Banks choosing to build and not buy tech, at least for advanced cash-forcasting solutions – suggests survey

A study of 12 countries and 900 senior decision-makers to understand how corporate banks must futureproof themselves.

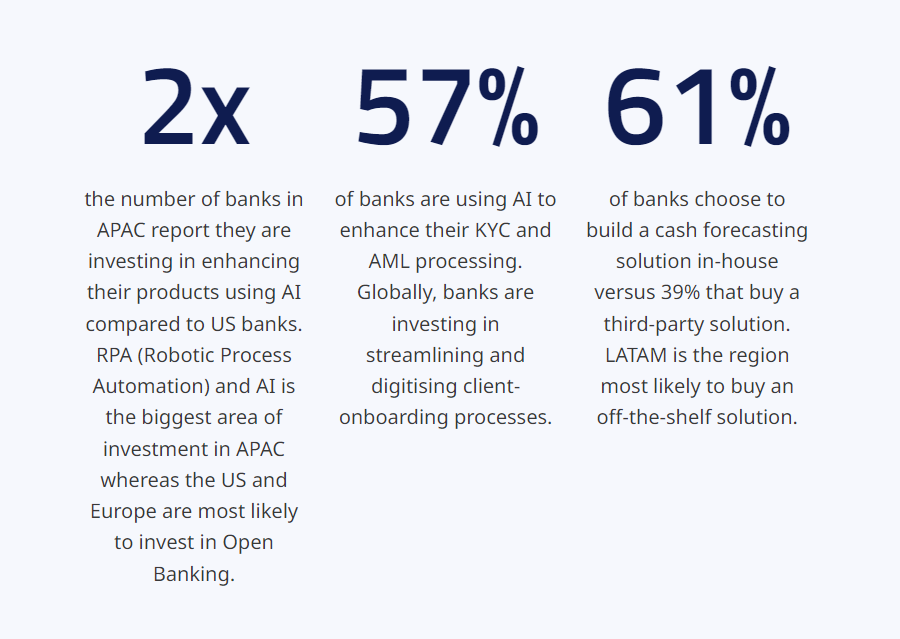

Banking research from NTT DATA has revealed that the majority (61 per cent) of banks are opting to build their own technology stack rather than buying existing solutions, according to information-age.com.

While the majority of banks are electing to build their own solutions to meet client demands, only 22 per cent are building their solutions from scratch, and 78 per cent are building upon their current cash forecasting solution.

Out of the participating banks electing to invest in tech solutions, 54 per cent are planning to work with fintech or a third-party provider, whilst 46 per cent are integrating an off-the-shelf solution.

NTT DATA’s Global Research into Corporate Banking’s Future 2022 collated data from 900 senior decision-makers working in corporate banking, across 12 countries.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: