Visa, Mastercard, Discover and American Express consumer, small business and commercial credit, debit and prepaid cards issued in the U.S., in addition to payments settled through Visa Direct and Mastercard Send, generated $1.859 trillion in payment volume in the first quarter of 2021 (January 1 through March 31), up 14.1% from the same period in 2020, according to Nilson Report.

Purchase volume on credit cards of $944.06 billion grew 0.8%. Credit card cash volume generated by balance transfers as well as at ATMs, over the counter at bank branches and from paper checks was $16.84 billion, a decline of 42.0%.

Discover credit cards generated $37.74 billion in purchase volume, an increase of 11.1%. Visa credit card purchase volume was $500.47 billion, an increase of 1.6%. Purchase volume on Mastercard credit cards was $219.90 billion, up 1.4%. American Express purchase volume was $185.95 billion, down 3.7%.

Cash advances accounted for 1.75% of total credit card volume, a drop from 3.00% in the first quarter of 2020.

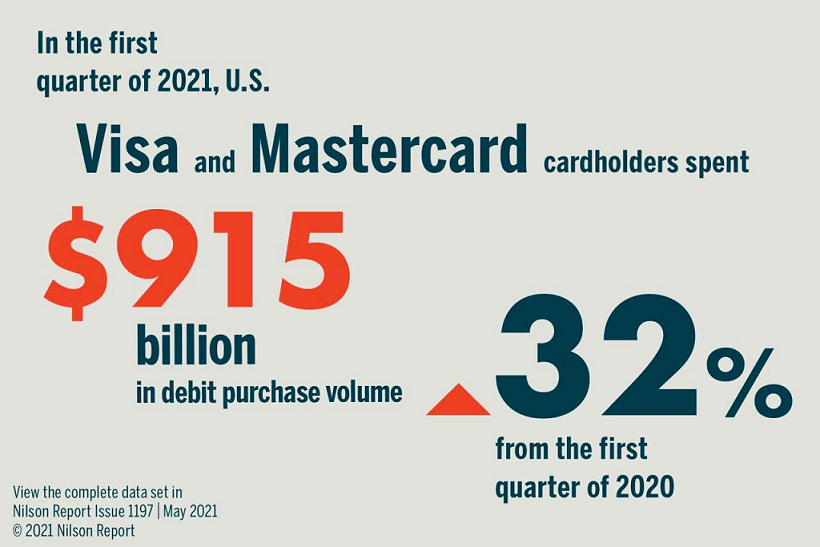

Total debit card volume—combined purchase and cash volume on Visa and Mastercard debit and prepaid cards plus Visa Direct and Mastercard Send volume—reached $915.21 billion, up 32.0%. Visa payment volume on debit and prepaid cards increased 33.9%. Mastercard debit and prepaid card payment volume grew 27.4%.

When comparing all purchase transactions at merchants, credit cards accounted for 35.49%, a drop from 39.00% in the first quarter of 2020.

Visa cards accounted for 55.44% of all credit card transactions. However, Visa’s market share fell by 64 basis points from a year earlier. The market share of Mastercard credit card purchase transactions was 23.30%, up 5 basis points. American Express had a 14.71% share, up 15 basis points. Discover had a 6.54% share, up 46 basis points.

Visa’s share of debit card purchase transactions was 71.02%, up 54 basis points from 70.48%. Mastercard’s share was 28.98%, down 54 basis points from 29.52% the prior year.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: