FED Study: 87% of the US adult population has a mobile phone – 22% of all mobile phone users made a mobile payment in the last 12 months

The use of mobile phones to access bank accounts, credit cards, or other financial accounts continued to increase among adults in the United States last year, according to a Federal Reserve Board report, Consumers and Mobile Financial Services 2015 (PDF). The report is the Board’s fourth looking at how consumers access banking services using mobile phones („mobile banking”), and their payments for goods and services using mobile phones („mobile payments”), as well as their use of mobile phones to inform their shopping decisions.

As of December 2014, 39 percent of adults with mobile phones and bank accounts reported using mobile banking–an increase from the 33 percent a year earlier. The most common use of mobile banking remains checking account balances or recent transactions. Transferring money between accounts is the second-most common mobile banking activity. More than half of mobile banking users received an alert from their financial institution through a text message, push notification, or e-mail–making this the third most common use of mobile banking.

Remote Deposit Capture, or depositing a check to a bank account electronically using a mobile phone camera, was also a common mobile banking activity. In the latest survey, 51 percent of mobile banking users reported depositing a check using their mobile phones, up from 38 percent a year earlier.

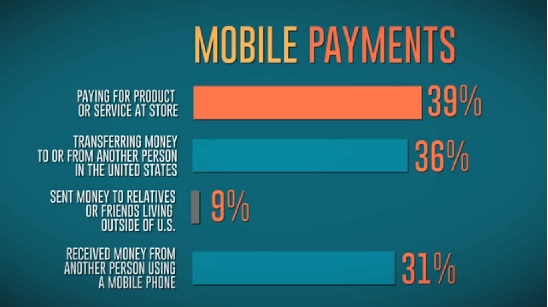

Twenty-two percent of all mobile phone users made a mobile payment in the 12 months prior to the survey, up from 17 percent a year earlier. For smartphone owners who reported using mobile payments, the most common types of mobile payments were paying bills through an online system or mobile app (68%), followed by making online or in-app purchases (54%). Paying for a product or service in a store was the next most common type of mobile payment.

39% of all mobile payment users with smartphones have made a point-of-sale payment using their mobile phone in last year. The most common method of POS payment is scanning a QR code or barcode, while 22% used an app without having to scan or tap their handset.

The survey found that while the underbanked make up 14 percent of consumers, 90 percent of that group has access to a mobile phone (73 percent of which are smartphones), and the underbanked represent a higher incidence of mobile banking (48 percent) than the fully banked (37 percent). The unbanked make up 13 percent of consumers and 67 percent of this group have access to a mobile phone (65 percent of which are smartphones).

For the first time, the survey looked at differences in mobile banking and mobile payment use in rural areas versus urban areas. Residents of rural areas have a lower incidence of mobile banking and mobile payment use than residents of urban areas.

The Federal Reserve Board completed its first Survey of Consumers’ Use of Mobile Financial Services in December 2011, and released a summary report in March 2012. The Board has conducted the survey annually to understand how the rapidly expanding use of this technology affects consumer decision making.

The survey was conducted on behalf of the Board by GfK, an online consumer research firm. The 2014 survey was conducted from December 5-21, 2014. More than 2,900 respondents completed the survey.

You can follow the link below for a video presentation of the FED report

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: