Fintech giants battling in $500 million PayU bidding war

Investment company Prosus is looking to sell PayU and bidders are believed to include Israeli fintech unicorn Rapyd, Canadian payments giant Nuvei, and Worldpay. Although the exact sale value has not been disclosed, it is estimated to be over half a billion dollars.

Bank of America has been chosen to manage the tender for the purchase, Calcalist has learned.

Rapyd operates the largest online payment network of its kind globally, supporting 65 different currencies across more than 170 countries.

__________

Prosus, a subsidiary of Naspers, is a global consumer internet group and one of the largest technology investors in the world.

Prosus has invested in, acquired or built, including 99minutos, Airmeet, Aruna, AutoTrader, Autovit.ro, Azos, BandLab, Bibit, Bilt, Biome Makers, Borneo, Brainly, BUX, BYJU’S, Bykea, Captain Fresh, Codecademy, Collective Benefits, Creditas, DappRadar, DeHaat, Detect Technologies, dott, EduMe, ElasticRun, eMAG, Endowus, Eruditus, EVERY, Facily, Fashinza, Flink, Foodics, Good Glamm Group, GoodHabitz, GoStudent, Honor, iFood, Imovirtual, Klar, Kovi, LazyPay, letgo, Luno, Mensa Brands, Meesho, merXu, Movile, Oda, OLX, Otodom, OTOMOTO, Oxford Ionics, PaySense, PayU, Pharmeasy, Platzi, Property24, Quick Ride, Red Dot Payment, Republic, Sharebite, Shipper, ShopUp, SoloLearn, Stack Overflow, Standvirtual, Superside, Swiggy, Thndr, Tonik, Ula, Urban Company, Virgio, Vegrow, 6atchtower, and Wayflyer.

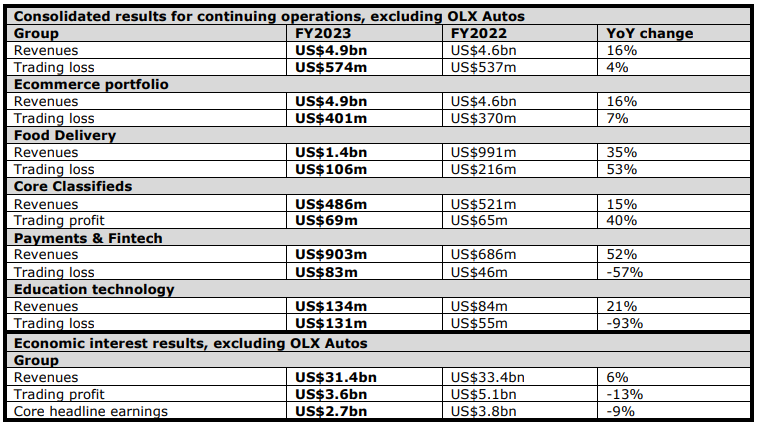

Prosus – Group Results 2023

According to the latest financial results, PayU’s activity is represented in the Payment & Fintech category.

„Strong overall performance, with Indian Payments Service Provider (PSP) business profitable and significant growth in Indian credit business” – according to the press release.

. Consolidated revenue increased 52% to US$903m as Total Payment Volume (TPV) in the core PSP business grew 39%.

. Indian PSP business profitable, with TPV up 44%.

. Indian credit business grew its loan book by 112% with revenue up 221%.

. Consolidated trading losses of US$83m impacted by a one-off provision of US$23m at Global Payments Organisation.

Bob van Dijk, Group CEO, Prosus and Naspers, commented: “There is much more to do, but we are on a good trajectory, we have strong momentum and remain confident in our commitment to achieve profitability in our Ecommerce portfolio during the first half of 2025.”

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: