young people have intentionally bought counterfeit goods online in the past 12 months, while 18% intentionally used illegal sources to access online content.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: