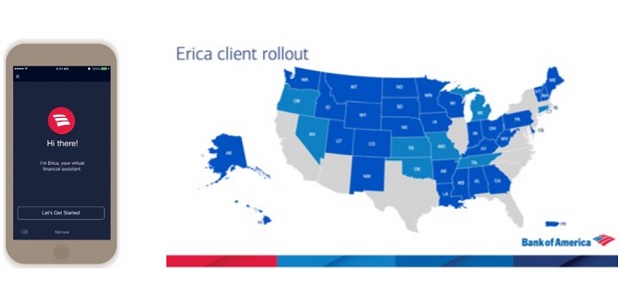

Bank of America begins full scale rollout of AI chatbot

Bank of America is rolling out the first widely available AI-driven virtual assistant of its kind in financial services, Erica, to its 25 million mobile clients. Erica combines the latest technology in artificial intelligence, predictive analytics and natural language to be a virtual financial assistant to clients.

„Erica is designed to learn from clients’ behaviors over time, helping them accomplish simple to complex tasks within the mobile banking app with easy-to-follow prompts. Clients can interact with Erica any way they choose, including texting, talking or tapping options on their screen.”, according to the press release.

“Everything we do is based on what we hear from our clients: how they want to interact with us and how we can make their financial lives better,” said Michelle Moore, head of digital banking at Bank of America. “Erica delivers on this in many ways, from making it easy for clients to find what they are looking for to providing new and interactive ways to do their banking using voice, text or gesture. Through Erica, we are also delivering personalized solutions at scale by providing insights, such as how you can improve your credit score or create a budget.”

The bank recently surpassed 25 million mobile banking clients and began rolling out Erica broadly across the country. The rollout will continue through June.

Currently, clients can ask Erica to:

. Search for past transactions, such as checks written or shopping activity, across any one of their accounts.

. Increase awareness about their credit scores and connect them to information that will help them learn about money management through Better Money Habits®.

. Navigate the app and access key information, such as routing numbers or the closest ATM or financial center.

. Schedule face-to-face meetings with more than 25,000 specialists in our financial centers.

. View bills and schedule payments.

. Lock and unlock debit cards.

. Transfer money between accounts or send money to friends and family with Zelle®.

“Erica’s knowledge of banking and financial services increases with every client interaction,” said Aditya Bhasin, head of consumer and wealth management technology at Bank of America. “In time, Erica will have the insights to not only help pay a friend or list your transactions at a specific merchant, but also help you make better financial decisions by analyzing your habits and providing guidance.”

In the coming months, Erica will be able to tackle more complex tasks, such as:

. Sending proactive notifications to clients about upcoming bills and payments.

. Displaying key client spending and budgeting information and advice on ways to save.

. Identifying ways for clients to save more.

. Managing credit and debit cards to help notify clients of card changes.

. Showing upcoming subscription charges and monitoring transaction history and changes.

Bank of America began piloting this technology with its employees in late 2017 and started rolling it out to clients in March of this year. Since its development, the bank:

. Integrated more than 200,000 different ways for clients to ask financial questions.

. Added new functionality based upon client patterns and behaviors.

. Expanded Erica’s conversational knowledge, including the ability to engage clients with salutations and well wishes, such as “happy birthday”.

. Implemented a real-time feedback capture to inform future enhancements.

Bank of America’s digital banking platform is serving more than 36 million digital clients, including 25 million active mobile users. During the first quarter of 2018, mobile banking clients logged into their accounts 1.4 billion times, made 140 million bill payments and deposited 33 million checks via mobile.

Bank of America is one of the world’s leading financial institutions. The company provides unmatched convenience in the United States, serving approximately 47 million consumer and small business relationships with approximately 4,400 retail financial centers and approximately 16,000 ATMs. Bank of America offers industry-leading support to approximately 3 million small business owners. The company serves clients through operations across the United States, its territories and more than 35 countries.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: