Restaurants added more than 45,000 terminals globally, in an increasingly competitive supplier market Increased efficiency and higher ticket sizes drive demand

Demand for self-ordering kiosks has expanded beyond international quick-service restaurant (QSR) chains to local firms and independents, according to a study by strategic research and consulting firm RBR.

Restaurant operators of all sizes are deploying the technology, which allows fully self-service ordering, including selection and payment, to increase efficiency between the point-of-sale and the kitchen, and boost ticket sizes. RBR’s research reveals a dynamic market with more than 100 hardware and software vendors present across 24 countries, including global, regional and domestic players.

Competitive market sees regional variations

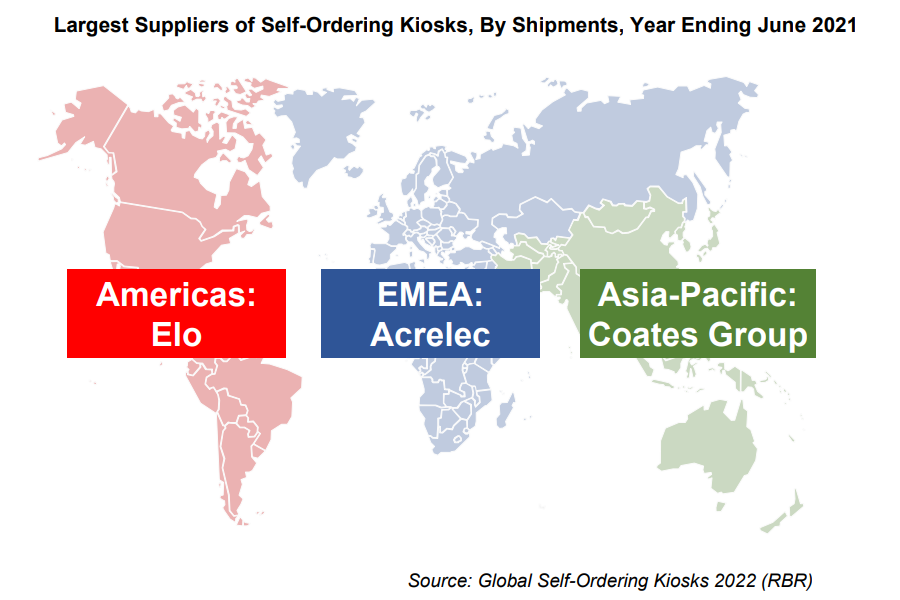

According to the study, self-service and digital technology firm Acrelec shipped the most self-ordering kiosks to the EMEA region in the year ending June 2021. The French firm has a global reach, working with major fast food chains including McDonald’s, Burger King and KFC. Digital merchandising and signage specialist, Australia’s Coates Group, is the largest supplier in Asia-Pacific, delivering terminals to McDonald’s in its home market and across a range of countries in the region.

US touchscreen manufacturer Elo delivered the most units to the Americas, the most fragmented region, supplying QSR chain Taco Bell, which has rolled out the technology across its more than 7,500 US outlets. Elo terminals are also used by smaller chains and independent restaurants; the firm partners with kiosk software firms which in some cases also provide mobile and online ordering platforms.

Other vendors with a major presence include Diebold Nixdorf. Its largest customer is McDonald’s, to which it supplies kiosks manufactured by German firm Pyramid across Europe and North America. Chinese suppliers Taiyun and HiStone (formerly Hisense) both work on major projects with domestic fast-food operators.

Demand set to remain high as new suppliers enter the market

RBR’s research reveals that, in addition to international chains, smaller QSR operators including independents are increasingly embracing kiosks, often deploying self-service software provided by their store technology platform partners which can be used on consumer-grade tablets.

The rapid growth of the kiosk market has also attracted major Korean electronics firms LG and Samsung to build solutions. Both intend to sell their products internationally, with Samsung working with software firm GRUBBRR on a rollout at fast-growing US chain BurgerFi during 2022.

Alan Burt, who led RBR’s research, commented: “The surge in demand for self-ordering kiosks is resulting in new suppliers entering the market. Restaurant operators can choose between software firms that can also integrate digital solutions and specialists in self-service hardware and software. Either way, with labour costs spiralling, future deployment of the technology will remain high”.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: