For Romania, due to the low interest in this area, the best way to move forward would be to set-up an OBIE-like entity to standardise technical requirements and consumer journeys. This would ensure that all industry participants are aware of the direction of the ecosystem. „Any other approach would be too slow to deliver considerable benefits in a reasonable timeframe,” according to a Yapily report.

Open Banking usage has increased significantly since the start of the pandemic. In the UK alone, the OBIE reports that over 3 million consumers now use Open Banking-enabled products and services to improve their financial wellbeing, and more and more countries are harnessing the power of Open Banking to enable better and fairer financial services.

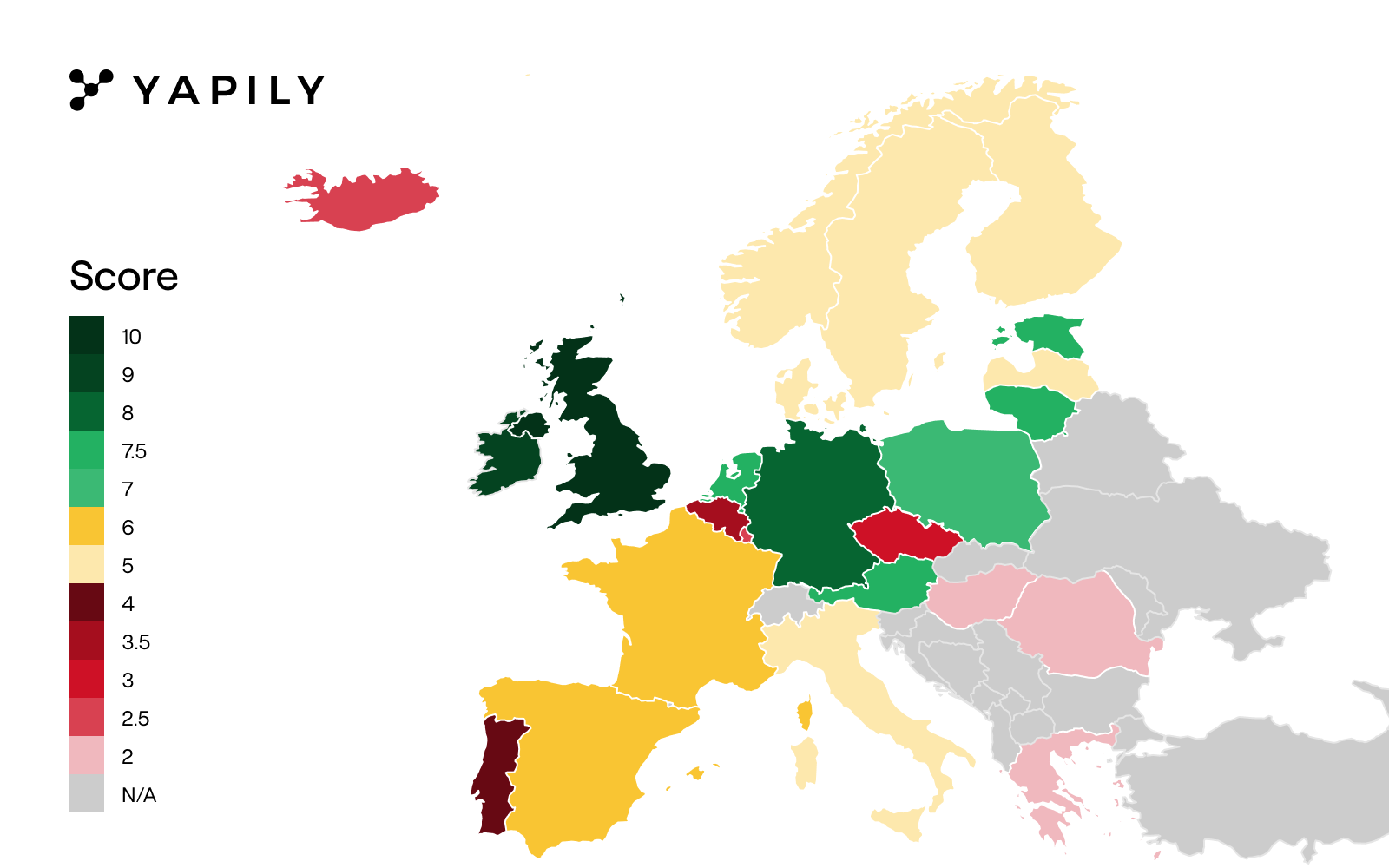

But while the market has a rough idea of who is winning the metaphorical league and who is missing the net, no-one really knows what the actual picture looks like across Europe. Or what this means for the future of Open Banking adoption. Yapily’s European Open Banking league table provides this comprehensive overview of the market.

The league table – based on data compiled in 2021 by Yapily through its EU-wide Open Banking API infrastructure and monitoring tools – reveals that while parts of the EU are making positive strides to drive Open Banking adoption and are on track to evolve into Open Finance, others are far behind and missing their scoring opportunity.

Each country has been ranked based on levels of supervision and enforcement by the member state, the presence of Open Banking from a technical standard, regulator interpretation, API standards and bank readiness, and overall product score. Yapily has also shared regulatory insight on where and how each country can positively improve their overall score and ranking.

Andria Evripidou, Policy Lead at Yapily comments on the data, “The league table demonstrates the positive impact Open Banking adoption has across markets and highlights that the ecosystem as a whole, is on the right path to offering fairer financial services for everyone.

“While some countries have a bigger presence, over the next few years, we will start to see standardised technical requirements that map customer journeys across all countries and better educate industries on Open Banking, as well as the direction of the ecosystem.

“Ultimately, all countries are working towards a common goal – to evolve with Open Finance – and at Yapily, we’re excited to watch the rest of Europe dive forward with this innovation.”

UK – the most advanced – Score 10

Yapily’s data reveals that the UK comes out on top as the leading adopter of Open Banking, with it’s clear functionality and more widespread mandating of interesting features, such as Bulk Payments and VRP (variable recurring payments).

Open Banking has been implemented successfully in the UK. The focus should now be on fixing some of the remaining issues in the technical implementation. Additionally, the industry would benefit from a roadmap to further the implementation of Open Finance.

Romania & Ungaria – the weakest interest – Score 2

Open Banking is a very low priority for regulators and there is no guidance around implementation.

Due to the low interest in this area, the best way to move forward would be to set-up an OBIE-like entity to standardise technical requirements and consumer journeys. This would ensure that all industry participants are aware of the direction of the ecosystem. Any other approach would be too slow to deliver considerable benefits in a reasonable timeframe.

Read here the full article for more details

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: