Numbrs Secures CHF 27 Million in Funding to Accelerate Growth and Drive Internationalisation.

Numbrs announces the completion of its fundraising activities for the year 2020 in the total amount of CHF 27 million. The lead investor in the latest funding round in December 2020 is the Swiss investment firm Saidler & Co Finance AG, which contributed an additional CHF 7 million, bringing its total investment amount in 2020 to CHF 17.5 million.

The new capital will enable Numbrs to accelerate the rollout of its new subscription-based business model in the United Kingdom and Germany. Key initiatives for 2021 include as well the market entry into three additional European markets (Spain, Italy, and France) and the development of new functionalities of Numbrs’ cutting-edge technology.

“We are pleased to have successfully completed our 2020 fundraising activities in the difficult market environment induced by the COVID-19 pandemic. We would like to thank our shareholders for their continued trust and support”, outlines Fynn Kreuz, a Managing Partner of Numbrs.

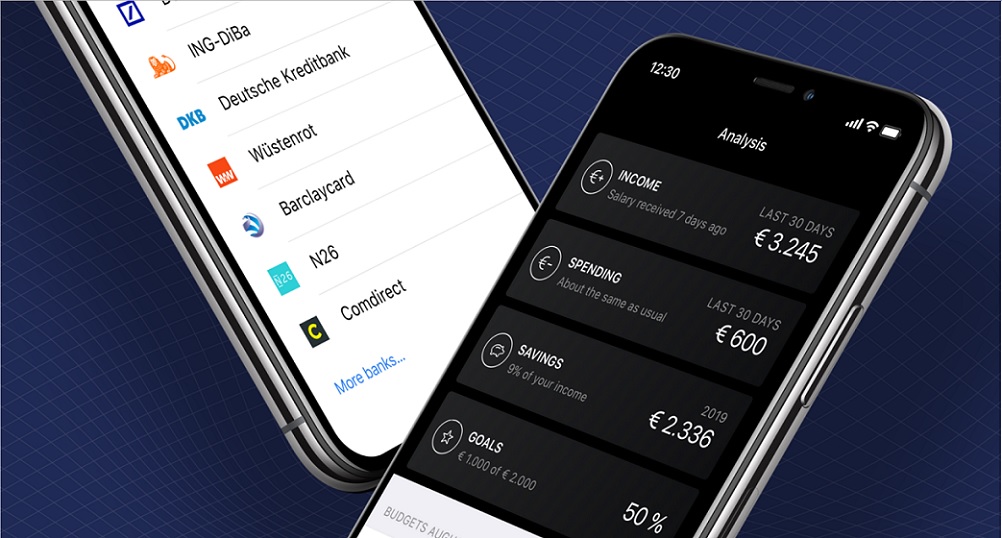

In November 2020, the personal finance app „Numbrs” changed its business model and has since focused on a paid software-as-a-service subscription model in Germany and the United Kingdom. The rollout of the new business model got off to a promising start and will be further expanded across different countries in Europe over the coming months.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: