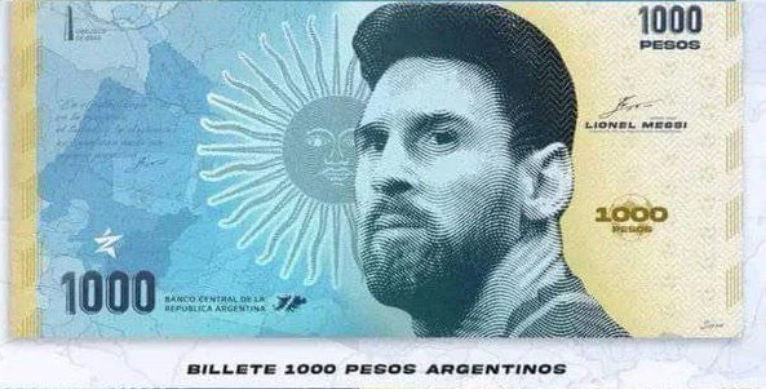

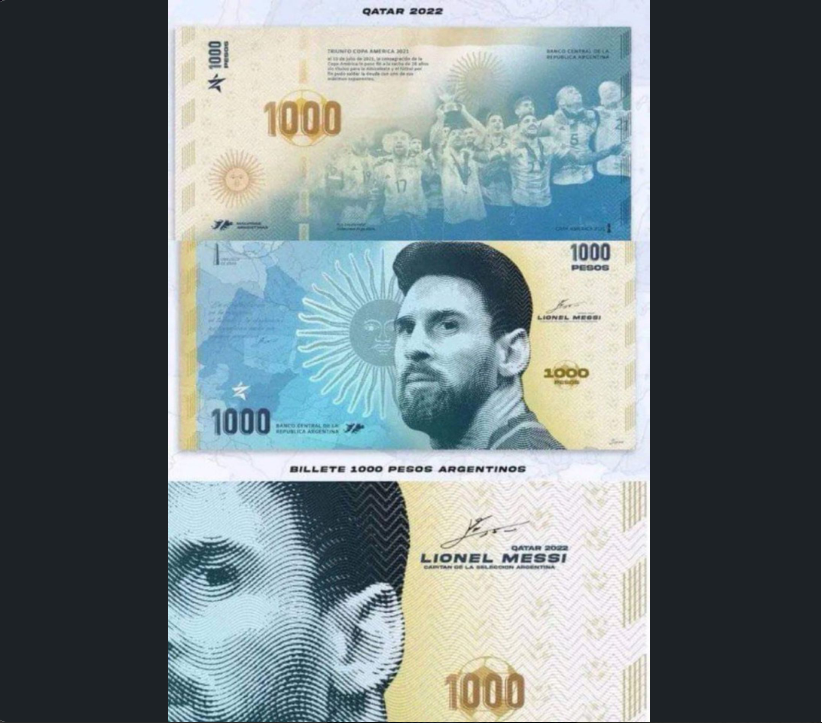

Argentina’s Central Bank is reportedly considering putting Lionel Messi’s face on 1000 peso notes. The institution introduced commercial coins to commemorate the country’s first of their three World Cup triumphs back in 1978.

This new option was ‘jokingly’ proposed by members of the Argentine Central Bank, although the most enthusiastic directors, such as Lisandro Cleri, a fervent supporter of Boca Juniors , and Eduardo Hecker, a follower of Independiente , agreed on that a banknote with this design would awaken the collecting spirit of Argentines, according to El Financiero newspaper.

Officials at the South American country’s financial governing body are looking at options to mark their nation’s historic World Cup triumph.

Having a snap of Messi’s mug on the grand bill is said to be a preferred option as the figure begins with a „10” – the shirt number worn by the GOAT.

And on the back of the proposed bit of dosh it has been suggested that „La Scaloneta” – the nickname of Argentine boss Lionel Scaloni – will be inscribed.

„With inflation of 92%, it might actually make more sense to launch a new currency and start with a blank slate. I even have a name for it – Pessi.„, says in a blog post Linas Beliunas – Country Manager, Europe, and General Manager, Flutterwave Lithuania.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: