Bitcoin’s price fell 39.6% in Q3 after rising 39.4% in Q2 – increasing merchant adoption explains the price evolution

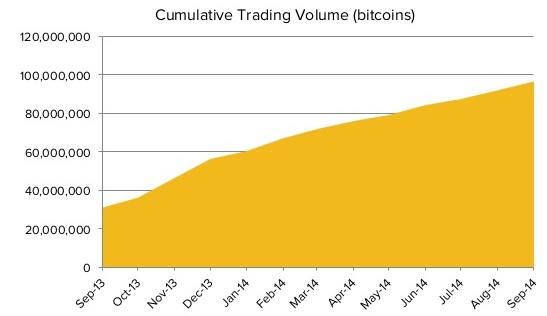

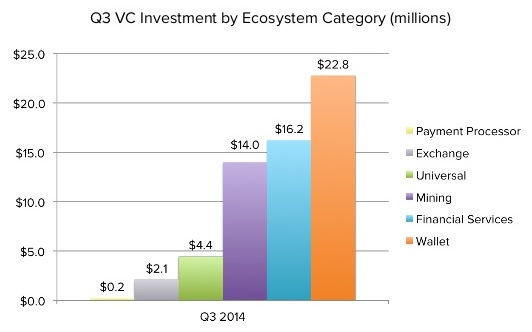

CoinDesk, the world’s leading source of bitcoin news, released the State of Bitcoin Q3 2014 report which analyse the latest bitcoin’s evolution in terms of price, investments, merchant adoption and volume traded. There were 1.2 million new bitcoin wallets created in Q3, representing 21% growth quarter-over-quarter. Coindesk continue to forecast 8 million total bitcoin wallets by the end of 2014 and expects that the number of the merchants who accepts bitcoin payments will exceed 100.000 level in the first quarter next year.

In the media business it is often said that bad news sells more than good, so perhaps the fact that bitcoin’s price fell nearly 40% in Q3 helps explain the greater relative interest in price in the most recent quarter. The third quarter also featured a remarkable price coincidence: after rising 39.4% in Q2, bitcoin’s price fell by a nearly identical amount in Q3.

A wide range of theories have been put forth to explain bitcoin’s price decline, ranging from macroeconomic factors (such as a strong US dollar) and regulatory concerns (like the BitLicense), to a lack of speculative investment momentum.

One of the more widely debated and somewhat counterintuitive theories proposed by Citi and others on why bitcoin’s price saw a steady decline throughout Q3 is increasing merchant adoption. This theory goes as follows: growing merchant acceptance by companies like Dell is creating selling pressure as these companies quickly liquidate bitcoins they accept for national currencies.

However, right now there are arguably too few merchant transactions to have a significant influence on price (for example Overstock is only averaging $15k per day in bitcoin sales) while a single bitcoin exchange like Bitstamp can do upwards of several millions of dollars in bitcoin trading volume each day.

Additionally, while it’s true that in the short-term timing differences may lead to commerce supply-demand imbalances, over the medium-term bitcoin-to-fiat conversions by payment processors should be balanced by fiat-to-bitcoin conversions by bitcoin-spending consumers.

For more details see the State of Bitcoin Q3 Report

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: