Scandinavia’s disappearing cash act – the Danish central bank has already stopped printing banknotes

By the end of this month, Scandinavia’s last mint will have closed. Following in the footsteps of Sweden and Norway, Denmark has decided to outsource the production of its coins to Finland. The Danish central bank has already stopped printing banknotes. They’ve become so unfashionable that there’s no rush to find a subcontractor for those.

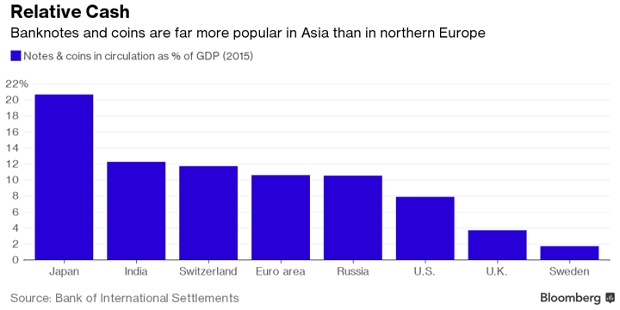

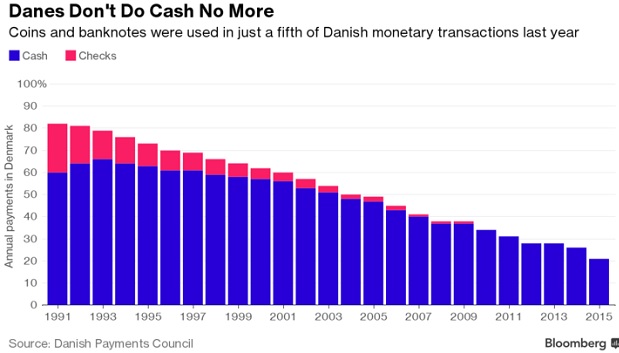

Denmark, along with neighboring Sweden, is today one of the countries with the lowest percentage of notes and coins in circulation. As recently as 1991, cash and checks were responsible for 82 percent of Danish transactions. The check went the way of the Dodo in late 1990s, while the use of cash has been dropping steadily ever, even during the current period of negative interest rates.

According to a March report by Denmark’s Tax Ministry, the size of the country’s black economy has fallen by a third between 2012 and 2014, from 45 billion kroner ($6.3 billion) to 31 billion. Although the ministry did not provide a reason for the reduction, it is interesting to note that cash usage also fell during the period (see second chart).

Still, the Nordics’ shift away from cash has as much to do with convenience as with the fight against crime. A June report by the Danish central bank found that the cost of handling cash is more than double that of handling domestic debit card payments. The same report also found that hardly any Danish shop prefers cash to plastic these days. Fear of robbery was often cited as a key reason for their preference.

The newest form of electronic payment to have taken Denmark by storm is Danske Bank’s MobilePay, an app which allows people to easily pay for purchases or send money to friends and family using their mobile phone. A similar product exists in Sweden, but MobilePay is the region’s runaway success. Launched in May 2013, it is already being used on a regular basis by more than half of Denmark’s population. Danske shares surged in November when a bunch of regional banks joined the platform.

Source: Bloomberg

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: