Will Metro Bank be 2023’s next banking collapse?

Metro Bank has had a rough week. News that the UK challenger bank was planning to raise up to £600 million from investors, prompted financial watchdogs to summon the bank’s bosses for a sit-down, according to Finextra.

While shares in the bank slumped almost 30% on Thursday, difficulties started in mid-September after the Bank of England announced it would not provide capital relief for mortgage lending until 2024 (at the earliest).

Metro met with rivals including HSBC, NatWest and Lloyds on Thursday to discuss buying a third of its mortgage book in efforts to bolster its balance sheet.

Business review

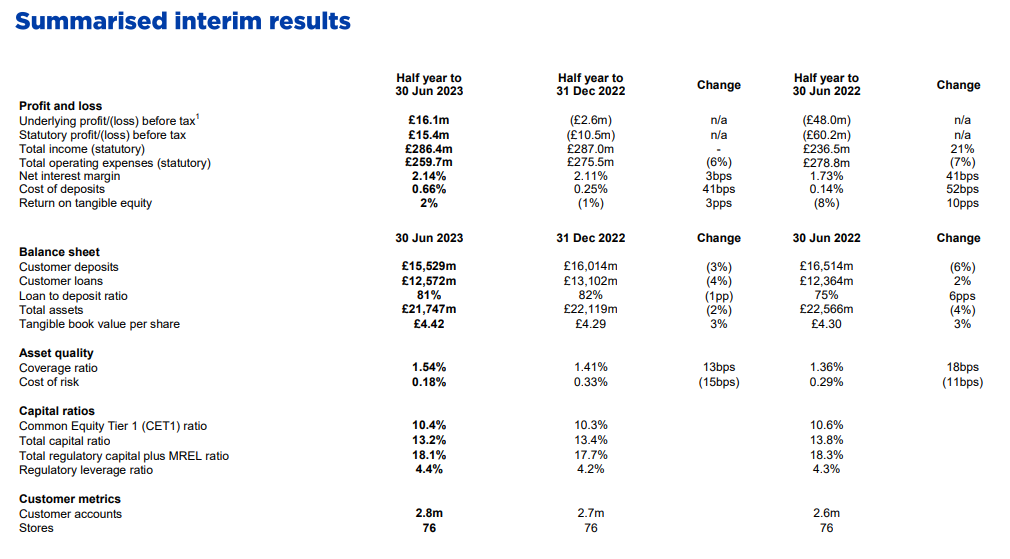

In the first half of 2023 total revenue increased year-on-year to £286.4 million from £236.5 million, but remained flat compared to the second half of 2022 (£287.0 million), according to Metro Bank Holdings PLC – Interim report for the half year ended 30 June 2023.

„The first six months of 2023 mark our first set of results since we completed our turnaround at the end of 2022 and has seen us deliver our strongest financial performance in several years.” according to the report. The bank reported its first half year of statutory profitability, with a profit before tax of £15.4 million (half year to 31 December 2022: loss of £10.5 million; half year to 30 June 2022: loss of £60.2 million), as well as our third successive quarter of profitability on an underlying basis.

„This momentum is evidence that our business model works, and that combined with continued execution of our strategic priorities is seeing us deliver on our ambition to be the number one community bank.” the bank said in the report.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: