A safer transition for fossil banking. The topic will be analyze at Banking 4.0 in the panel entitled: „Green Finance: CO2 neutral bank accounts and lending, between opportunity and threat”

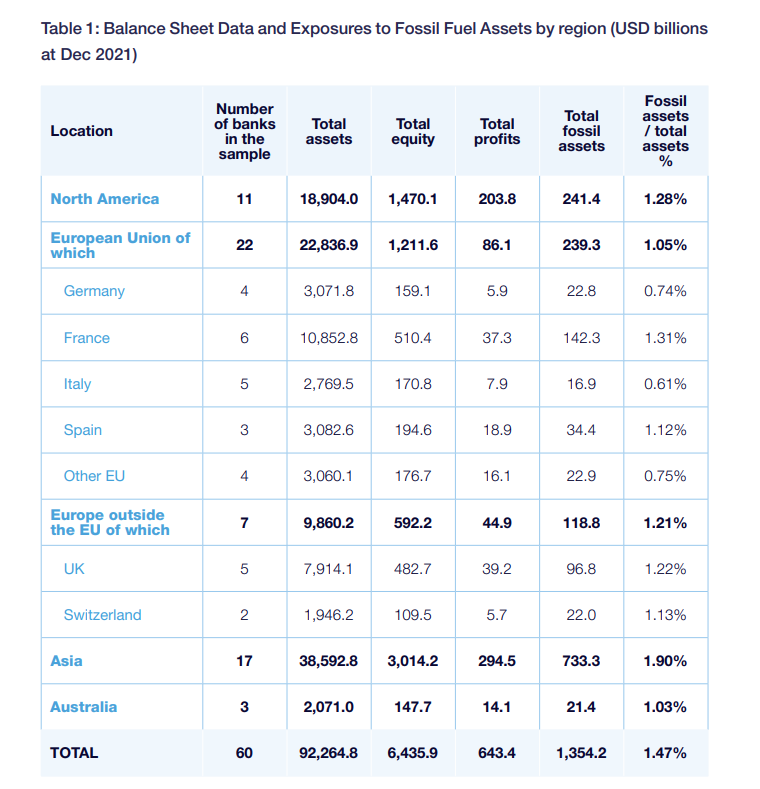

New research shows the world’s 60 biggest banks have $1.35 trillion USD of exposures to fossil fuel assets. Capital increase needed to reflect risk is equivalent to 3-5 months of bank profits.

Bank supervisors have recognised the increasing financial stability risks resulting from climate change and warn of possible devastating losses from a disorderly transition.

As fossil fuels are the main contributors to accelerating climate change and many of the assets associated with the fossil fuel industry will need to be abandoned before the end of their economic life (stranded) to achieve the transition to a carbon-neutral economy, banks’ exposures to fossil fuel assets should be a matter of priority for prudential regulation.

Finance Watch estimates that the 60 largest global banks have around $1.35 trillion of credit exposures to fossil fuel assets. At the moment, the climate-related risks associated with these assets are not reflected in bank capital rules to make sure that banks can cover future losses.

Applying a 150% risk weight – the risk weight applicable for higher risk assets under the Basel framework – to banks’ existing fossil fuel assets globally as a Pillar 1 capital measure would be an important first step in cushioning banks against future financial losses on these exposures.

We estimate that for the 60 banks in our sample, this measure would require additional capital in the range $157.0 billion to $210.2 billion, equivalent on average to around three to five months of banks’ 2021 net income.

This evidence suggests that increasing capital requirements for fossil fuel exposures in this way can be achieved without a reduction in lending capacity, which is important in the context of the sustainable transition. This solution also encourages supervisors to work with banks to establish plans over a suitable time frame.

The current practice of not treating banks’ fossil fuel exposures as higher risk assets under the Basel framework not only encourages the continued build-up of prudential risk, but is also effectively a subsidy from banks to the fossil fuel industry, which we estimate to be worth around $18 billion a year.

Download the report: A safer transition for fossil banking

Banking 4.0 is dedicated to the impact of the emerging technologies in banking (AI, machine learning, cloud computing, Robotic Process Automation, Banking as a Service, open banking, SoftPOS technology, etc.) and is probably the most relevant digital banking event in SEE region. Tickets are available here

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: