BBVA ports 92% of product portfolio to the mobile – clients in Spain use their smartphones to interact with the bank, on average, once a day

Virtually the entire portfolio of BBVA products in Spain will be available on the mobile by the end of 2017. BBVA has made substantial progress in its digitization process in recent years: The bank’s mobile banking app has gone from offering 16% of the products just three years ago, to 82% today, and will reach 92% next December.

In August, the bank reported over three million mobile customers in Spain, with product sales via the smartphone now surpassing online applications from the bank’s Website.

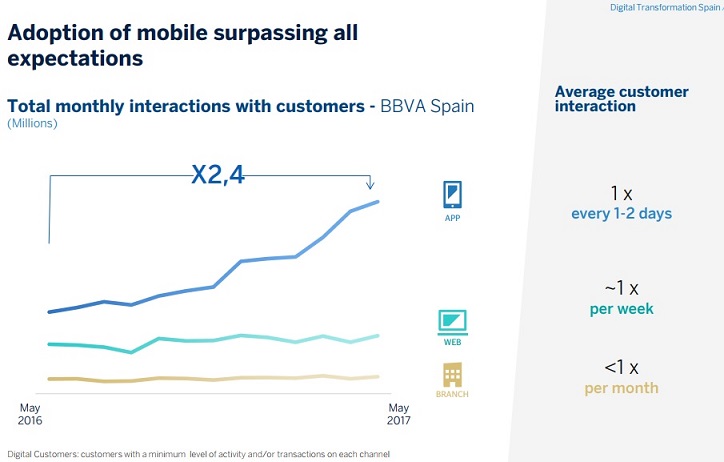

The Spanish bank says interactions via the mobile app have seen a 135% increase over the course of the past year, rising from 23.8 million in May 2016 to 56 million in May 2017. Mobile app subscribers have grown by 30% over the past seven months, continuing the strong momentum that has been in place since December 2015, when the bank had 1.9 million mobile customers.

Gonzalo Rodríguez, head of digital transformation at BBVA Spain, recently explained to a group of analysts the bank’s progress in the process so far, the main metrics and BBVA’s next steps. In his presentation, he underscored the value of the DIY banking experience that BBVA offers its customers, which allows them to taylor services to fit their needs.

The adoption rates of mobile banking is surpassing all expectations. BBVA’s digital clients in Spain use their smartphones to interact with the entity, on average, once a day or every other day. Thus, the number of smartphone-based monthly interactions of BBVA with its Spanish digital customers has doubled in one year.

What are the reasons for this exponential growth figures? BBVA is committed to developing a convenient banking model, one that allows customers to interact with the entity however, wherever and whenever they choose to. And increasingly, customers are turning to digital channels. In 2017, BBVA’s digital channels already accounted for 18% of new customer acquisitions. Another example: 20% of all direct debits were set up using the mobile app.

Another of BBVA’s goals is to offer a transparent and simple integrated product portfolio through its app: mobile payments, cash withdrawal, debit and credit cards management and registration of virtual cards, notifications, etc. For example, so far this year, 90% of all financed payments have been managed through the app.

Between January and June 2017, BBVA’s digital sales in Spain represented 26.3% of total sales. One of the most popular products in digital channels are consumer loans. As of June 30, 2017, 40% of total digital sales were consumer loans.

BBVA complements its digital product offering with a personal advisory service, provided through a number of channels, including remote managers. A customer now can initiate a transaction with support from his/her manager through the BBVA app — recently named the world’s best mobile banking app by Forrester Research— , continue the process by phone, and finally complete the transaction visiting the branch, because managers always have access to all the information available, regardless of the channel that customers chose. BBVA’s manager network already boasts over 1,000 individuals, integrated in the branch office network, and offers service to more than 800,000 clients.

In short, this digital offer is the cornerstone on which BBVA has built its strategy to become its customers’ financial advisor, thanks to technology. How? Helping them make daily decisions about their finances, manage their savings or decide on important issues such has buying a home. Other examples of BBVA’s intent include the personal financial management (PFM) service that BBVA offers through its app —with over 1 million active monthly customers already in 2017—, or the financial calendar, smart alerts or savings goals functionalities.

Source: BBVA

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: