An investigation by a financial research firm into Temenos „uncovered hallmarks of manipulated earnings and major accounting irregularities”. The company’s stock price drops by a third although Temenos dismissed the report citing „false and misleading allegations”.

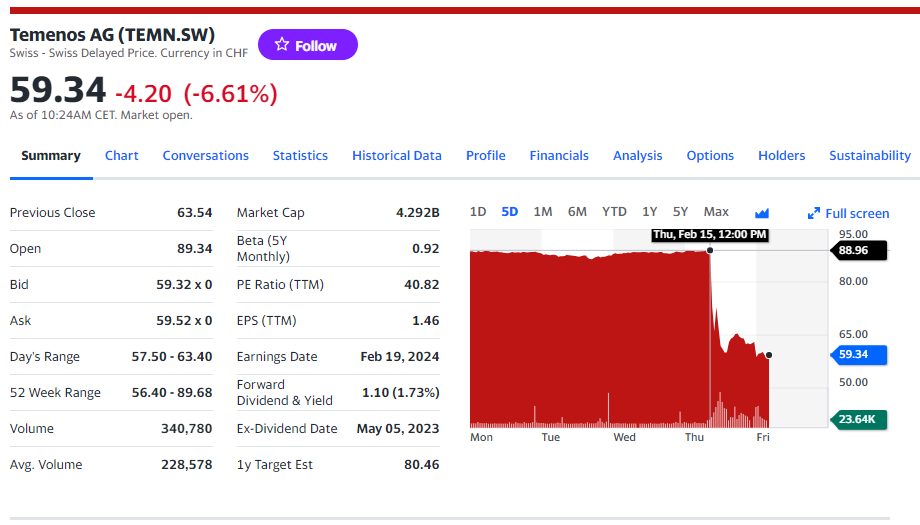

Swiss banking software provider Temenos saw its shares plunge nearly 30% after a damning report entitled Temenos: Major Accounting Irregularities, Failed Products And An Illusive Turnaround published by short-seller Hindenburg Research alleged accounting manipulation and failed product implementations, according to Reuters.

„Our 4-month investigation into Temenos, involving interviews with 25 former employees, including senior leaders at the company, uncovered hallmarks of manipulated earnings and major accounting irregularities. This includes evidence of roundtripped revenue, sham partnerships, rampant pulling forward of contract renewals, backdated contracts, excessive capitalization of seemingly non-existent R&D investments, and other classic accounting red flags.

These aggressive accounting practices seemed to be an open secret among many of the former employees we spoke with. Several indicated that CEO Andreas Andreades encourages the practices, which help gloss over significant customer product dissatisfaction and attrition.” according to the Hindenburg report.

„The report contains factual inaccuracies and analytical errors, together with false and misleading allegations, which are intended to adversely impact the company’s share price,” Temenos said in a statement. „The company was not contacted in advance for any comment on the report.”

Temenos, opens new tab shares tumbled nearly 35% on Thursday after Hindenburg Research said it had taken a short position in the Swiss software company and alleged accounting irregularities in a report. The share price continues to fall even today.

On 19 February 2024 after market-close the Company will issue its audited results for the year ended 31 December 2023 and confirms that they are in line with the pre-results announcement made on 19 January 2024. This highlighted the Company’s strong Q4 and FY23 performance:

. Annual Recurring Revenue exceeding guidance and Total Software Licensing and EBIT significantly exceeding minimum guidance

. Strong free cash flow growth ahead of guidance in FY23, up 26% to $242.6m – the Board expects free cash flow to continue to grow strongly in the coming years

. c. 3,000 customers – industry-leading churn of only c3% p.a. on a dollar basis

. The Company’s transition to a recurring revenue business model continues at pace – 391 go-lives on our software in 2023

. Significant progress on customer engagement, NPS score of +54 based on survey of over 900 customers

The Hindenburg report, which cited public filings and interviews with former employees, alleged that Temenos secretly funded the purchase of its own software.

Temenos, which helps connect the customer and client-facing part of banks with back-office processing departments, announced a partnership with fintech company Mbanq in 2021 that would allow them to expand into the U.S. market.

The Hindenburg report said that as part of this deal, Mbanq committed to purchasing about $20 million in software licences and maintenance contracts from Temenos.

Hindenburg alleged that when Mbanq became unhappy with the partnership, Temenos invested in the fintech via convertible notes. The report cited court documents and internal emails between Mbanq executives.

Hindenburg alleged that this was an example of „round-trip transactions” where a company sells something to a partner or subsidiary, books it as revenue and then buys it back via another channel.

The Hindenburg report also alleged that Temenos executives cashed out $1.1 billion worth of stock holdings over the last decade, but only bought $26 million.

___________

Hindenburg Research, founded in 2017 by Nathan Anderson, is a forensic financial research firm, which looks for accounting irregularities and mismanagement and makes bets against companies where it has found alleged wrongdoings.

Temenos (TEMN) is a ~$7.5B market cap Swiss-listed banking software developer and services company that serves 3,000 customers globally and reported $1 billion in preliminary 2023 revenue.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: