China has officially outlawed ICOs activities

In a joint statement issued by seven financial regulators today, the world’s most populous nation outlined why it believes that nascent fundraising mechanism is illegal under domestic law. Authorities backing the statement include the People’s Bank of China, the Central Network Office, the Ministry of Industry and Information Technology, the State Administration for Industry and Commerce, the China Banking Regulatory Commission.

A translation of the statement reads:

„ICO financing refers to the activity of an entity raising virtual currencies, such as bitcoin or ethereum, through illegally selling and distributing tokens. In essence, it is a kind of non-approved illegal open fund raising behavior, suspected of illegal sale tokens, illegal securities issuance and illegal fund-raising, financial fraud, pyramid schemes and other criminal activities.”

The second article further clarifies what this determination means, stating that „as of the date of this announcement, all types of currency issuance financing activities shall cease immediately.”

Adding to that, it also demanded that „persons or organizations who have completed ICOs shall refund the investors, protect the investors’ rights, and deal with the risks properly. It concluded with a warning that „people who refuse to cease ICO activities or refuse to refund investors will be investigated and severely punished according to the law.”

The third article states that the regulation on trading platforms shall be tightened, „as of the date of this announcement, trading platforms shall not conduct any exchange business between fiat money and virtual currencies, shall not provide information and price for virtual currency trading.”

At this time, it is not clear how ethereum, the largest platform that has leveraged such a token sale, and the platform on which many are being launched, will be affected.

Other articles prohibit financial institutions such as banks from doing business with ICO funding, and warn about the public risks of trading ICO tokens.

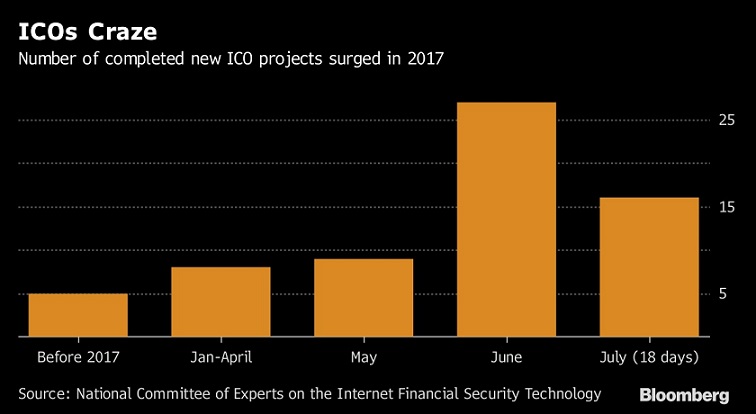

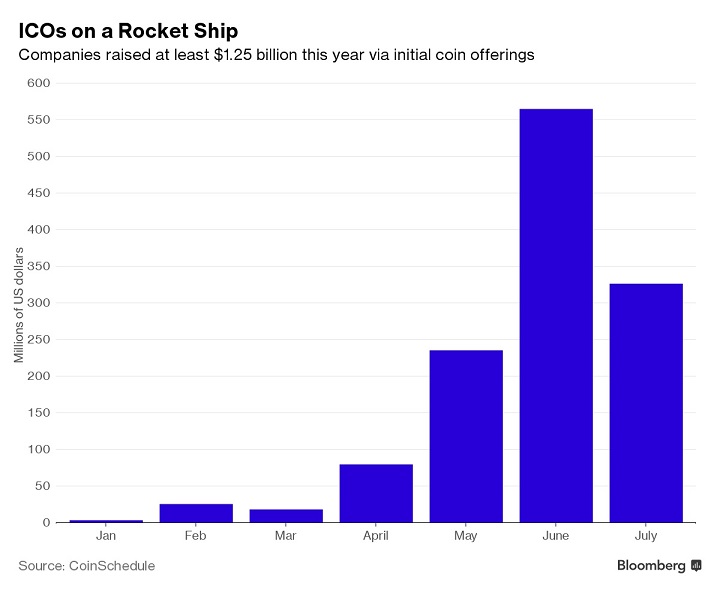

So, the central bank ordered all fundraising efforts related to ICOs halted immediately, a decision that may have an impact on investors who had participated in at least 65 of the projects by mid-July.

There are 43 ICO platforms in China, with almost 60 percent located in Guangdong, Shanghai and Beijing, the National Committee of Experts on the Internet Financial Security Technology said in a July report. The venues had raised 2.6 billion yuan ($399 million) from 105,000 investors as of July 18, according to Bloomberg.

Market reaction

At press time, the value of cryptocurrency assets issued by way of ICOs has seen a substantial impact on the news. Valued at a combined $10 billion earlier this week, according to CoinMarketCap, the market declined to below $7.5 billion today, a 25% decline.

Source: coindesk.com

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: