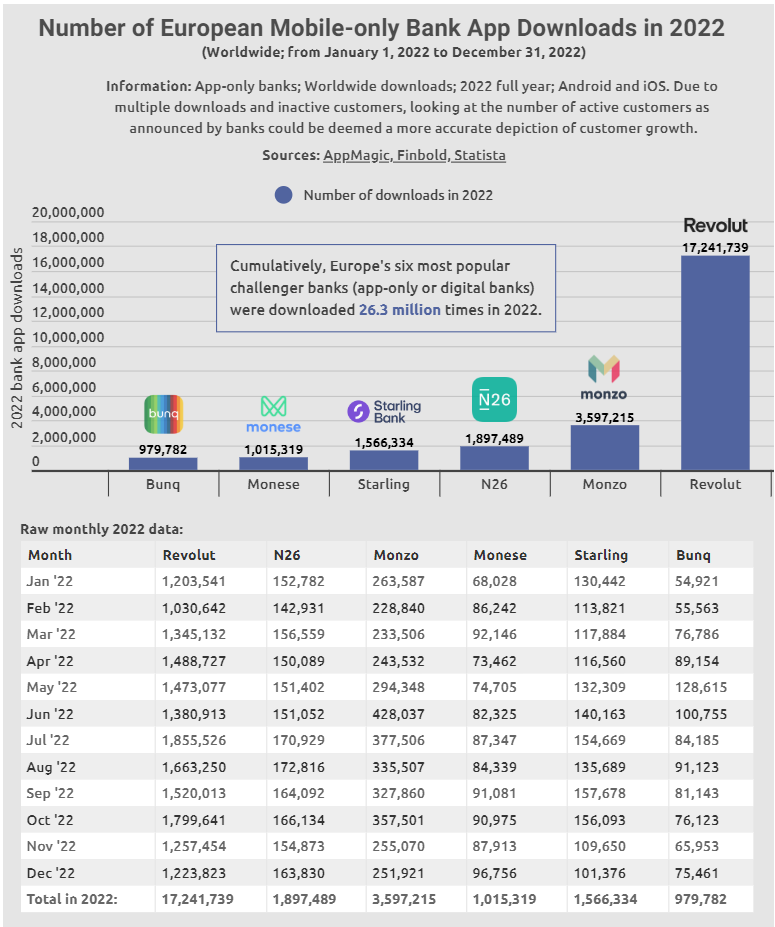

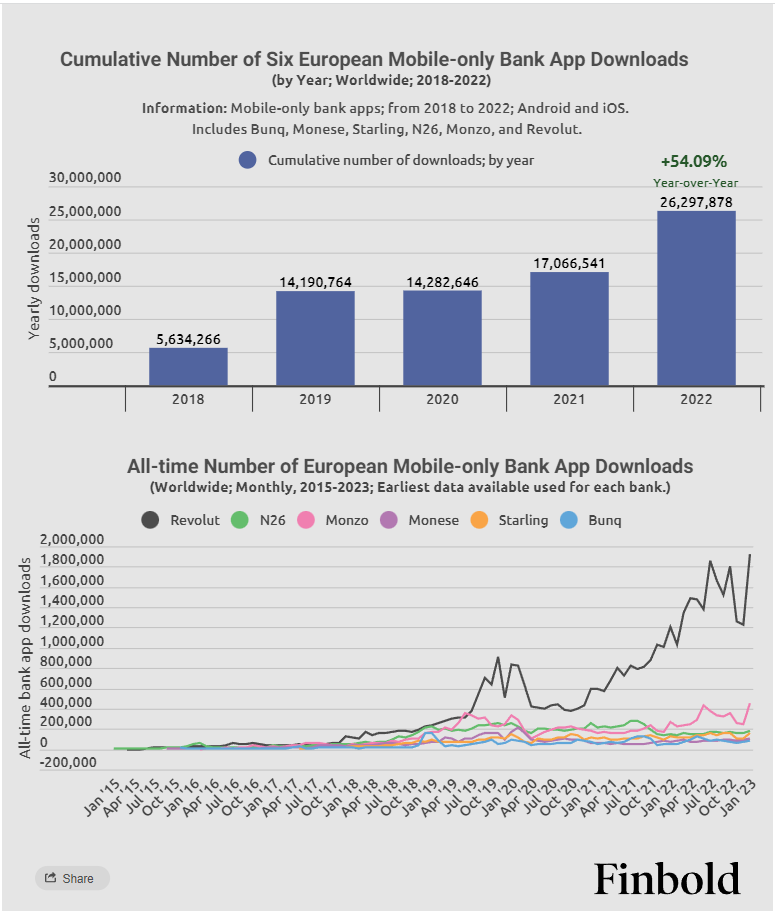

According to data acquired by Finbold, downloads for selected six European mobile-only bank apps peaked at 26.3 million in 2022 for Android and iOS operating systems. The downloads represent year-over-year (YoY) growth of 54.09% from 2021’s figure of 17.06 million. In 2018, the number of downloads stood at 5.63 million before spiking by over 150% to 14.19 million in 2019.

Among the selected apps, the United Kingdom-based challenger bank Revolut accounted for 17.24 million or a share of about 65% among the six banks. Monzo ranked a distant second with 3.59 million downloads, while N26 emerged third with 1.89 million. Starling Bank, with 1.56 million downloads, emerged fourth, while Monese occupied the fifth spot with 1.01 million downloads. Only Bunq failed to surpass the one million mark among the six most popular challenger banks, with 979,782 downloads in 2022.

The growing number of downloads highlights the rapid expansion of Europe’s fintech sector, with mobile-only banks being a notable player in the industry. The growth has been accompanied by significant investment by venture capitalists, which has signaled confidence in the space while driving the adoption of digital banking.

The data indicates that the remarkable increase in download numbers is not solely attributed to the unusual circumstances created by lockdowns but reflects a more enduring change in consumer behavior. In this line, mobile-only banks received prominence amid the pandemic as more jurisdictions implemented social distancing measures.

The astronomical growth of challenger banks was mainly triggered by the significant opportunity presented by the underserved market, previously overlooked by traditional banks, and became more pronounced during the pandemic.

Regulations have also supported the growth, with authorities enacting new laws to support the industry. For example, the United States is developing a new regulatory framework to understand partnerships between banks and fintech, while in the UK, the regulator’s sandbox has been open to digital banking. Currently, the Financial Conduct Authority (FCA) has updated its laws allowing digital banks to submit their applications year-round and access testing environments and services at the beginning of their development cycle.

It is worth noting that downloads do not represent direct new customers, but the figures highlight the banks’ continual impact and growth on the industry. The banks mainly track active customers using metrics such as the number of accounts opened, customer deposits, and the number of banking products used; the download data still offers insights into which companies are reaching the largest audience.

On the other hand, Revolut has broken away from the general market in downloads, a factor that can be attributed to the bank’s continued expansion globally. Indeed, Revolut is tapping into the borderless economy’s potential as the bank becomes a super app. For instance, the bank is growing its product offering in the United States with plans to unveil a streamlined app under Revolut lite for specific markets.

While digital banks have played a crucial role in driving digital banking adoption among consumers, they still fall behind traditional banks regarding deposits, uptake, and profitability. Most mobile-only banks are still struggling with profitability. The challenge to turn profits is highlighted by the fact that Revolut recorded its first full year’s profit for 2021 despite several years of existence.

Without profitability, mobile-only banks may struggle to survive and face consolidation by competitors or incumbent lenders. As the market for digital banks matures, they need to recognize that they are banks and that profitability is crucial for their continued existence.

Looking ahead, it remains to be seen if the banks can sustain the download growth. Notably, the digital banking sector faces increasing competition from established banks entering the market with highly digitized offerings. As a result, the industry is experiencing significant changes, with traditional banks looking to leverage their resources and expertise to take on the neobanks.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: