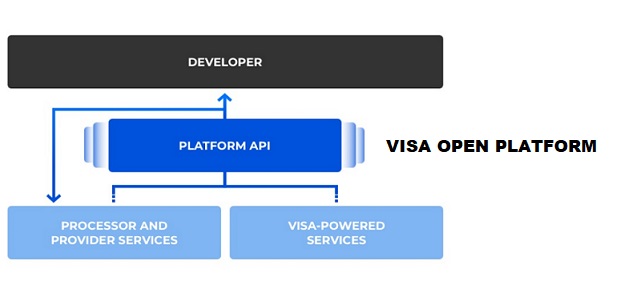

Visa has unveiled a platform with a set of beta APIs and development tools that help issuers and issuer processors build and test digital payment products. Available to the payment giant’s clients and partners through a new site, called Visa Next, the platform promises to „help re-imagine” how people access, manage and control their money in the digital age.

“Imagine if parents could instantly create a Visa card on their mobile device and send it to their child’s phone for immediate use, instead of giving them cash for movies, for example. They could also set parameters around where, when, even how long the child can use this card – and adjust these controls at any time via their own mobile device,” said Sam Shrauger, SVP, global issuer and consumer solutions, Visa.

„Visa introduced a new platform with a set of beta APIs, specifications and development tools for issuers and issuer processors to begin building and beta testing new payment products to help meet the future needs of digital-first consumers. The offering will be available to clients and partners via Visa Next, a new destination for accessing new solutions in Visa’s product pipeline.”, according to the press release.

The first set of beta APIs will help Visa’s clients and partners build unique new ways for individuals to use, manage and control their money digitally – and in a way that works for them. The APIs available immediately on the platform, through Visa Next, will have the following functionalities:

. Create new digital card accounts on demand;

. Add newly-issued or existing cards to the platform to build solutions that seamlessly combine multiple Visa digital services;

. Instantly activate and tokenize digital accounts for use in ecommerce and in mobile wallets;

. Enable a consumer’s mobile device for contactless or QR payments using tokens;

. Deliver rich transaction data to clients for real-time actions or authorization decisions, and purchase alerts to the cardholder;

. Configure rules/limitations around use of digital cards, such as turn on/off transaction controls at any time, setting dynamic transaction or spending limits, control use by purchase channel or by geography, control use by merchant type, merchant, etc.;

. Share digital companion cards and control access in real time – independently manage controls on linked/shared digital cards.

In addition, many consumers in Asia, for example, use a super-app wallet that is only accepted within their country borders, but not necessarily elsewhere. With the new set of capabilities, Visa’s clients and partners can give their customers an option to turn their wallet balance into a digital Visa card, right on their mobile device, and begin transacting in over 200+ countries and territories, at 53.9 million merchant locations where Visa is accepted.

The capabilities can also help bring to life additional functionality, including the ability to set card controls, load ‘tap to pay’ and create transaction notifications for consumers.

„Visa Next will also enable the creation of globally interoperable and tailored solutions for digital-first individuals around the world. Throughout 2019, it will bring to life additional beta APIs including loyalty, benefits and rewards and new transaction controls.”, Visa added.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: