UK Finance releases its 2024 annual fraud report, detailing the amount its members reported as stolen through payment fraud and scams in 2023.

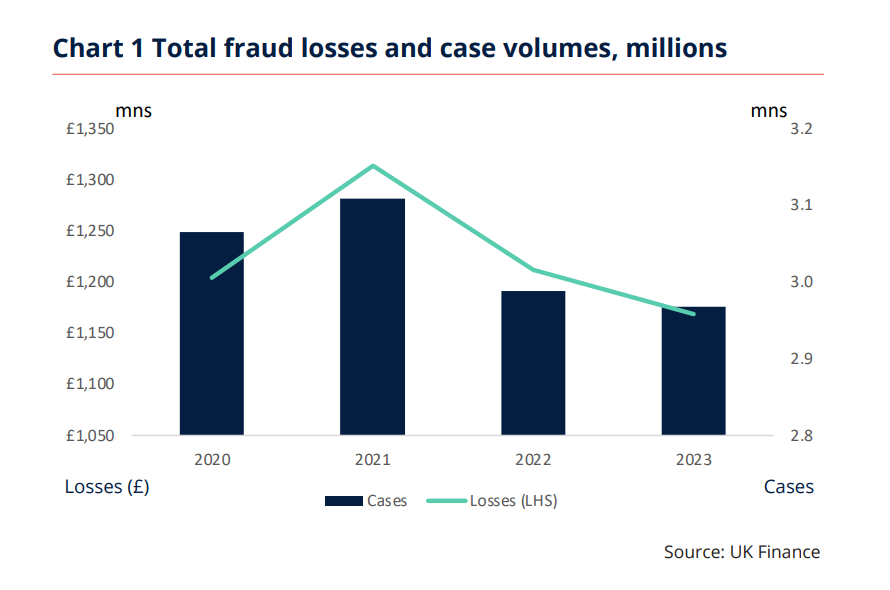

Criminals stole £1.17 billion through unauthorised and authorised fraud in 2023, a four per cent decrease compared to 2022. Banks prevented a further £1.25 billion of unauthorised fraud through advanced security systems. 76 per cent of APP fraud started online and 16 per cent started through telecommunications networks.

Ben Donaldson, Managing Director of Economic Crime at UK Finance, said: „Nearly £1.2 billion was stolen from customers in 2023 and the criminals who commit these crimes destroy lives and damage our society. The money stolen funds serious organised crime and victims often suffer emotional damage as fraud is a pernicious and manipulative crime. (…) With reimbursement rules set to change we risk even more money getting into criminal hands, unless the technology and telecommunication sectors take proper action to stop the fraud that proliferates on their platforms and networks.„

Unauthorised fraud losses

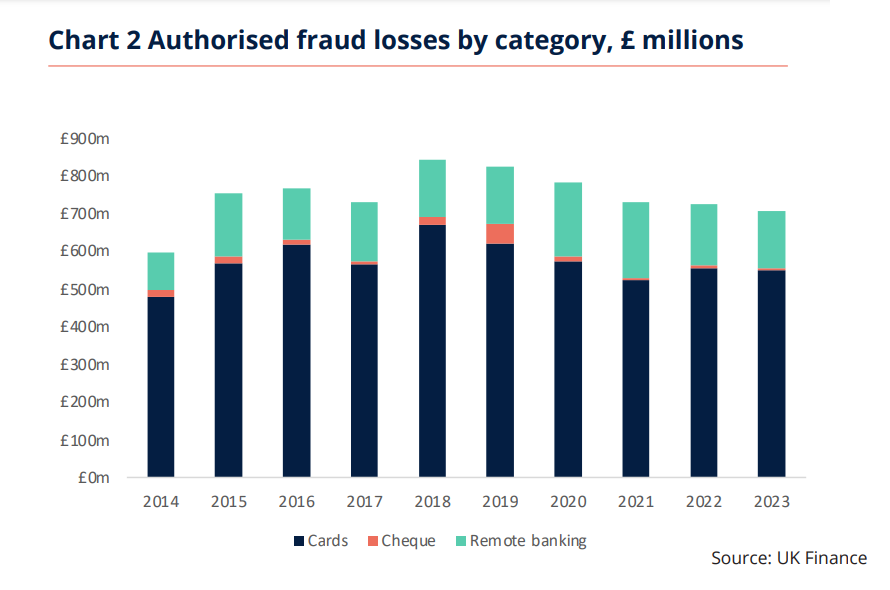

Losses due to unauthorised transactions across payment cards, remote banking and cheques were £708.7 million this year, down three per cent compared to 2022. The total number of recorded cases was 2.7 million, down two per cent.

One of the main contributors to the overall fall in payment card fraud losses was a nine per cent fall in remote purchase losses, the fifth consecutive year of declines in this fraud space. The roll-out of Strong Customer Authentication (SCA) over the past two years has helped to reduce this type of fraud by verifying customer’s identity.

Card ID theft increased again this year, with losses up 53 per cent to £79.1 million. Where criminals are unable to socially engineer their victims into making authorised push payments, they use the personal information gathered as well as stolen card details to either take over existing accounts or apply for new credit cards.

There was a seven per cent increase in the amount of unauthorised fraud prevented, to £1.25 billion.

Victims of unauthorised fraud cases such as these are legally protected against losses. And UK Finance research indicates that customers are fully refunded in more than 98 per cent of unauthorised fraud cases.

Authorised Push Payment fraud losses

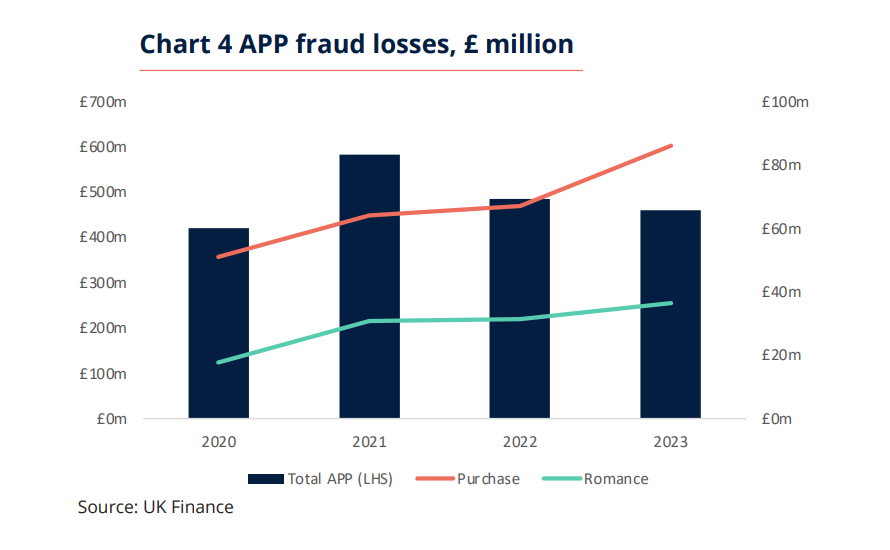

Authorised push payment (APP) fraud losses were £459.7million, down five per cent compared to last year. This comprised £376.4million of personal losses and £83.3million of business losses.

The total number of APP cases was up 12 per cent to 232,429. The main driver behind this is purchase scams, where people are tricked into paying for goods that never materialise. The total number of these cases rose 34 per cent to over 156,000, while the amount lost rose 28 per cent to £85.9 million making it the highest loss and case total ever recorded. Purchase scams account for 67 per cent of the total number of APP cases.

The number of romance scams, where victims are tricked into believing they are in a relationship, also reached its highest highs in terms of losses and cases, which were up by 17 per cent (to £36.5million) and 14 per cent respectively.

The number of fraud cases where criminals impersonate a bank or the police and convince someone to transfer money to a “safe account” fell by 37 per cent and the amount lost to this type of fraud fell by 28 per cent. There has been significant investment made in warning consumers that a bank will never ask someone to transfer money in this way.

In total £287.3 million of APP losses was returned to victims in 2023 or 62 per cent of the total loss. This has increased from 59 per cent in 2022.

Changing behaviours and post-pandemic business as usual

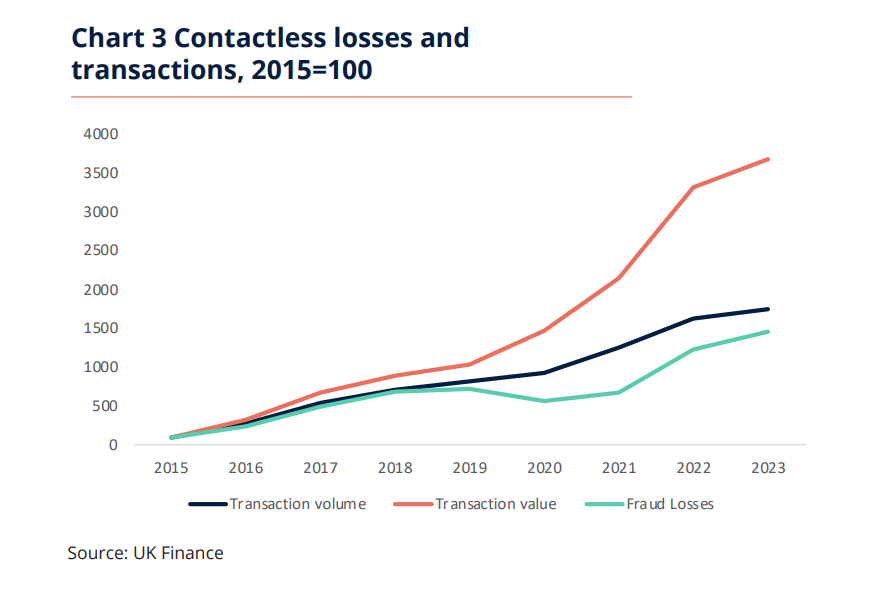

UK Finance data shows that losses across some fraud types have reverted to pre-pandemic trends, such as internet banking related losses, and lost and stolen card fraud. In other loss categories, data shows the effects of changing preferences and use of technology – for example in the rise in contactless cards and mobile banking losses.

Lost and stolen card losses, which dropped sharply during lockdowns, have returned to pre-pandemic levels in the past two years. This type of fraud occurs when a criminal uses a lost or stolen card to make a purchase or payment (whether remotely or face-to-face) or takes money out at an ATM or in a branch. This can involve obtaining cards through lowtech methods such as distraction thefts and entrapment devices attached to ATMs.

Related to the rise in lost and stolen fraud is that linked to contactless cards. UK Finance called out the growth in contactless card losses in last year’s report – in 2022 contactless card losses jumped by over eighty per cent as the limits were increased during the pandemic and there was a significant expansion in acceptance. This rise continued but at a more moderate pace in 2023.

Authorised Push Payment enablers

Authorised Push Payment (APP) fraud losses continued to be driven by the abuse of online platforms and telecommunications. Not only do criminals take advantage of these platforms to encourage the transfer of money through investment, romance or purchase scams but criminals also use scam phone calls, text messages and emails to trick people into handing over personal details and passwords.

Typically, criminals first focus their attempts on socially engineering personal information from their victims with a view to committing APP fraud in which the victim makes the payment themselves. If this is not successful, the criminal often has enough personal information to enable them instead to impersonate their victims, with a view to either taking control of their existing accounts or applying for credit cards in their name.

UK Finance data on the sources of APP fraud shows:

. 76 per cent of APP fraud cases originated from online sources. These cases tend to be lower-value scams, such as purchase scams, and so account for 30 per cent of total losses.

. 16 per cent of cases originated in telecommunications and these tend to include higher value cases, such as impersonation fraud, and so account for 43 per cent of total losses.

Pedro Barata, Chief Product Officer at Feedzai, who have sponsored the report, said: „Scam mitigation has never been more important and although it’s promising that there’s been a slight decrease in the amount stolen through fraud compared to last year – there’s clearly more that can be done to protect consumers.

While behavioral biometrics, device analysis and transactional data and profiling can stop fraud early and with minimum impact on the user – as proven by the fact that banks were able to prevent a further £1.2 billion being stolen – we must collaborate and work together as an industry to ensure maximum protection for the end customer is in place. This is even more pertinent with laws around reimbursement changing and stopping criminal activity in its tracks, shutting down fraudsters and beating them by fighting AI with AI is paramount.”

Download the 2024 Fraud Report here

_____________

UK Finance publishes both the value of fraud losses and the number of cases. The data is reported to us by our members which include financial providers, credit, debit and charge card issuers, and card payment acquirers. Each incident of fraud does not equal one person being defrauded, but instead refers to the number of cards or accounts defrauded.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: