A bank in Canada claims to rolls out world’s first full-featured virtual banking assistant on Facebook Messenger

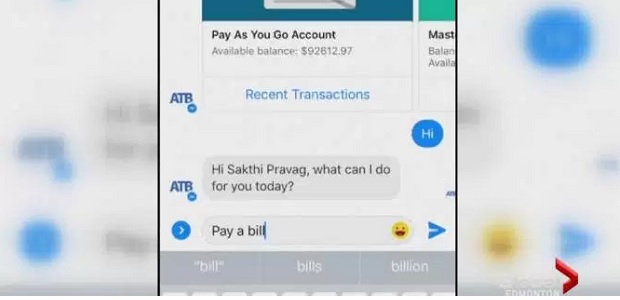

ATB Financial officially launches a virtual banking assistant to the company’s nearly 700,000 personal banking customers, working with FinTech Finn.ai to make access to secure, day-to-day personal banking as easy as initiating a conversation in Facebook Messenger.

„At ATB we’re innovating at the forefront of robotics, AI, biometrics and blockchain, and we’re so excited to bring conversational commerce to all our personal banking customers. It’s one more way we’re delivering on our commitment to really make banking work for people,” says ATB Chief Transformation Officer Wellington Holbrook about the new Messenger-based virtual assistant.

“It lets you do your banking whenever, wherever, and however works best for you.”

While Canada’s big five face off in the bank innovation race, being an agile mid-sized FI has had its advantages. Partnering with like-minded FinTechs—such as Finn.ai—has enabled this project to move from proof of concept to rapid full market deployment. Just last February, ATB announced it was testing AI and chatbot technology with early adopters to enable banking through Facebook Messenger. Now, through rapid iteration and collaboration, well over half a million personal banking customers have access to an industry-leading AI-powered virtual assistant.

What makes ATB’s virtual assistant unique?

„Far beyond a Q&A chatbot, its sophisticated banking transaction abilities offer robust personal financial management tools tailored to fit the needs of each individual customer. Customers can seamlessly pay bills, view account balances, send Interac e-Transfers or transfer money between accounts, as well as perform cross-currency money movement all from within their Messenger platform. The platform also offers spending insights, provides access to a live customer care representative, and Mastercard statement alerts.”, according to the press release.

“AI is completely reinventing the consumer banking experience,” explains Jake Tyler, CEO at Finn.ai. “With the Finn.ai platform, you get more than immediate, secure banking access, you get smart, personalized financial insights to help you achieve your specific financial goals. We’re excited to join forces with ATB and bring this innovative technology to another segment of our fast-growing customer base.”

And that’s just how the assistant can help right now. The virtual assistant is always learning. The more customers engage with it, the more it will be able to do. Accuracy and capabilities will build and improve over time through consumer feedback, customer care agent feedback and reinforcement learning. “The more you interact with the assistant, the smarter it gets,” says Holbrook. “This empowers us to continually improve service and delivery to our customers.”

When it comes to the safety of customers’ personal information, the virtual assistant uses the same level of security and fraud prevention methods as the company’s other online and mobile platforms. This platform also only allows for „friendly” money movement transactions—in other words, customers can only send money to payees or recipients they’ve set up themselves in ATB Online banking or ATB’s mobile app. Accessing banking capabilities through the virtual assistant also requires two-step verification.

ATB’s future vision is to expand this technology into other platforms, helping customers conduct their daily banking in places they never thought possible, says Holbrook.

“We will be tracking the value the virtual assistant provides so that we can potentially replicate this model through additional delivery channels, such as smart televisions, devices and other social networks.”

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: