Orange Money Romania will use OneSpan to secure mobile banking app against fraud

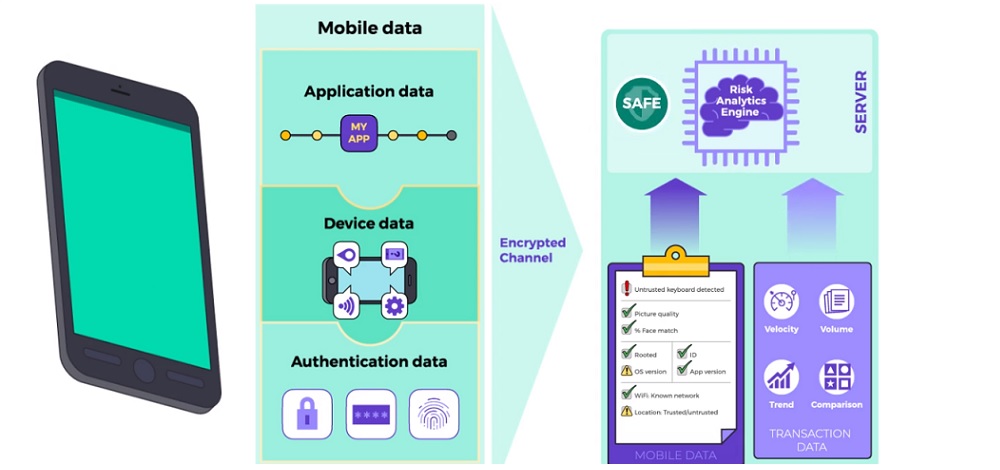

US-based OneSpan has announced that mobile-only bank Orange Money, has integrated OneSpan’s Intelligent Adaptive Authentication (IAA) to help fight online and mobile fraud, according to thepaypers.com.

The company specialising in securing remote banking transactions offers its IAA service to Orange Money, a subsidiary of Romania’s telecom provider Orange, enabling it to secure its mobile banking application and authenticate mobile transactions while detecting and preventing against mobile malware.

Using IAA, Orange Money can protect its customers through a range of multifactor authentication technologies. IAA also offers pre-configured, customizable rule sets for threat detection together with AI-based machine learning, behavioural analysis, and transaction risk analysis.

IAA is built on OneSpan’s Trusted Identity (TID) platform, which brings together a portfolio of technologies to enable real-time fraud detection through a set of cloud-based solutions.

Watch the video below to see how it works

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: