As Neo-banks like Revolut and N26 make news headlines with multi-billion-dollar valuations, the world of digital banking seems very lucrative. In 2021, there were over 250 digital banks globally, and COVID-19 has driven a global surge in use of digital banking; 76% of adults globally now have an account either at a bank, other financial institution or with a mobile money provider, up from 68% in 2017. On top of this, two-thirds of the world’s adult population now receive or make digital payments, with the share in developing economies growing very quickly.

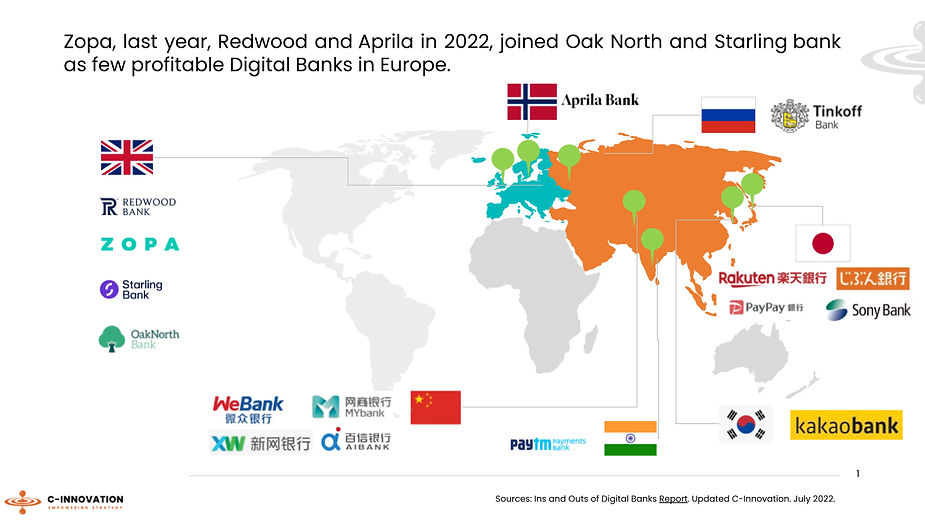

Of the profitable digital banking players, many are corporate-backed, financial and non-financial firms that have launched a digital brand. They come mainly from Asia, especially China and Japan, and see their pure digital offering expand into more growth markets where they have not previously had a presence.

A variation of this business model includes the Incumbent Bank and Internet Giant “Tie-up”. aiBank serves as a distinctive global example whereby it leveraged CITIC Bank’s financial expertise and well-developed offline channels, as well as Baidu’s (Chinese multinational technology company specializing in Internet) advanced technology and large online customer traffic, in order to create greater innovative capacity, stronger technological ability and provide a large online customer base thanks to the customer traffic of the Internet parent company. Successful brands have huge benefits in the form of low cost of acquisition and activation due to their association with their parent companies, which had lots of potential customers and data on which the challenger could leverage.

In Europe, while some brands struggle with the current financial environment, profitable independent digital brands have taken up this year, new cohorts of Sme focused lenders such as Redwood and Aprila Bank, joined now Zopa, OakNorth, Tinkoff and Starling bank as few profitable Digital Banks in Europe.

In this article, using publicly available information and data that C-Innovation has built during the years for their subscribers, we go through the analysis of the diverse elements of these five european and independent Neo-banks, to identify what they have in common, that could have push their financials figures into the blacK.

There are three common traits of high-performing global banks, they focus on resilience, commit to cost reduction and put the customer at the heart of everything. We go further those elements that are still true for profitable banks and identify extra factors in their strategy that complement the above view and provide further understanding of the successful digital brands journey.

● The Bank Licence may be key to sustainable growth

● Lending is a critical source of income

● In-house technology to better mitigate risk

Read more about the Secrets of a rare breed: Profitable Neo-banks in C-Innovation blog post by Isabel Richardson

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: