Square to take on incumbents with business banking accounts

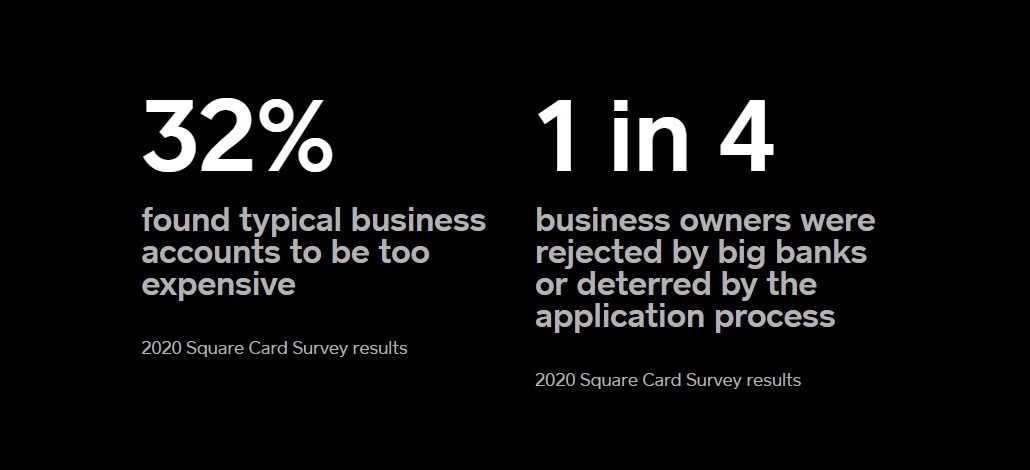

Square is to take on the nation’s big banks with the launh of Square Banking, providing small businesses with a full suite of checking and savings accounts, payment cards and loans.

Today, Square launches Square Banking, a suite of financial products purpose-built to help small business owners easily manage their cash flow and get more out of their hard-earned money. Coming on the heels of Square’s industrial bank, Square Financial Services, beginning operations in March, „Square Banking represents a major milestone in Square’s continued efforts to expand access to financial tools for underbanked populations and marks the beginnings of the company’s journey to provide more banking solutions to small businesses,” according to the press release.

“Historically, small businesses have had to contend with numerous hurdles while trying to access vital financial services that are often readily available to larger companies. With Square Banking, we’ve reimagined the financial system for small business owners with their cash flow needs at the center. We’re introducing fair, accessible financial services that connect directly with our sellers’ payments, helping them unlock instant access to their sales, automate their savings, and receive personalized financing offerings,” said Christina Riechers, Square Banking’s Head of Product.

Square Banking consists of three core products designed to help small business owners confidently manage cash flow stress: two new deposit accounts, Square Savings and Square Checking, join Square’s existing lending capability, now called Square Loans.

By offering essential banking tools that work seamlessly with Square’s ecosystem of solutions like payments and Square Payroll, sellers now have a single home for their entire business, gaining a unified view of their payments, account balances, expenditures, and financing options.

Square Savings: Automated Preparation for the Future

Small business owners recognize the value of setting aside funds, but the day-to-day challenges they face trying to manage their cash flow can make it difficult to build up a cash buffer. Square Savings, powered by Square Financial Services, offers small business owners a simpler way to start or continue building up their cash reserves.

With automated savings, Square Savings removes the friction from setting aside funds, enabling sellers to effortlessly save a percentage of every Square sale they make. To better help businesses organize their savings, Square Savings also offers customizable folders that sellers can use to save for specific goals and priorities, like purchasing new equipment or paying quarterly tax obligations. These FDIC-insured accounts offer a 0.5% annual percentage yield[1], and have no minimum deposits, balance requirements, or account fees.

Square Checking: A Home for Business Finances, Connected to Payments

Since Square first introduced the Square Debit Card, adoption has increased every quarter as more sellers seek a way to decouple their personal and business finances and immediately access and spend their earned funds. In 2020, the number of active Square Card sellers increased 140% year over year, and the total balance stored by these sellers increased 250% in the same time period. Square Checking builds off the company’s existing business banking tools, and in partnership with Sutton Bank, offers sellers an FDIC-insured business checking account that provides instant access to card sales they process via Square.

With Square Checking, Sellers can immediately spend their funds with their Square Debit Card, send and receive money via ACH with new account and routing numbers, or use their balance to pay their teams with Square Payroll. Square Checking has no account minimums, overdraft fees, or recurring fees, and sellers are able to instantly move funds between their Square Savings and Square Checking accounts whenever they need to, at no cost. Soon, sellers will also be able to deposit checks via the Square Point of Sale app, helping them further consolidate business funds into one place.

Square Loans: Personalized Financing Based on Sales, Not Credit History

Financing is critical for small businesses looking to grow or gain better control over their cash flow, and yet, according to the Federal Reserve, fewer than half of small businesses report that their credit needs are met. Since beginning operations, Square Capital – now Square Loans – has facilitated more than $9 billion in small business loans and Paycheck Protection Program loans to more than 460,000 Square sellers, with an average loan size of $6,750. These numbers highlight Square’s ability to reach and serve small businesses that have been traditionally underserved by existing lending options.

Square Loans continues to give sellers increased access to credit with proactive loan offers that are uniquely tailored to their business needs and can be automatically repaid through a percentage of their daily Square sales. Soon, sellers will also be able to instantly access their Square Loan from their Square Checking account once they are approved for a loan.

_______________

Sellers use Square to reach buyers online and in person, manage their business, and access financing. Square, Inc. has offices in the United States, Canada, Japan, Australia, Ireland, Spain, Norway, and the UK.

[1]For Savings accounts, annual percentage yield (APY) of 0.50% or more will apply until 12/31/2021, after which the APY in effect at that time will apply and will be subject to change.

All Square Loan numbers reflect metrics through March 31, 2021.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: