‘Tap and Go’ tipping point in UK: contactless overtakes Chip and Pin for instore card payments

The latest figures from Worldpay show that contactless transactions have overtaken chip and pin payments for the first time in the UK, as consumers embrace more convenient forms of payment. Contactless usage jumped by 30%1 in the past year to become the most popular form of card payment for in-store transactions.

This trend has continued into the second half of this year, with a consistent rise in contactless paymentsversus chip and pin. Earlier this month, research found that nearly half of all UK payments (including cash) were contactless enabled2, demonstrating the nation’s drive for more convenient forms of paying.

Worldpay predicts that during the final six months of 2018, UK shoppers could spend up to £38.5billion3via contactless transactions in-store. Part of this growth comes from the rise in use of mobile wallets such as Apple Pay, Samsung Pay and Google Pay, which have seen an astonishing 114% increase on the high street over the same period.

Clothing and footwear contactless sales soar

Fashion retailers have seen the greatest shift from Chip and PIN to contactless, with the sector citing a massive 415% year-on-year increase. Mobile contactless payments also rose significantly in the clothing and footwear sector, up almost 500% over the past year. Betting shops and department stores also saw significant growth of mobile contactless payments: between 150-250%.

With the value of mobile contactless payments rising 122% over the past year, the added convenience and security of ‘limitless’ mobile contactless payments could pave the way for phones to replace wallets over the next decade. Worldpay research has also found that 65% of consumers say they’d happily make a contactless purchase of up to £504.

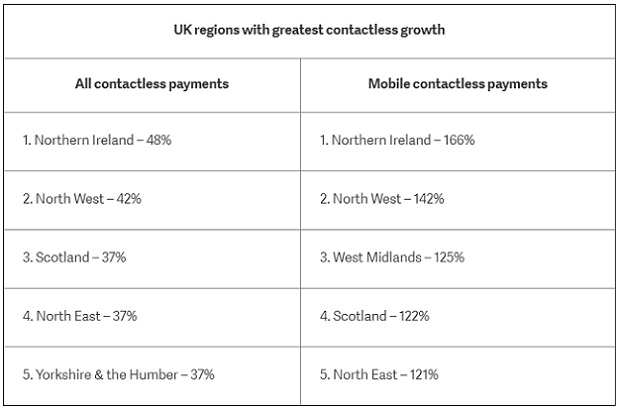

The trend towards tap-and-go is being seen nationwide: Northern Ireland has seen the greatest uplift in both contactless and mobile contactless transactions, demonstrating that the desire for more frictionless and convenient purchasing experiences is being driven by an evolution in shopper behavior over isolated regional trends.

Steve Newton, Executive Vice President at Worldpay comments: “The data clearly shows that shoppers are moving towards more convenient forms of payment. This aligns to what we’re seeing in a number of sectors: time-poor consumers want instant access to their goods. Whether buying clothes or booking holidays, speed and ease are the watch words for meeting consumer expectations. The popularity of online shopping, mobile payments and click-and-collect is testament to this.

“The rise of contactless is part of a bigger story: it’s not simply about tap and go – it’s about convenience and reducing the parts of the shopping experience that customers find irritating, like queuing and waiting to pay. Over 50% of shoppers believe that their phones could replace their wallets within the next five years5 – the phenomenal growth of mobile contactless is a leap along this path. With the added benefit ‘limitless’ transactions and biometric security offered by mobile wallets, our smart phones could be the key to the next frontier of frictionless commerce.”

About the data:

Analysis of card transactions processed by Worldpay in the UK between January 2018 and July 2018 versus the previous year. Contactless transactions refers to a combination of mobile contactless and card present contactless. Mobile transactions refer to mobile contactless transactions only.

About Worldpay

Worldpay, Inc. is a leading payments technology company. Worldpay processes over 40 billion transactions annually through more than 300 payment types across 146 countries and 126 currencies. The company’s growth strategy includes expanding into high-growth markets, verticals and customer segments, including global eCommerce, Integrated Payments and B2B.

Worldpay, Inc. was formed in 2018 through the combination of the No. 1 merchant acquirers in the U.S. and the U.K. Worldpay, Inc. trades on the New York Stock Exchange as “WP” and the London Stock Exchange as “WPY.”

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: