Losses from online payment fraud to exceed $362 billion globally over next 5 years. A rise in eCommerce transactions in emerging markets is driving this growth.

Merchants are facing new threats, such as an increased use of AI for attacks.

A new study from Juniper Research, the foremost experts in payment markets, forecasts that merchant losses from online payment fraud will exceed $362 billion globally between 2023 to 2028, with losses of $91 billion alone in 2028. Online payment fraud is where cybercriminals conduct false or illegal transactions online, using a number of different fraud strategies, such as phishing, business email compromise or account takeover.

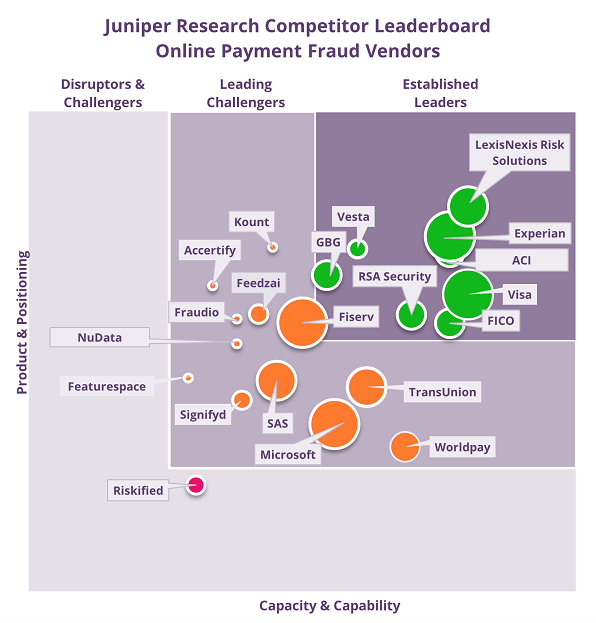

Top Fraud Detection and Prevention Vendors Ranked

As part of the study, Juniper Research released its latest Competitor Leaderboard for 2023. Underpinned by a robust scoring methodology, the new Competitor Leaderboard ranked the top 21 fraud detection and prevention vendors, using criteria such as the relative size of their customer base, completeness of their solutions and their future business prospects.

The top 5 vendors for 2023: 1) LexisNexis Risk Solutions, 2) Experian, 3) ACI Worldwide, 4) Visa, 5) FICO

The research found that the leading players scored well based on the breadth of their anti-fraud orchestration capabilities, as well as their use of AI for analysing trends in fraudster behaviour. In order to stay ahead of the competition, vendors must utilise data collected throughout the whole eCommerce process to further develop their fraud detection and prevention solutions through training and advancing AI models.

Research author Cara Malone remarked: “Fraud detection and prevention providers must educate their clients in the importance of data sharing, in order for the highest accuracy within their solutions. This is increasingly important with the growing use of AI, as it utilises a variety of data to examine patterns within fraud, which is extremely advantageous in a space where fraudsters usually attack at scale, rather than attacking a specific customer.”

____________

Further explanation is available in the new Juniper Research report, Online Payment Fraud: Market Forecasts, Emerging Threats & Segment Analysis 2023-2028. A free download sample is available.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: