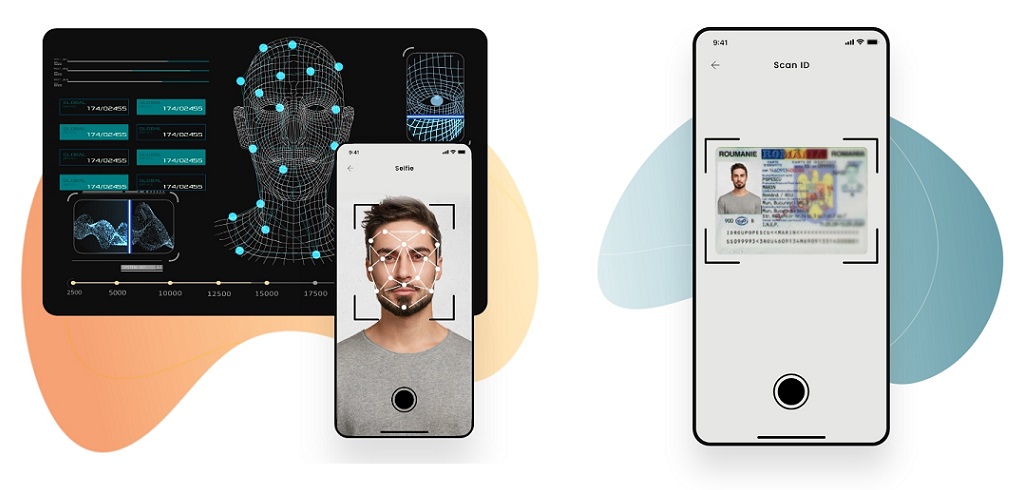

QOOBISS, a fintech company focused on process automation and specialized in developing remote identity verification solutions using video means, has updated its Qoobiss Identify solution (e-KYC) and has become „the first provider in Romania that enables remote identity validation through video means for the new identity cards with CIP” – according to the press release.

This update occurs as Romanian citizens, since the beginning of the year, regardless of their home locality, can choose electronic identity cards, either upon their first issuance or when replacing previous IDs. The new identity cards are the size of a bank card and contain a chip where the holder’s personal data, including name, photograph, date of birth, personal numerical code, and two digital fingerprints, will be stored.

For companies using e-KYC solutions, identification that enables the validation of the new identity cards brings a series of advantages:

. Fraud and crime prevention: Advanced technologies used in the integrated chips can make falsifying or altering identity cards more difficult, thereby reducing the risk of fraudulent use or identity-related crimes;

. Enhanced safety and security: The integrated chips in identity cards use advanced encryption technologies to protect users’ personal information;

. Increased conversions and, consequently, customer numbers.

Currently, in Romania, about 35% of companies use such solutions. This year, the remote identity verification solutions market will accelerate due to the amplification of digitalization in business and the adoption of online services by end users.

„The need to reduce companies’ operational costs through process automation and the necessity for better expense control will contribute to market growth. In this context, Qoobiss estimates a doubling of its revenue in 2024. For this year, the company has budgeted investments of 500,000 euros in developing existing solutions, launching new services, and international expansion.” the company said.

At the end of last year, Qoobiss provided services to 30 clients in Romania. For 2024, it aims to double the number of clients.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: