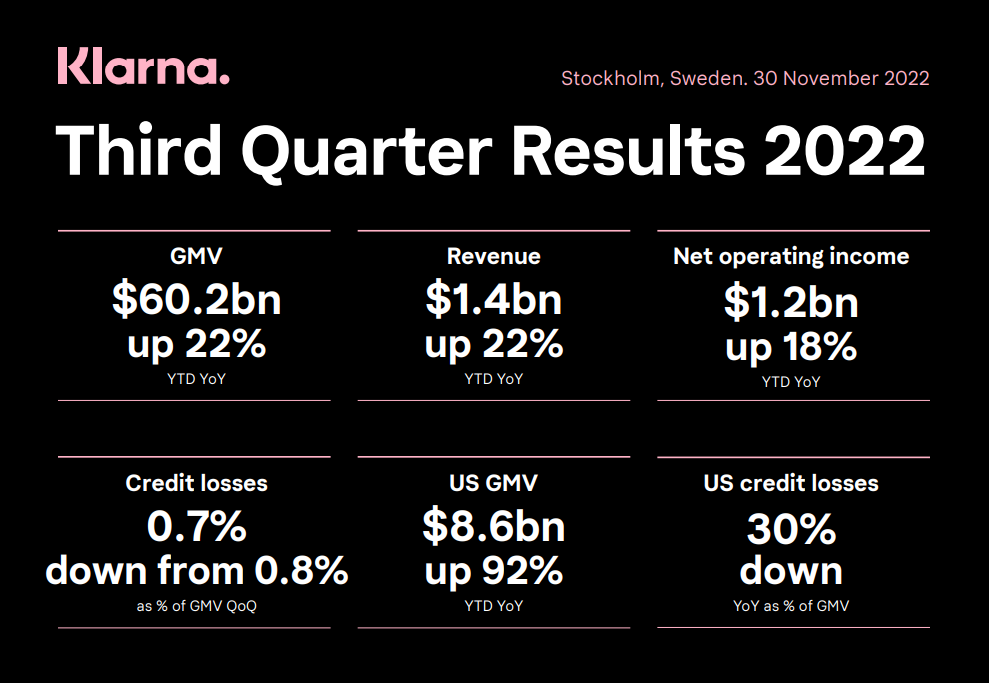

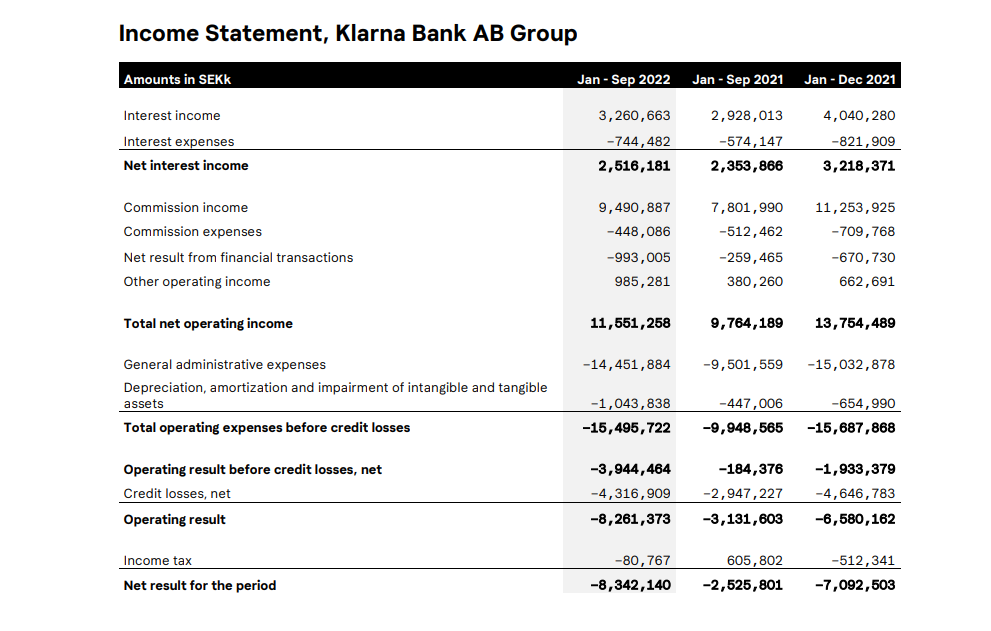

Despite losses more than tripling in the first nine months of 2022 compared to the same period in 2021, buy now, pay later giant Klarna is forecasting to break back into monthly profit in the second half of 2023.

„We have made significant progress on the path to profitability with our top line continuing to grow while both credit losses and total operating expenses declined compared to the prior quarter. Total operating expenses before credit losses decreased 21% in Q322 compared to the prior quarter as we see the impact of changes announced in May and ongoing cost initiatives.” according to the Klarna Q3 results 2022.

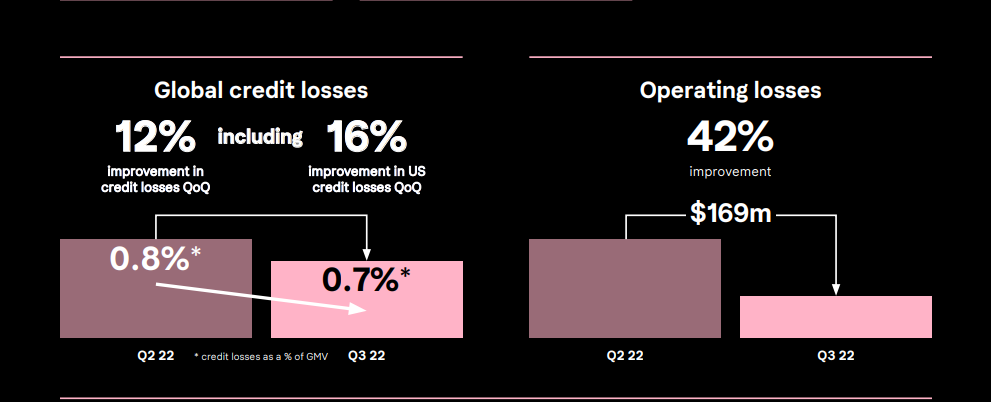

„Global credit loss rates improved 8% compared to the prior quarter at 0.7% of GMV YTD. This is a testament to the dynamic nature of Klarna’s underwriting that allows us to make changes and see the impact just a few months later. Overall the net operating loss for the quarter reduced by USD 169m compared to the prior quarter.” – the company explains.

“Klarna continues to outperform the market with global gross merchandise volumes and revenue up 22% YoY. Klarna has made huge progress on our path to profitability, which we expect to hit on a monthly basis in the second half of 2023, with our operating result improving $169m or 42% on last quarter. We have achieved this while maintaining credit loss rates at very low levels, actually reducing them to just 0.7% of GMV and launching a ton of amazing products from search comparison to automated discounts all of which save consumers time and money.” – says Sebastian Siemiatkowski, CEO and Co-Founder of Klarna.

“The US continues to show massive growth with volumes up 92% YoY. That is a brilliant result considering 2021 was significantly boosted by pandemic-driven e-commerce growth, and because we have driven credit losses down 16% compared to the last quarter and credit loss rates down 30% versus 2021. Our consistent average order values with 99% of consumers paying us back and 70% of global pay later orders settled early, highlight the strength of Klarna’s business model in more challenging times for consumers and retailers alike.” added Sebastian Siemiatkowski.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: