Bunq, a Netherlands-based app-only bank, has announced the launching of joint accounts for its Premium and Business account holders.

With Bunq+1 users will be able to create an account for anyone they want to, including partners and children. Bunq+1 business clients will be able to create accounts for employees helping them track expenses and company spending easily.

„The more we share our lives with people, the more we’ll be sharing our finances too. Managing money for 2 can be a hassle – so we took it upon ourselves to make it hassle-free for you.”, the bank said.

„Invite anyone to a shared account, with a simple tap in the app! You can set up a shared +1 account from anywhere, anytime. No need for bank branches, wasting time, complicated documents or other mumbo jumbo. Just you, your phone and your colorful bunq app!”

All new users will receive their own card and will be able to spend and deposit money freely.

bunq is seen as part of the four biggest European challengers, together with N26, Revolut, and Monzo, that are building the bank of the future. bunq is the first of the European challenger banks to introduce a credit card.

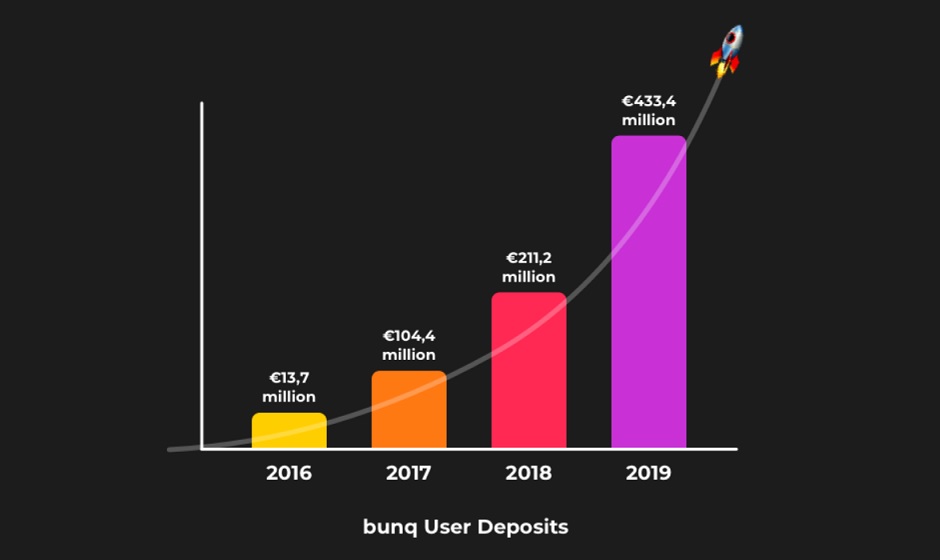

bunq was founded in 2012 by Ali Niknam (1981), who managed to get the first European banking permit in over 35 years. He set out to radically change the traditional banking industry and, as its sole investor, invested €44.9m in bunq. bunq’s latest publicly available number of user deposits is €433,410,761, based on the deposits in December 2019.

Over 2019 the total amount of user deposits doubled and is increasing every day. bunq is currently available in 30 European markets: the Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Poland, Portugal, Romainia, Slovakia, Slovenia, Sweden, the United Kingdom and Norway and Iceland.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: