Three out of five European consumers have tried a new shopping behaviour since the appearance of Covid-19, and most intend to continue these post-pandemic. Buy online pick-up in store has grown by 200% from April 2019 to April 2020.

Nets, a leading provider of digital payment services and related technology solutions across Europe, today announces the release of its 2021 Payments Outlook Innovation Report, a follow-up to its 2020 Payments Outlook, which captures key trends affecting merchants and the payments industry in light of the Covid-19 pandemic.

The purpose of the report is to understand the impact and consequences of the pandemic to help merchants prepare for the new normal. It identifies a total of 64 trends that sit within four categories: Consumer, Technology, Market, Regulation.

Nets subsequently worked to further analyse these trends through internal and external industry and innovation workshops, grouping them into eight key themes that will define the payments landscape going forward:

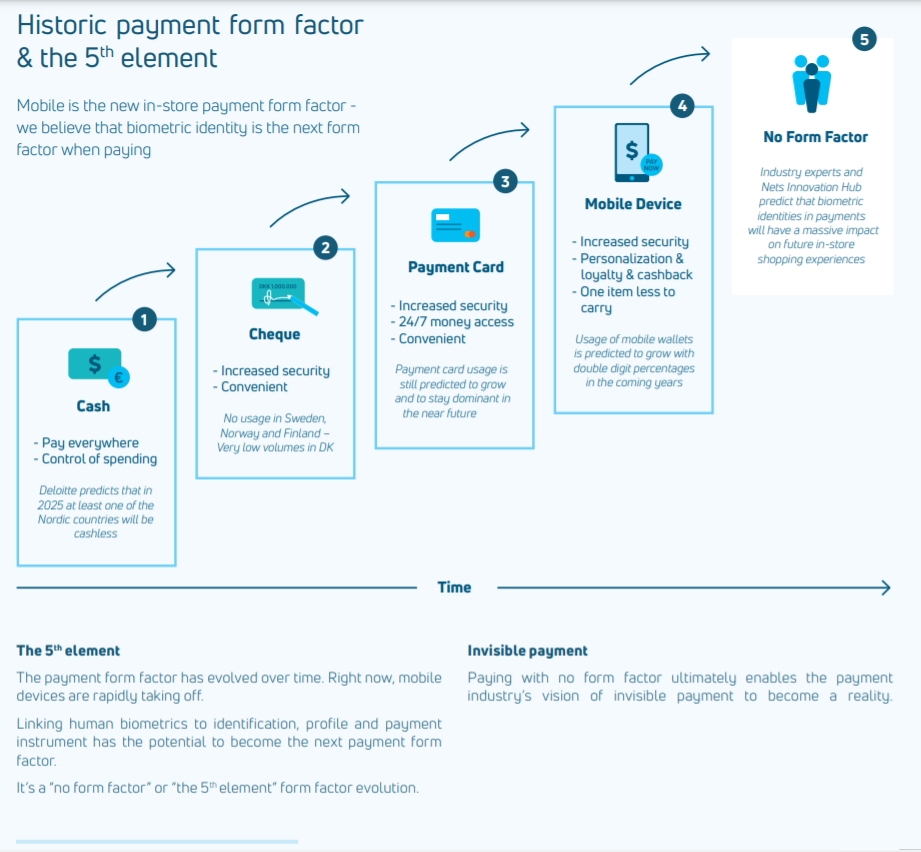

The Nets Payments Outlook Report notes developing seamless ways for consumers to access funds is the only way for merchants to craft new, personalised experiences via innovative touchpoints and fresh value propositions. Consumers increasingly want to control when, how, and with what they pay. Digital payment adoption is increasing rapidly, as especially mobile and contactless payments are gaining traction. On top of this, the value with which consumers pay is evolving in multiple directions, further disrupting the payments ecosystem as we know it.

Meanwhile, the report shows commerce will become increasingly fluid thanks to customers of all generations and nationalities adapting to online shopping as a result of the pandemic. Online and physical channels are no longer separate in consumers’ minds and they expect interactions across multiple channels to be unified. As more consumers shop online for safety, convenience and speed, merchants are rethinking their online and in-store experience towards an integrated „clicks and mortar” offering. Merchants must reflect the behaviour of their consumers and search for new ways to incorporate the best of both worlds.

Buy online pick-up in store (BOPIS) has grown by 200% from April 2019 to April 2020 [Kibo], demonstrating the importance of retailers being able to identify the consumer decision journey, predict their demands and offer a wide range of solutions to accommodate these. In fact, three out of five European consumers have tried a new shopping behaviour (i.e. changed stores, brands, or the way they shop) since the appearance of Covid-19, and most intent to continue after the crisis [McKinsey].

These opportunity areas for merchants must be underpinned by customisable privacy, as the report predicts data will only become more fundamental to the evolution of the payments sector. During the past decade consumers have become increasingly aware of the value their data possess. Consumers are more reluctant to share personal data but are at the same time beginning to acknowledge the value. In exchange, customers demand personalised products, services and experiences, as the clearer the benefit for sharing data the more willing they are to do so.

End-users can also benefit from collected data. Consumers want to utilise personal data to track personal areas like performances, lifestyle and financials. They increasingly want something tangible to inspire change, compete and compare results to set measurable goals.

In addition, fitness apps and wearables with built in tracking are growing in popularity – global revenue for fitness apps and wearables has increased by 30% from 2019 to 2020, with wearables contributing a greater proportion than basic apps [Statista]. This demonstrates the willingness consumers have to allowing companies to gather data on them, providing the individuals see the decision as one than enables an improvement, change, or redefinition in their lifestyle.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: