Cybercriminals target the mobile revolution – one third of all attacks now targeting mobile

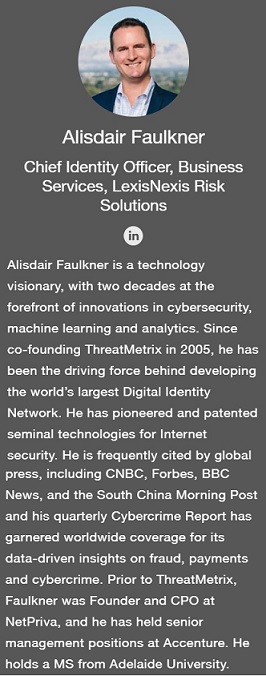

The latest edition of the ThreatMetrix Cybercrime Report is based on actual cybercrime attacks from April to June 2018 featuring global insights from the ThreatMetrix Digital Identity Network. Report Highlights Include analysis of 151 million global cybercrime attacks and 1.6 billion bot attacks. One third of all attacks now targeting mobile.

The latest edition of the ThreatMetrix Cybercrime Report is based on actual cybercrime attacks from April to June 2018 featuring global insights from the ThreatMetrix Digital Identity Network. Report Highlights Include analysis of 151 million global cybercrime attacks and 1.6 billion bot attacks. One third of all attacks now targeting mobile.

A 24% spike in mobile fraud attack rates globally is sparking concern as mobile transaction rates continue to rise at a higher than expected rate.

According to the new Q2 2018 Cybercrime Report from ThreatMetrix, mobile transaction volumes are up 72% year-on-year, reflecting an acceleration in consumer mobile adoption patterns. Today, 6 out of 10 digital transactions are made via mobile devices —up 3X from just 19% in 2015, according to a company’s blog.

Back then, it was almost inconceivable that mobile would virtually replace desktop for many industries and use cases, at least not this fast. Yet that seems to be the trajectory we’re on as mobile rapidly becomes the key enabler at almost every stage of the customer journey.

Naturally, fraudsters have not failed to notice the continued shift in consumer behavior towards embracing mobile. According to the report, which is based on actual attacks within the ThreatMetrix Digital Identity Network from April through June 2018, fraudsters launched more than 51 million attacks on mobile payments, logins and account openings.

Snapshot from the Cutting Edge

The quarterly reports from ThreatMetrix show some of the most current data available globally on cybercrime and fraud patterns. This quarter a number of key trends stand out about the rapidly expanding mobile revolution. Those developments include all the following and more.

Mobile is Now the Main Event

Make no mistake, mobile is no longer a channel for checking and monitoring desktop accounts. Today, it’s quickly becoming the predominant way to access a growing number of goods and services. Nearly two thirds of all account creations now come from mobile devices, whereas in the media industry 76% of payments are mobile, as consumers embrace digital wallets and mobile payments such as Apple Pay. Consumers are also growing more comfortable with storing credit cards in mobile apps.

It Will be a Global Revolution

Consumer habits showcase different stages of development in nations around the world. While 75% of all digital transactions in the UK now come from mobile—the highest percentage of any country analyzed—China is experiencing the fastest growth. There, mobile adoption has soared 60% in the last 12 months.

Mobile-First Could Soon Be More

Mobile-first business models are quickly giving way to mobile first, second- and third- strategies. Looking at the findings from the ThreatMetrix Cybercrime Report, it is clear why such strategies are rapidly evolving; mobile transactions have grown 72% year-on-year – a nearly unconceivable 606% jump from 2015 – while industries like social media and dating sites are seeing 85% of all traffic come from mobile devices. Further still, the fact that 70% of all banking logins are now mobile means this medium has entered a whole new phase.

Fraud is Following Suit

Cybercrime always goes where the opportunities are, and it’s no different with mobile. Today 1 in 3 fraud attacks come from mobile devices, indicating that the channel is still the safest way to transact. However, there were 51 million mobile attacks worldwide during the second quarter, a 101% increase from Q2 2017. For banking, that translated into a 200% increase in attack rates on mobile logins in just three months, perhaps indicating a potential shift in focus of fraudsters to mobile RAT attacks or social engineering scams via the mobile channel.

Bots are Booming

Many of these attacks are now automated. During the second quarter, there were 70 million bot attacks targeting the mobile channel, mostly testing credentials for account takeover. It’s been estimated that 1 in every 17 mobile devices across all six major mobile networks are now part of botnets, acting as launching pads for highly advanced bot attacks.

Fighting Fraud on Many Fronts

Not everything’s doom and gloom—far from it. As mentioned, mobile remains the more secure channel relative to desktop and only 2% of all mobile transactions are rejected as fraudulent on the ThreatMetrix network.

What’s more, there are encouraging signs that this kind of low rate could be sustainable—or even reduced. That’s because mobile is helping to ensure better, more accurate customer recognition rates based on a user’s digital identity, helping businesses to more easily identify good returning users. This also helps them avoid step-ups and manual reviews for transactions that are genuine.

The result: strong customer engagement and a higher proportion of trusted interactions.

Looking Forward

It will be interesting to see how the mobile landscape shifts and morphs in the coming months, especially in Europe with the introduction of PSD2. PSD2 requires greater adoption of multi-factor authentication, and mobile can often be integral for delivering this without adding unnecessary consumer friction.

So, while mobile fraud is on the rise – this channel is integral for the future of secure and seamless consumer experiences. This is a challenge—and opportunity—that businesses in every industry face as the mobile revolution kicks into higher gear.

Download the Q2 2018 Cybercrime Report from ThreatMetrix to learn more about global cybercrime trends and how a digital identity-based approach to mobile fraud prevention can help your business thrive.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: