On the day that marks one year since the first State of Emergency was declared in Portugal, SIBS releases a full report on the evolution of consumption in Portugal over the last 365 days, according to the various stages of evolution of the new Coronavirus pandemic (COVID-19).

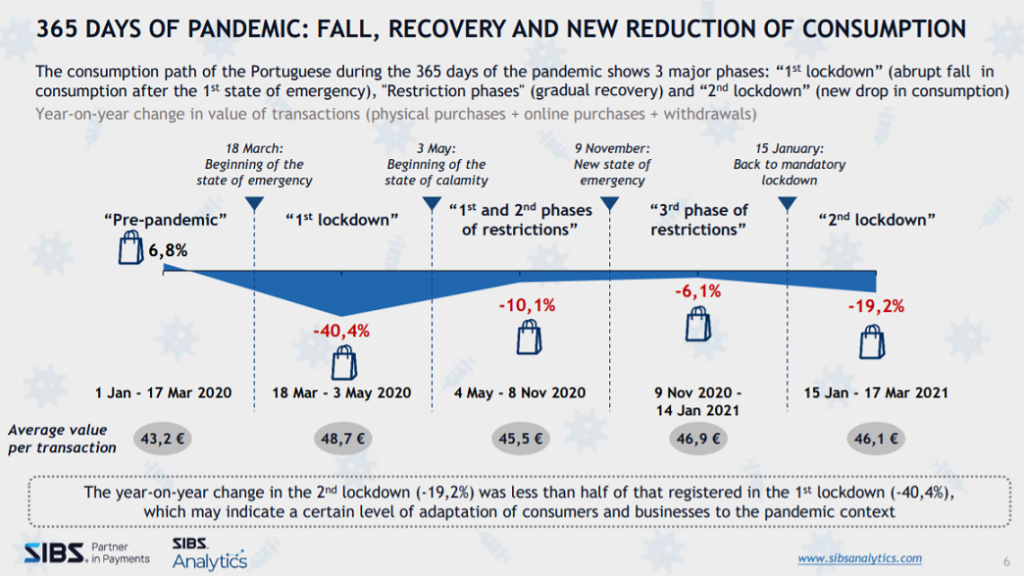

The analysis shows 3 phases: “1st lockdown”, with a sharp reduction in consumption; “Restriction phases”, with a progressive recovery; and “2nd lockdown”, with a new drop in the volume of transactions.

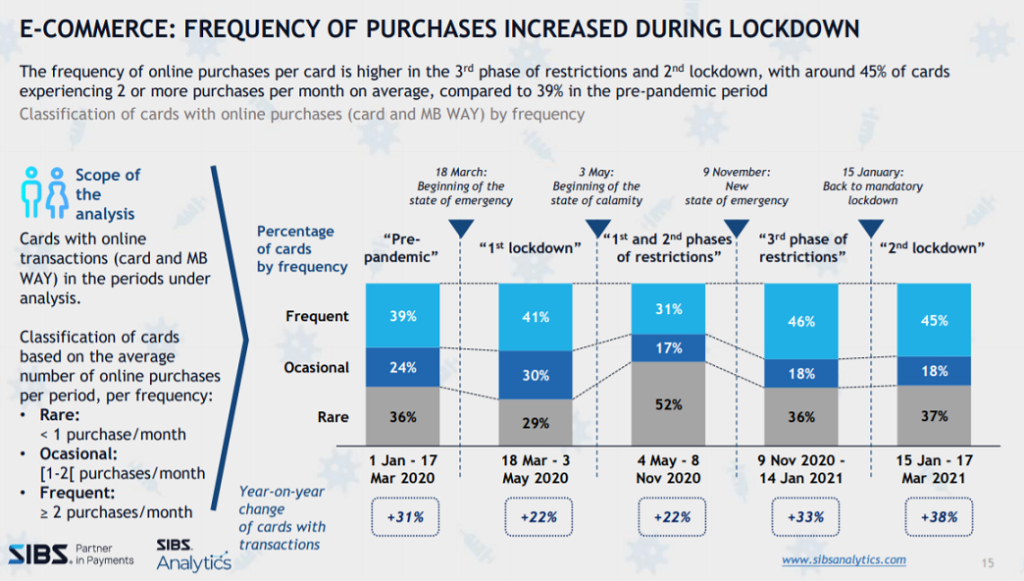

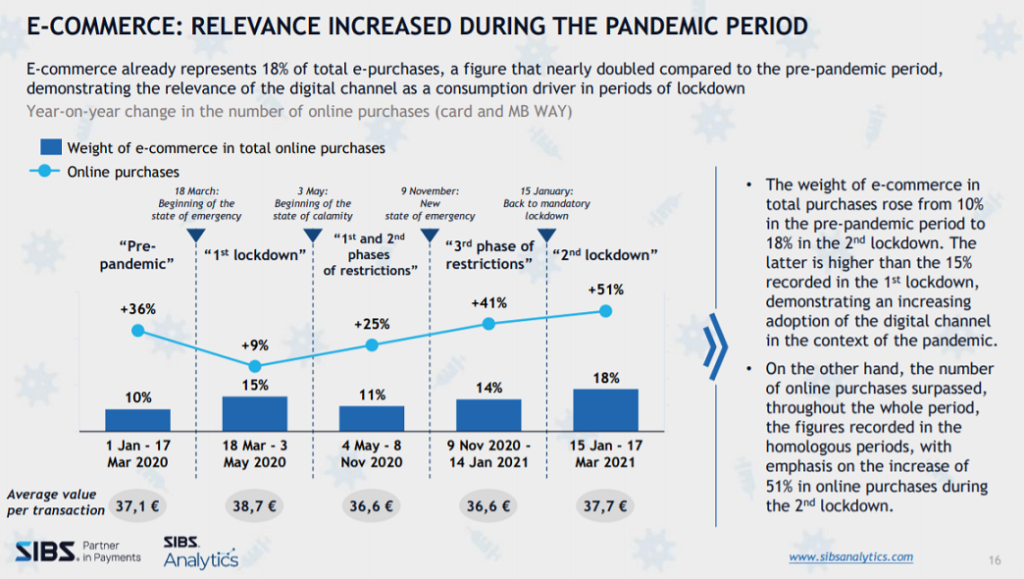

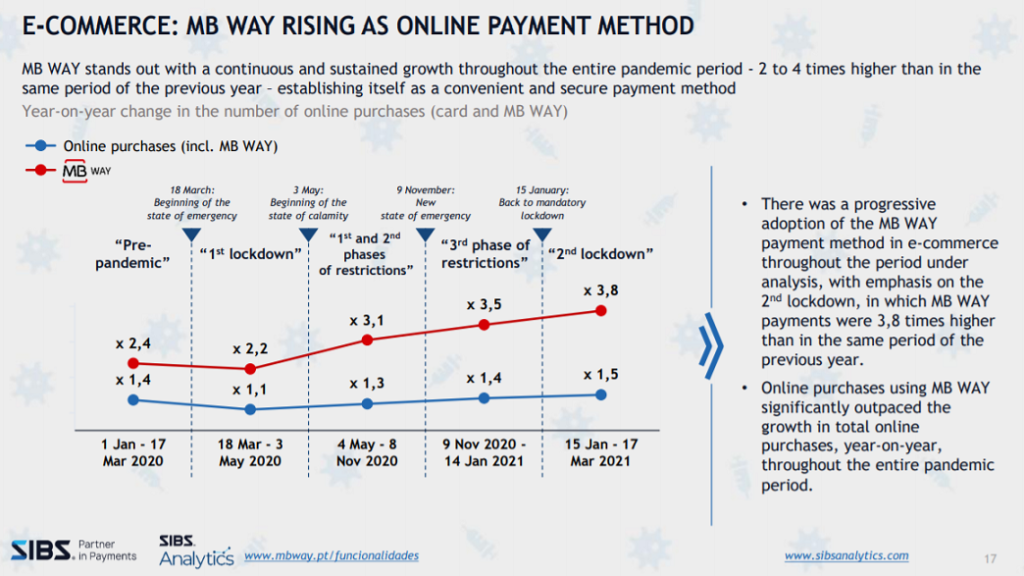

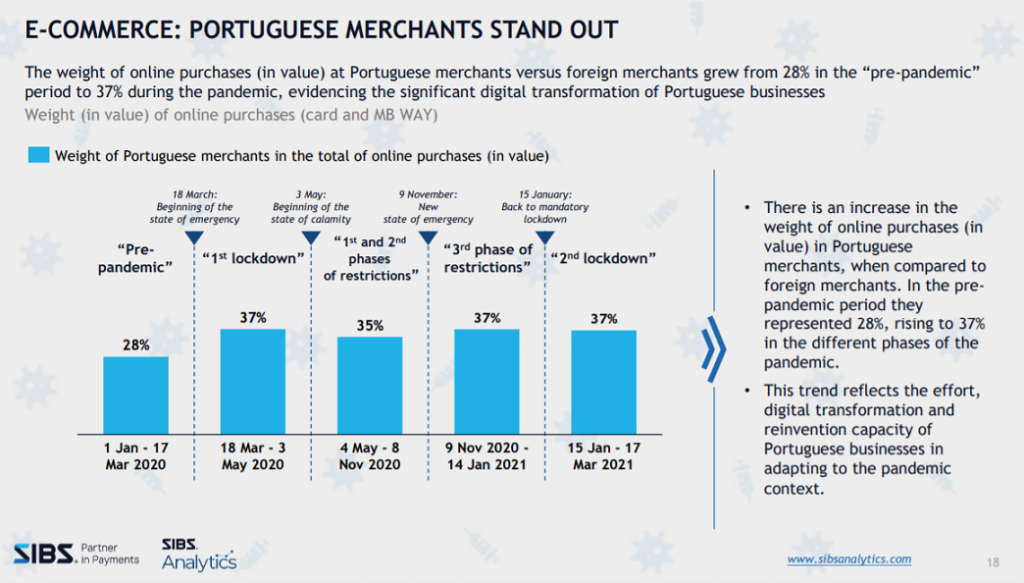

Among the most relevant indicators in this analysis, which allow measuring the changes in the consumption habits of the Portuguese, e-commerce stands out, now representing 18% of the total of electronic purchases in Portugal – a figure which nearly doubled compared to the pre-pandemic period – and the increased weight of digital payments, namely the MB WAY payment method on the mobile phone, which show significant growth compared to the same period last year – 2 to 4 times higher – both online and in-store purchases, reinforcing the consumer’s preference for reducing physical contact and for mobile, convenient and safe solutions.

The increase in the weight of digital payments in total physical purchases, which includes MB WAY payments, over the pandemic period, reached almost four in every 10 card purchases in the 2nd lockdown (39%), compared to one in every 10 purchases (12%) in the pre-pandemic period.

See the remaining consumption indicators in the attached report.

18 Mar_SIBS Analytics – Report 365 days of pandemic .PDF 1 MB

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: