BBVA will offer digital customer onboarding everywhere it operates by the end of 2019

Today, the online enrollment service is available in Mexico, Spain, the U.S., and Colombia. It will soon be launched in Peru, Argentina, and Turkey, according to a BBVA press release.

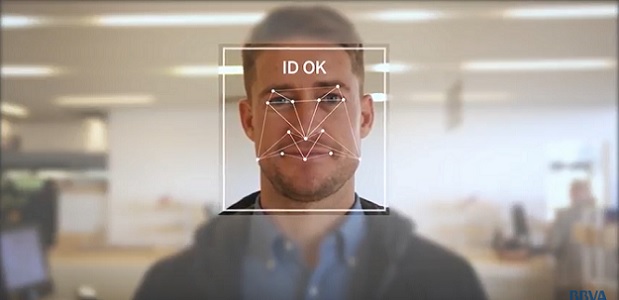

The digital onboarding process based on biometric identification technologies, which is already available in Spain, will now reach other countries thanks to the reuse of globally designed components.

One of the greatest achievements made possible by technology in recent years is that one can become a bank customer without ever having to step foot in a branch. The digital enrollment process is now even more convenient thanks to biometric technologies, which use unique physical traits – faces, voices, or fingerprints – to verify users’ identities.

BBVA customers now use digital channels to make 51 percent of their investment fund transactions. Both the bank’s web site and its mobile application have various tools that help customers make decisions about their savings and investments.

By implementing this biometric technology, BBVA became the first bank in Spain to offer digital enrollment to potential customers. Technology has been improving ever since, making the process even easier. For example, it is no longer necessary to set up a video call to verify the identity of customers in Spain. A short “selfie-video” with the customer showing his or her form of identification is now all that’s needed.

„Our goal is to have digital enrollment available to all users across our operating footprint by the end of 2019,” explained Gonzalo Rodriguez, BBVA Global Head of Customer Solutions.

For 80 percent of the bank’s footprint, this is only possible thanks to the reuse of components that enable biometric identification, components that have been designed holistically so that they can be easily adapted to the distinct requirements of different countries and markets.

For example, in some countries – Colombia, for instance – customers will not have to download or install an app to take advantage of digital enrollment. They will be able to complete the process on the web, which is the preferred channel in this region. Whereas in Turkey and the U.S., the bank uses different identity verification mechanisms via digital channels that conform to regulatory requirements and customer habits specific to these markets.

Veridas, a world leader in biometrics

These biometric solutions have been a collaborative development with Veridas, BBVA’s 2017 joint venture with the Spanish start-up, Das-Nano. Veridas is dedicated to the <strong>research and development of biometric identity verification software, such as voice and facial recognition. In 2019, the U.S. Department of Commerce’s National Institute of Standards and Technology recognized Veridas for having the third best biometric technology in the world. NIST is an international leader in technology standards and releases a vendor test assessment each year.

The test involves running an algorithm to analyze real facial images in poor lighting where the subjects aren’t looking directly at the camera or who might be hiding part of their faces with their hands or hair. Veridas managed to come in third place and is the only Spanish company among more than 100 participants.

„BBVA”s goal is to allow everyone in its footprint to become a BBVA customer securely and over their preferred channel. We want customers to be have access to maximum banking features and services via their preferred channel at any time of day or night, conveniently and safely. To this end, Veridas has demonstrated that they have unrivaled technology, which will now be available to our customers wherever we operate,” Rodríguez explains.

This is why BBVA is looking to do even more than new customer online enrollment. The bank is also working to develop technical solutions that allow current customers to sign up for products – new payment cards, loans, or mortgages, for example – entirely online without having to visit a branch. Throughout 2020, the bank aims to gradually roll-out these features – currently available in some countries – across its entire operating footprint.

New invisibile payment experiences

With the power of biometrics, BBVA also sees a clear opportunity to change the way customers interact not only with the bank but also with merchants and restaurants. In fact, the Veridas BBVA technology is already supporting a functioning facial recognition payment system, operational in the bank headquarters’ corporate cafeterias. This new type of payment experience eliminates lags in customer transactions, resulting in a faster purchasing process and shorter lines, benefiting customers and businesses alike.

„We are already working to explore new experiences for both customers and businesses, novel use cases that will dramatically change the way people pay for products and services.”, Rodriguez concludes.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: