Europol’s first report on the most threatening +800 criminal networks active in the EU

The report represent the most detailed contemporary study on the most threatening criminal networks ever undertaken by the European law enforcement community.

EU Member States and third countries identified a total of 821 most threatening criminal networks active in the European Union, and affecting the region’s internal security. The total memberschip of the identified networks exceeds 25 000 individuals. These criminal networks were selected based on criteria around the threat they pose.

This overview of 821 most threatening criminal networks is a unique feat for the European Union as it brings together details on their functioning and operations in a uniform way by all contributing countries.

These networks and the suspects they are composed of are active in a range of crime areas, such as drug trafficking, frauds, property crime, migrant smuggling and trafficking in human beings (THB), among others. Drug trafficking clearly stands out as a key activity – half (50 %) of the most threatening criminal networks are involved in drug trafficking, either standalone or as part of a portfolio of activities. One third (36 %) have a unique focus on drug trafficking.

„Each of the 821 identified criminal networks is unique. They vary in composition, structure, criminal activity, territorial control, longevity, types of cooperation and a range of other dimensions. This report decodes the ABCD of the most threatening criminal networks and assesses what makes these networks most threatening – they are Agile, Borderless, Controlling and Destructive.

This analysis of over 800 criminal networks lays the foundations for tackling and disrupting their operations. Investigating and bringing them to justice is a goal that can only be achieved through a culture of police cooperation across Europe and beyond. With this first analysis, Europol and our partners make the invisible visible and decode the inner workings of criminal networks.” – says Catherine De Bolle, Executive Director of Europol.

Key takeaways

. 34 % of the most threatening criminal networks have been active for more than 10 years.

. 86 % of the most threatening criminal networks make use of legal business structures (LBS). The sectors most vulnerable to infiltration by organised crime include construction, hospitality and logistics

. 68 % of networks are composed of members from multiple nationalities, while 32 % have members from only one country.

. 76 % of the most threatening criminal networks are present or active in two to seven countries. Less than a quarter operate in more than seven countries

Frauds

Fraud schemes affect millions of people in the EU, and harm the financial interests of the EU and its Member States. This is the second most common activity of the most threatening criminal networks. One-fifth of these networks engage in fraud as their main criminal activity, sometimes strategically engaging in other crime areas.

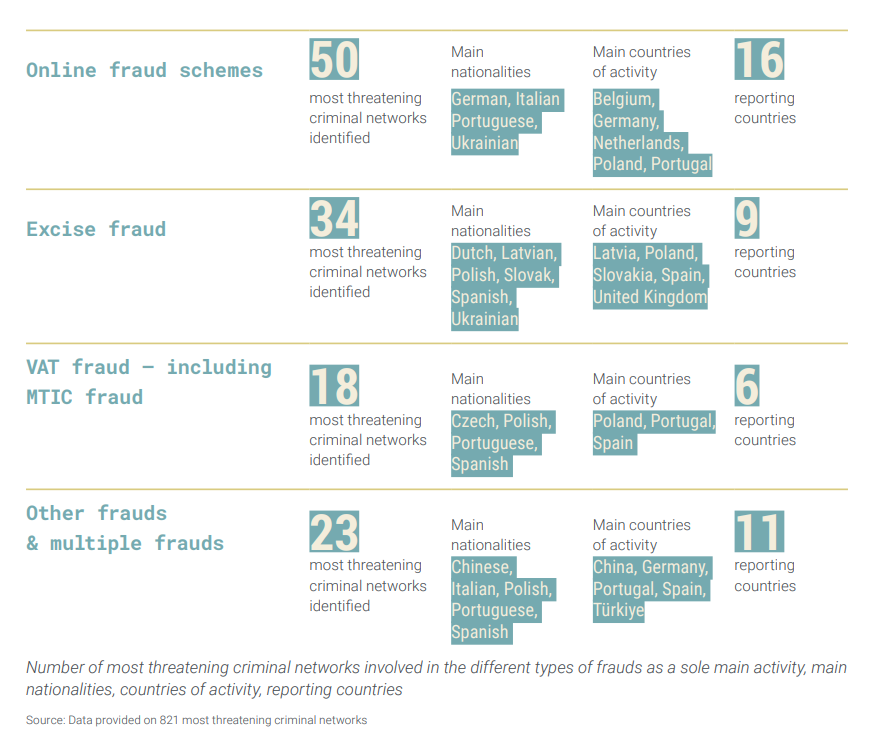

Criminal networks lure victims into various types of online fraud schemes, mainly investment and romance fraud. Such fraud schemes are the speciality of 50 of the most threatening criminal networks. The main countries of activity of such networks include Belgium, Germany, the Netherlands, Poland and Portugal.

Call centres play an important role in these schemes, targeting specific categories of victims such as elderly people. Operators are often located outside of the EU, such as India, Israel, Türkiye and the United Kingdom, but also sometimes in the EU. While certain call centre operators limit their activity to making the fraudulent calls, others take charge of the whole process, including tasking individuals, recruiting new personnel and regulating the distribution of individual remuneration.

Annual profits from online fraud schemes vary depending on the type of scam. Investment fraud scams can lead to networks obtaining hundreds of millions in a short period of time. A wide variety of nationalities are involved in online fraud scams, including Belgian, French, German, Italian and Portuguese as well as Albanian, British, Israeli and Ukrainian from outside the EU.

Excise fraud is the sole main activity of 34 of the most threatening criminal networks. Tobacco excise fraud in particular is often a core activity, mainly for networks composed of Polish, Slovak and/or Ukrainian nationals. They operate in Poland, Slovakia, Spain and the United Kingdom. Half of the networks engaging in tobacco excise fraud have end-to-end control, the other half control particular stages such as the acquisition of tobacco for production of illegal cigarettes, transportation and distribution. Most networks involved in tobacco excise fraud limit themselves to this criminal activity. However, some combine the production and trafficking of illicit cigarettes with drug trafficking activities or with other types of fraud (oil excise fraud or customs import fraud).

Eighteen of the most threatening criminal networks specialise in VAT fraud – including carousel fraud. They usually have end-to-end control over the criminal process. The most represented nationalities in these networks are Czech, Polish, Portuguese and Spanish. Poland, Portugal and Spain are most affected by this type of fraud.

Other types of fraud, such as subsidy fraud and customs import fraud, are the sole main activity for 15 of the most threatening criminal networks and 8 networks combine various types of fraud. Poland and Portugal are the main countries reporting on subsidy or customs import fraud. The most represented nationalities in these networks are Brazilian, Chinese, Polish, Portuguese, Spanish and Vietnamese. China and Portugal are the most affected countries.

Download the report: Decoding the EU’s most threatening criminal networks

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: