Antitrust: e-commerce sector inquiry finds geo-blocking is widespread throughout EU

More and more goods and services are traded over the internet but cross-border online sales within the EU are only growing slowly. The Commission’s initial findings from the sector inquiry published last week address a practice, so-called geo-blocking, whereby retailers and digital content providers prevent online shoppers from purchasing consumer goods or accessing digital content services because of the shopper’s location or country of residence. This is one factor affecting cross-border e-commerce.

The European Commission has published initial findings on the prevalence of geo-blocking which prevents consumers from purchasing consumer goods and accessing digital content online in the European Union. The information was gathered by the Commission as part of its ongoing antitrust sector inquiry into the e-commerce sector, launched in May 2015. In particular, the replies from more than 1400 retailers and digital content providers from all 28 EU Member States show that geo-blocking is common in the EU for both consumer goods and digital content. 38% of the responding retailers selling consumer goods and 68% of digital content providers replied that they geo-block consumers located in other EU Member States.

The number of respondents by Member State varies mainly because of the different size of e-commerce markets across the Member States, and the number of spontaneous requests to participate in the inquiry that the Commission received.

The results present valuable insight into the prevalence of geo-blocking practices in the EU but are not statistically representative of EU e-commerce markets overall.

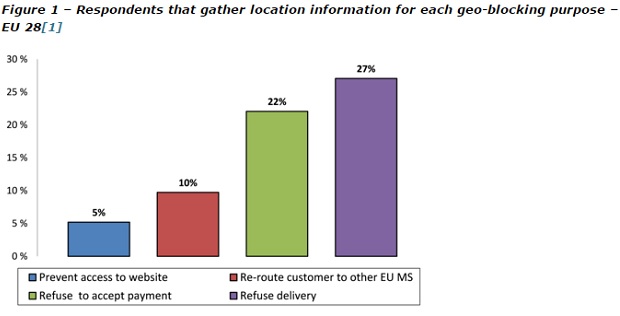

Retailers were asked whether they gather any location related information from users (e.g. internet protocol (IP) address, credit/debit card details) in order to geo-block users. 38% of participating retailers reported they collect such data and use it for geo-blocking purposes.

The methods they use to implement geo-blocking of consumer goods are outlined in the figure below.

(1) a single respondent was able to select multiple types of purposes for which it gathers location information

Geo-blocking by retailers may result from unilateral business decisions by retailers or be based on contractual restrictions agreed between the retailer and its suppliers (see further below Question 3).

Margrethe Vestager, Commissioner in charge of competition policy, said „Where a non-dominant company decides unilaterally not to sell abroad, that is not an issue for competition law. But where geo-blocking occurs due to agreements, we need to take a close look whether there is anti-competitive behaviour, which can be addressed by EU competition tools.„

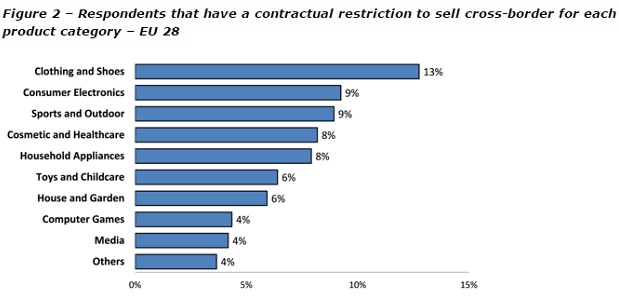

On the basis of the information gathered, contractual restrictions to sell cross-border can be found in all investigated product categories. The figure below summarises the proportion of retailers that reported having such contractual restrictions broken down by product category. Overall, 12% of retailers across the EU reported facing contractual restrictions to sell cross-border.

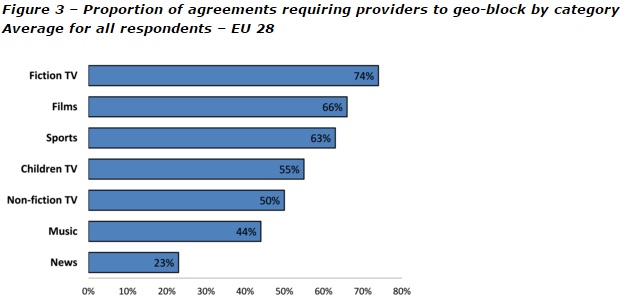

As regards online digital content, the majority (68%) of providers replied that they geo-block users located in other EU Member States. This is mainly done on the basis of the user’s internet protocol (IP) address that identifies and gives the location of a computer/smartphone.59% of the responding content providers indicated that they are contractually required by suppliers to geo-block. There are significant differences as regards the prevalence of geo-blocking between different digital content categories and EU Member States.

What do these initial findings mean?

In some cases, geo-blocking appears to be linked to agreements between suppliers and distributors. Such agreements may restrict competition in the Single Market in breach of EU antitrust rule. This however needs to be assessed on a case-by-case basis.

In contrast, if geo-blocking is based on unilateral business decisions by a company not to sell abroad, such behaviour by a non-dominant company falls outside the scope of EU competition law.

There are a number of reasons for retailers and service providers not to sell cross-border and the freedom to choose one’s trading partner remains the basic principle. Against that background, it is a key priority of the Commission to address unjustified barriers to cross-border e-commerce with legislative actions as part of its Digital Single Market Strategy and it will come forward with further legislative proposals in May. The common objective of competition enforcement and the Commission’s legislative initiatives is to create an area where European citizens and businesses can seamlessly access and exercise online activities, irrespective of their place of residence.

A more detailed analysis of all findings from the on-going e-commerce sector inquiry will be presented in a Preliminary Report due to be published for public consultation in mid-2016. It will not only cover geo-blocking but also any other potential competition concerns affecting European e-commerce markets. The Final Report is scheduled for the first quarter of 2017.

Source: europa.eu

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: