Visa Europe has confirmed that it plans to cut its 5.3% stake in struggling UK mobile banking vendor Monitise. Visa took a 14.4% stake in Monitise after signing a five year $13 million partnership deal with the UK outfit back in 2009. That shareholding has been gradually whittled down as Monitise skipped successive breakeven targets over the years, according to finextra.com.

In a brief statement, the company says: „Monitise and Visa Europe will continue to work together on a number of projects and services under the three-year commercial agreement which runs until 31 March 2016. Both parties look forward to working together for the duration of this commercial agreement and will assess on an ongoing basis opportunities to work together in future.”

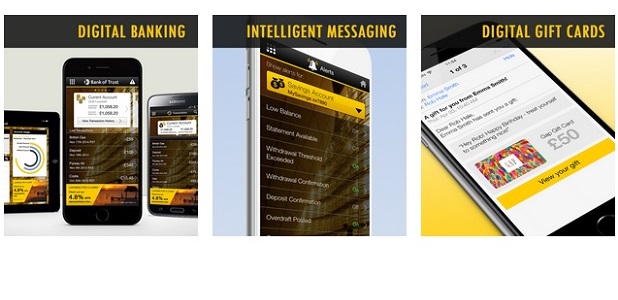

According to the company, Monitise is a world leader in Mobile Money – banking, paying and buying with a mobile device. Leading banks, payments companies, retailers and mobile networks use Monitise’s technology platforms, products and services (see photo) to securely connect people with their money. Monitise’s digital agency designs and delivers high-engagement apps across multiple industry verticals.

Bloomberg – Monitise’s share price evolution: from £80 to £8 in the latest 16 months

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: