In the dynamic world of fintech, open banking has risen as an innovative solution, reshaping how consumers interact with financial services. According to Statista, the number of open banking users worldwide was expected to grow by an average of 50% per year between 2020 and 2024, with 12.2 million users in Europe in 2020. In 2024, the number of open banking users is close to 64 million, 70% more than predicted.

an article written by Salt Edge

As we navigate through the complexities of fintech, open banking serves as a foundation for a broader and more complex concept: Open Finance. Open Finance extends the principles of open banking, moving towards a more transparent, accessible, and customer-centric financial world. According to FDX, 78 million consumer accounts in the US and Canada are currently utilising its FDX API for safe Open Finance data sharing as of March 2024.

The potential of Open Finance is immense. It holds a future where financial services are more intuitive, personalised, and seamlessly integrated into business operations. Let’s explore its fundamentals, what new use cases to expect, and some concerns related to the standard.

Open Finance fundamentals

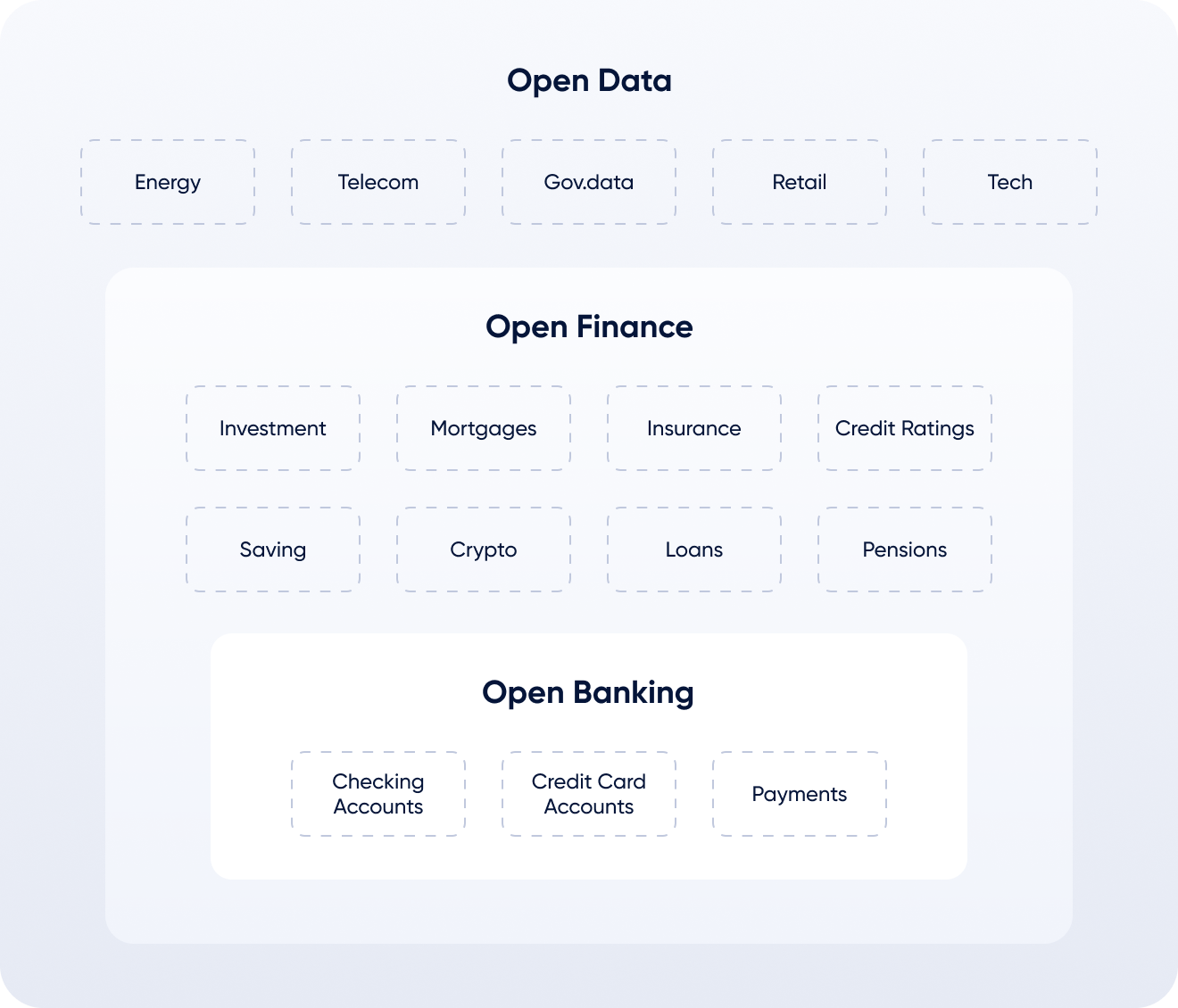

Open Finance is built on open banking concept with a much wider financial ecosystem. Therefore, Open Finance goes beyond standard banking services, enabling its use in a broader range of financial products and services. With the use of open APIs, the framework enables third parties to develop and build applications and services for multiple types of financial institutions, including mortgages, pensions, savings, and insurance. Moreover, it is intended to ensure that all consumers have stronger control over their financial data, which aligns with the General Data Protection Regulation (GDPR).

Open Finance data refers to a variety of data that includes account balances, transactions, savings accounts, pension data, and more, and is accessible and usable by multiple parties within a larger financial ecosystem.

With more data available, Open Finance is expected to inspire the emergence of new use cases, supporting the development of fresh and improved products and services that meet the changing needs of consumers. Several of them include:

Mortgages:

Open Finance can streamline the mortgage application process by providing lenders with secure access to consumers’ financial data, providing faster and more accurate verification of income and assets, and leading to quicker loan approvals. On the consumer side, the model enables them to compare mortgage offers from different lenders based on pre-approved eligibility and get the best possible terms.

Pension:

Due to the numerous administrative procedures and documentation required, pension transfers demand more time and effort. By integrating Open Finance APIs, providers can connect and access consumers’ data and offer a pension dashboard with a complete view of all their data, including current accounts, investments, and savings.

Savings:

Open Finance enables consumers and businesses to optimise their interest earnings. By identifying inactive funds across different accounts, Open Finance can suggest automated transfers to higher-interest savings accounts, maximising returns. This enables keeping the bulk of the money earning interest while still having the flexibility to ‘sweep’ the funds to a current account when needed for expenses like mortgages, supplier payments, or other bills.

Variable Recurring Payments:

Sweep accounts leverage Variable Recurring Payments (VRPs) to automate money movement between consumers’ accounts based on pre-defined triggers. For example, imagine the consumer sets a minimum balance in the checking account. When it dips below that level (the trigger), a VRP securely sweeps excess funds from a linked savings account, avoiding overdraft fees and maximising the interest earned.

Open Finance benefits

Based on the paper by the OECD, “Open Finance policy considerations”, the advantages of data sharing frameworks like Open Finance aim to:

Improve financial products and services for customers, meaning a greater variety of products with personalised and cost-efficient options.

Give customers more control and choice over their data. Open Finance is intended to ensure all consumers have strong control over their shared data, in line with GDPR, meaning that finance management, tax estimations, and loan options comparison become easier. Moreover, an Open Finance framework can bring advantages such as reducing bureaucracy and friction and providing an easier process for switching services or providers.

Increase competition among financial institutions, driving innovation in the financial sector and leading to de-monopolisation of data. The framework can potentially encourage organisations to offer their clients new or innovative services, expanding the range of services available to them.

In the European Union, there’s an even broader plan to create a data marketplace. This would allow data to flow freely across different industries (finance, healthcare, and transportation) throughout the EU, benefiting businesses, researchers, and governments.

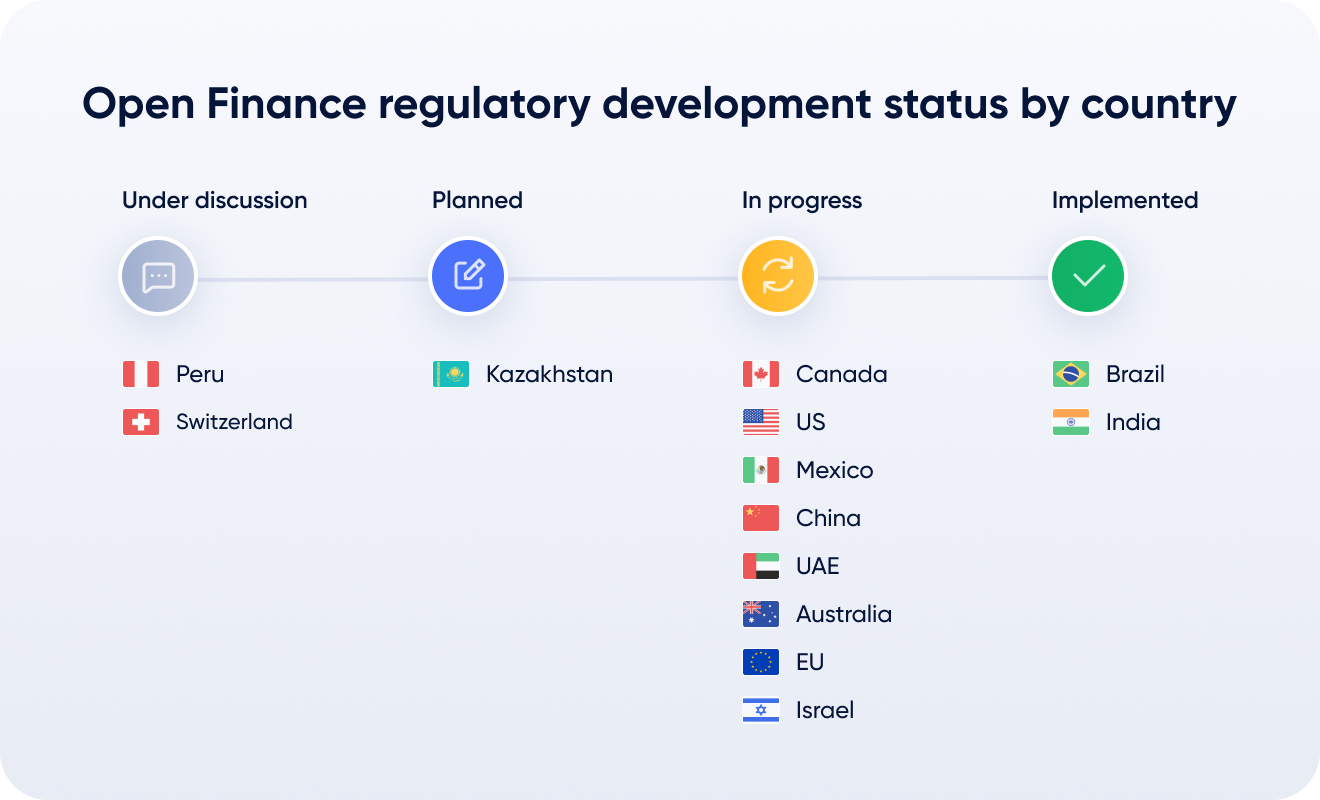

State of Open Finance worldwide

There are currently 43 countries in various stages of implementing an Open Finance regulation. The UK, for instance, has its Open Finance policies integrated into its Smart Data initiative and has also implemented amended Electronic Money, Payment Services and Payment Systems (EPPRs). Australia is already in Phase 2 of adopting Open Finance and is considering expanding the CDR by creating regulatory testing platforms and governance mechanisms. Brazil introduced Open Finance in 4 phases, currently in the final stage, with the scope to combine more data sources, already including data on investments. The total number of weekly API calls had reached 1.65 billion at the beginning of March.

Jordan has also introduced The Jordan Open Finance Standards, intending to use a common set of APIs to streamline operations within the financial sector in the region. While Open Finance offers a wealth of potential benefits and opportunities, there have been a set of challenges that banks in Jordan have to navigate.

„Beyond the technical difficulties of adapting systems and APIs, banks in Jordan, for instance, have had to undertake significant reviews of their internal policies and terms of service to align with the regulations. In Jordan, Open Finance includes not just payment accounts but also extends to all types of accounts, service details, products, local premises, ATMs, FX rates, and consent dashboards. This broad scope requires meticulous adherence to compliance measures, including the TPPs’ onboarding process.” – shares Andrei Scutari, Head of Sales at Salt Edge

Despite these concerns, on February 14, 2024, the Jordan Payments and Clearing Company (JoPACC), along with the Central Bank of Jordan (CBJ) and a group of local banks, launched The Jordan Open Finance Standards. This initiative was made possible through JoPACC’s fintech Incubator JOIN Fincubator, and it is set to revolutionise the financial landscape in Jordan.

Building on the foundations established by open banking, Open Finance brings in a new era of user control and financial innovation. This evolution empowers consumers with greater autonomy over their financial data and an easier switch between financial services and products. Businesses will also benefit from a more comprehensive view of their customer base, allowing them to offer personalised and innovative offerings to their clients.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: