The central role traditionally played by banks in the European payments ecosystem “may be coming under challenge”, according to a report jointly published by the Euro Banking Association and McKinsey & Company.

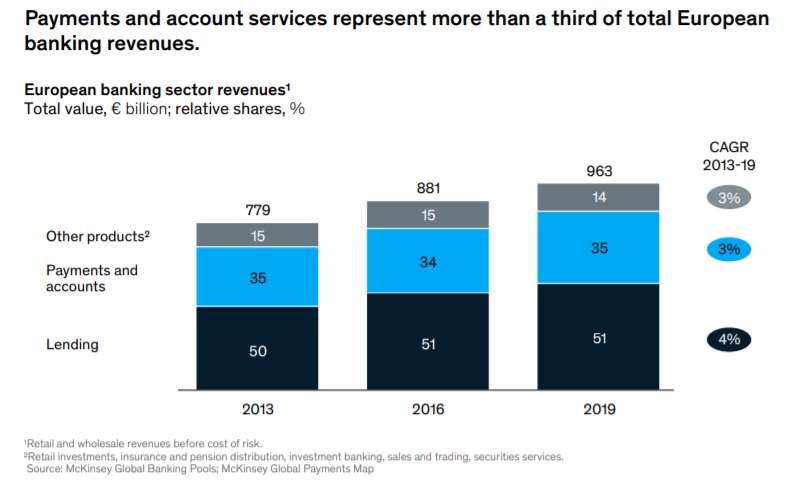

‘The future of European payments: Strategic choices for banks’ shows that payments and accounts services accounted for 35% of European banking revenues in 2019 and that growth in the sector “has remained steady at about 3% per year over the past six years”.

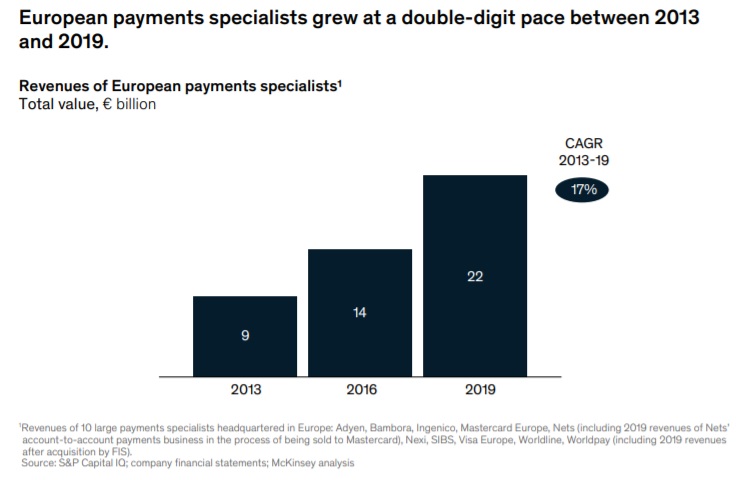

“However, a number of large payments specialists — processors, acquirers, schemes, and others — grew considerably faster than the sector as a whole, with some achieving double-digit growth rates,” the report continues.

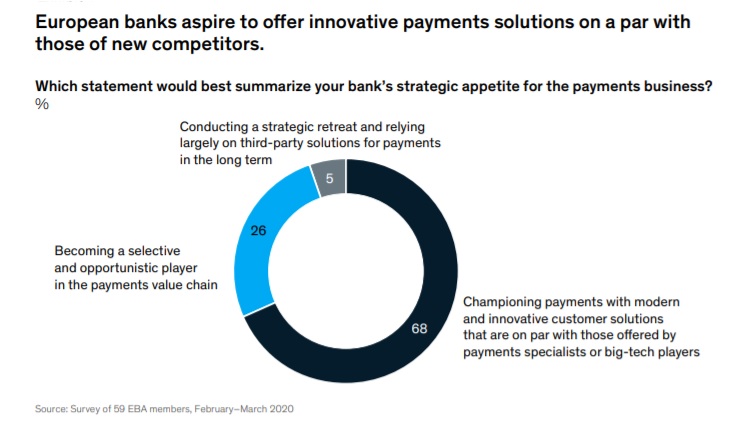

The 22-page report also reveals that almost two-thirds of executives and experts interviewed during the research believe that “banks will continue to be the leading players in European payments over the next five years.

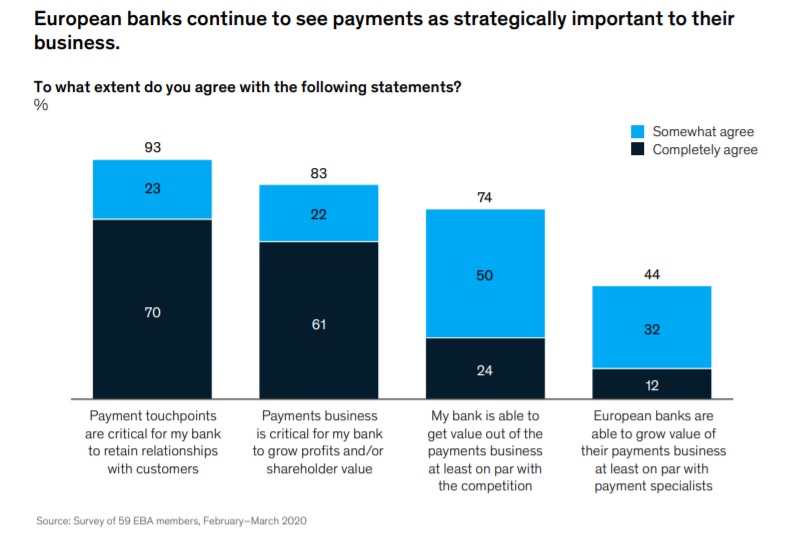

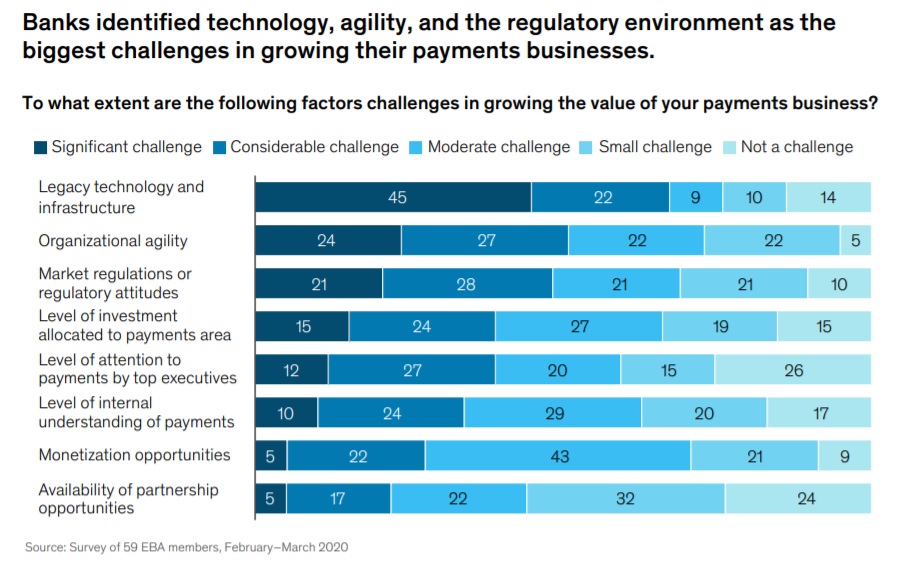

“However, survey respondents and interviewees identified a number of challenges faced by banks.

“These included increasing competition (especially from tech companies and fintechs), the rise of technologies that could allow other payments providers to come between banks and their customer relationships, the lack of flexibility in banks’ operating models, the constrained revenue environment, rising customer expectations, and the complex regulatory outlook.

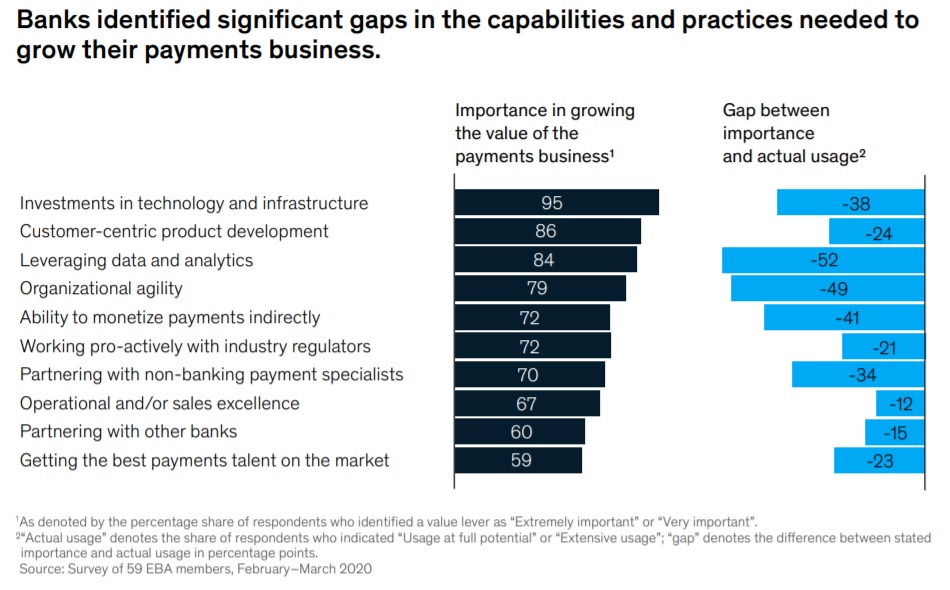

“Executives also identified gaps in the capabilities and practices needed to grow their payments business, especially in technology, organisational agility and monetisation models.”

The report reveals that participants believe that the Covid-19 pandemic and the “temporary fall of about 6% in European payments revenues in 2020” predicted in McKinsey’s Global Payments Report for 2020 will prompt banks to “reinforce their commitment to digitising customer journeys, introducing machine learning, and improving their technological and operational resilience”.

“Interviewees also commented on banks’ opportunities to accelerate growth in digital payments, use real-time payments infrastructure to offer fully digitised customer experiences, and improve the flexibility and cost of their operating models by using APIs, offering Payments-as-a-Service (PaaS), and setting up industry utilities to build scale,” the report adds.

The full ‘The future of European payments: Strategic choices for banks’ report can download it here.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: