OCBC Bank is first to leverage Visa Commercial Pay Mobile as part of its inaugural virtual purchasing card offering

OCBC Bank ups the ante with its virtual commercial card offering with the integration of „the first-of-its kind mobile employee payment solution for corporates”.

OCBC Bank says that is the first in the world to leverage Visa Commercial Pay mobile solution as part of its inaugural virtual purchasing card offering. The OCBC Virtual Purchasing Card enables businesses to digitalise and streamline all their payment requirements.

This solution provides real-time visibility of their employees’ spending on OCBC Virtual Purchasing Card, as well as captures enhanced data for automatic reconciliation. Benefits that can be unlocked by having better visibility include the identification of core spending categories, and with that knowledge, more effective price negotiation with suppliers is possible.

Visa Commercial Pay mobile enables the employees and non-employees of OCBC corporate customers to request virtual cards on demand via their mobile app and use the virtual cards for making mobile contactless, in- app and online payments at all Visa accepting merchants. This reduces the need for employees and non-employees such as contract staff and visiting delegates, to pay out of their own pockets first as the card can be instantly issued even for ad-hoc transactions.

The OCBC Virtual Purchasing Card also features two other B2B payment offerings – the Visa Commercial Pay B2B and the Visa Commercial Pay travel.

Visa Commercial Pay B2B: A digital platform that allows corporates to generate unique virtual card numbers with pre-defined control parameters and customised data fields for each invoice payment to their suppliers.

Visa Commercial Pay travel: A solution that enables businesses to centrally manage their business travel spend, such as air travel, hotel, rail and car rental. The solution seamlessly integrates into business travel reservation processes and can deliver enhanced travellers’ data, full spend visibility and automated expense reconciliation through the use of unique virtual card numbers for each booking. Travellers are also able to view their travel reservations together with their trip spend within the Visa Commercial Pay mobile app.

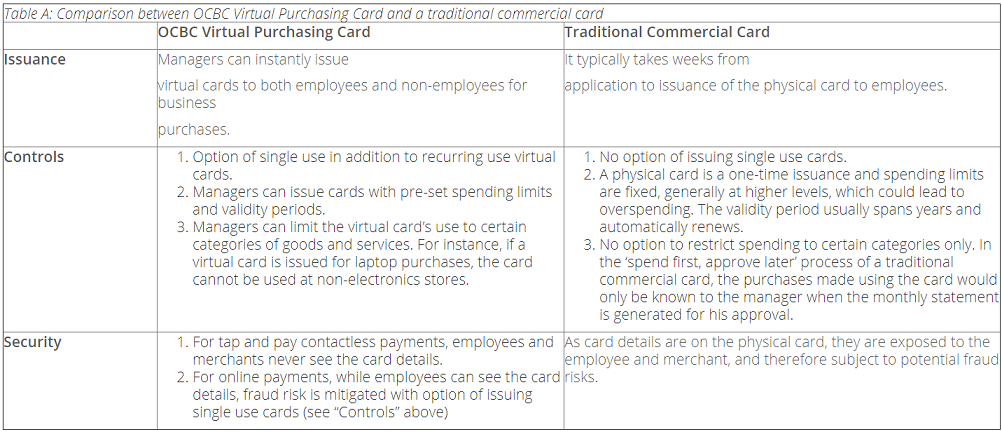

Virtual cards issued under the OCBC Virtual Purchasing Card programme can be for single or recurring use, with pre-defined control parameters. These control parameters can be spend limit, validity period or even right down to a specific category of goods and services.

These features make the OCBC Virtual Purchasing Card a more appealing payment tool than the traditional commercial card.

The launch of the OCBC Virtual Purchasing Card is timely as such digital payment solutions are expected to grow in popularity. According to Mercator Advisory Group, which specialises in global payments, their research on commercial cards for international markets showed that the adoption of virtual card solutions by companies in Asia Pacific is poised to grow at 40 per cent over the next four years. The benefits that such virtual card solutions canbring to working capital were citedas one of the factors behind this potential growth.

Singapore University of Social Sciences (SUSS) is the bank’s first customer to sign up for this solution and will be piloted to its employees in the second quarter of 2021.

They will be able to use their virtual commercial cards across a range of procurement scenarios, including items like software licenses, subscription fees and payments for travel booking.

Currently, university employees use personal cards to pay for certain corporate purchases and seek reimbursements thereafter. The OCBC Virtual Purchasing Card programme will replace the manual processes of reimbursement and account reconciliation with a streamlined and user- friendly alternative that saves time for employees.

Ms Kwek Peck Lin, Director for Planning & Finance, SUSS, said, “We want to digitalise the way we work and that extends to all aspects of the university’s operations. This virtual card solution makes payments easier for our employees – everything can be done via mobile app – and for our finance department too. In terms of security, virtual cards provide more assurance compared to traditional commercial card solutions, and that was also an important factor for us when deciding to come onboard.”

Mr Melvyn Low, Head, Global Transaction Banking, OCBC Bank, said, “The OCBC Virtual Purchasing Card is very relevant to businesses today. It is a highly secure payment solution that gives a bird’s-eye view on spending – which is data that many businesses do not yet have access to today.

Many of the bank’s clients have expressed interest in adopting this solution, with SUSS being the first to come onboard. We expect the take- up to be strong, especially for businesses looking to introduce a commercial card scheme for the first time as they can now leap-frog physical cards and go straight to a virtual card scheme.”

Mr Kunal Chatterjee, Visa Country Manager for Singapore & Brunei commented, “The opportunity to convert more business payments to be made digitally is tremendous in the commercial sector in Singapore. We believe it is important for us to work with our partners, such as OCBC Bank to introduce innovative solutions that will benefit corporates including the ability to issue virtual commercial cards instantly to employees of organisations so that they can make business payments seamlessly. We are also proud to share that it will be the first time in the world that corporates are able to make mobile contactless payments using their virtual payment cards with Visa Commercial Pay.”

________________

OCBC Bank is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

OCBC Bank’s key markets are Singapore, Malaysia, Indonesia and Greater China. It has more than 480 branches and representative offices in 19 countries and regions. These include over 230 branches and offices in Indonesia under subsidiary Bank OCBC NISP, and over 70 branches and offices in Mainland China, Hong Kong SAR and Macau SAR under OCBC Wing Hang.

OCBC Bank’s insurance subsidiary, Great Eastern Holdings, is the oldest and most established life insurance group in Singapore and Malaysia. Its asset management subsidiary, Lion Global Investors, is one of the largest private sector asset management companies in Southeast Asia.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: