The Italy cards and payments market size is valued at $347.1 billion in 2022 and is expected to achieve a CAGR of more than 8% during 2022-2026.

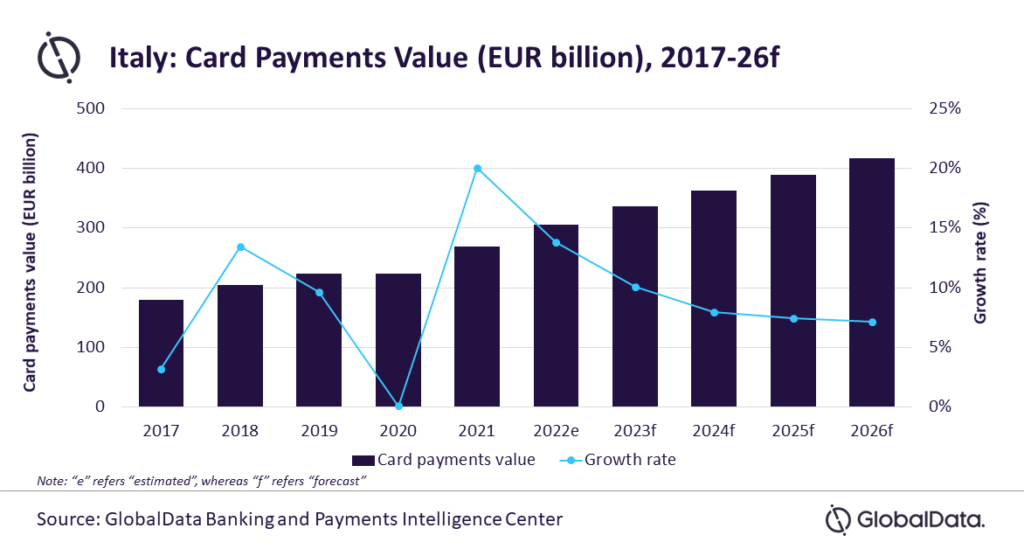

The Italy card payments market is expected to grow at a strong compound annual growth rate (CAGR) of 8.1% between 2022 and 2026 to reach EUR417.4 billion ($474.9 billion) in 2026, forecasts GlobalData, a leading data and analytics company.

GlobalData’s report, “Italy Cards and Payments: Opportunities and Risks to 2026,” reveals that card payment value in Italy registered a growth of 20% in 2021, driven by improving economic conditions and a rise in consumer spending. The value is estimated to have registered a growth of 13.8% to reach EUR305.3 billion ($347.3 billion) in 2022.

Growth in the card payment market will mainly be driven by debit cards, which accounted for 70% of the overall card payment value in 2022. The government’s financial inclusion initiatives, consumers’ preference for debt-free payments, and prudent consumer spending have resulted in their dominance.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Italian consumers remain relatively slow adopters of electronic payments, primarily due to strong inclination towards cash, which accounted for around two-thirds of the total payment transaction volume in 2022. However, with the government making concerted efforts to promote electronic payments, and improved payment card acceptance infrastructure in the country, card payments market registered robust growth in past few years.”

GlobalData notes that rising consumer awareness of electronic payments and a growing preference for contactless payments during the COVID-19 pandemic also helped accelerate this trend. As a result, the number of contactless cards are set to increase from 107 million in 2022 to 117.8 million in 2026.

While the Italian economy recovered from the pandemic, it is now facing new hurdles in the form of global geopolitical risks and rising inflation. The inflation rate in the country skyrocketed to 11.8% in October 2022 – highest in last few decades. The ongoing Russia-Ukraine war and rising inflation resulted in economic uncertainty across the world and Italy is no exception. These factors are weakening the consumer confidence about their financial situation and could affect the overall consumer spending.

Sharma concludes: “The pandemic changed the way Italian consumers make payments, with an increasing number of consumers preferring electronic payments supported by an improved payment infrastructure, thereby benefitting card payments market. However, the uncertain economic environment and rising inflation pose challenges for faster growth in the short run.”

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: