BBVA reaches digital tipping point in Spain – more than half of the clients are engaging with the bank via digital channels

In October the bank in Spain passed the 50% mark in terms of the percentage of its Spanish customer base now engaging with the bank via digital channels. In fact, across its wider business, six of BBVA’s 11 core countries have now passed this tipping point, with the USA, Turkey, Argentina, Chile and Venezuela also past the 50% mark.

In Spain specifically, the use of digital channels to access banking services has grown by more than 17% in the last 12-months alone. Meanwhile the figures for customers accessing by mobile has also soared – rising by 30% in the last year.

Across the whole Group, the digitally active customer base has grown by 24% since this time last year, demonstrating the ongoing change in behaviour the ubiquity of online access is bringing. BBVA has 21.5 million digital customers around the world – of which 16.5 million use mobile devices to do their banking. Similarly, digital sales are growing at a robust pace in all of the bank’s locations. At the end of September, 25.4% of the BBVA Group’s sales took place on digital channels – up from 16.8% in 2016.

For BBVA is a clear justification of the Group’s focus on building the best digital banking services on the market. That drive was recognized again this week after consultancy firm Forrester named BBVA Spain as leading the rest of Europe when it came to online services.

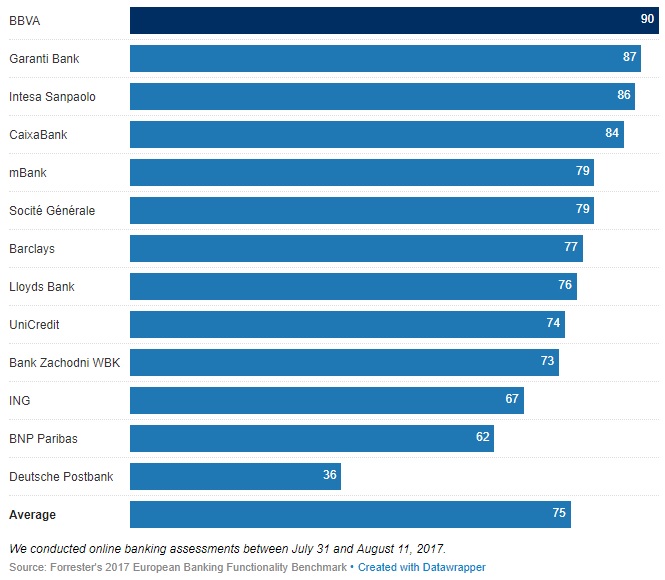

BBVA’s Turkish bank Garanti was also ranked second, on a list that analysed 13 top European banks including those in the UK, France, Turkey and the Netherlands. BBVA Spain’s online banking received a final score of 90 points out of 100 – 15 points above the European average of 75.

Forrester reports that “BBVA creates value for online banking customers with outstanding money movement tools, strong marketing and sales functionality, sophisticated money management, budgeting and advice services – all tightly integrated on the secure website.” BBVA is the first bank to reach a score of 90 – the highest score ever given by the consulting firm in this category.

Earlier this year, Forrester also named BBVA as having the best mobile banking app in the world, beating off competition from dozens of banks in dozens of countries.

Forrester – 2017 European Online Banking Functionality Benchmark (1-4 Overall scores by Bank)

Source: BBVA

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: