In 2Q23 the acquiring volumes (1) registered a sustained volume growth in all geographies, despite tough Y/Y comparison due to Covid-19 re-openings in 2Q22. „Compared to 2019, there has been an acceleration of volumes in 1H23, reaching approximately 30%+ across all geographies in June. The volume growth rates across different categories started to converge towards more normalised levels, post Covid-19.” according to the press release.

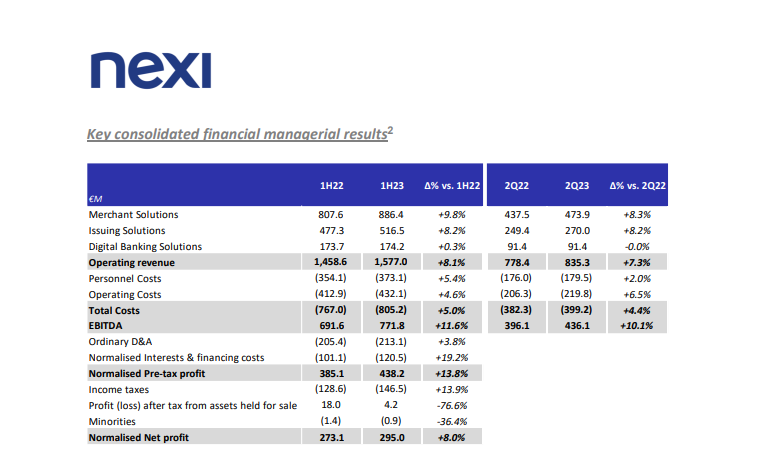

In 1H23 the Group delivered solid financial results, with revenues reaching € 1,577.0 million, +8.1% versus 1H22, and EBITDA reaching € 771.8 million, +11.6% versus 1H22. The EBITDA Margin was at 49%, up by 153 basis points compared to 1H22.

In 2Q23, revenues reached € 835.3 million, +7.3% versus 2Q22 and EBITDA was at € 436.1 million, +10.1% versus 2Q22, with EBITDA Margin at 52%.

Nexi Group’s operating businesses delivered the following results in 1H23:

Merchant Solutions, representing approximately 56% of Group’s total revenues, reported revenues of €886.4 million, +9.8% Y/Y. In 1H23 8,766 million transactions were processed, +14.9% Y/Y, with value of processed transactions at € 392.0 billion, +9.7% Y/Y. Transactions value growth continued across the Group, primarily driven by international schemes, coupled with continued strong growth of customer base and number of terminals.

In 2Q23, Merchant Solutions revenues reached € 473.9 million, +8.3% Y/Y, despite tough Y/Y comparison.

Issuing Solutions, representing approximately 33% of Group’s total revenues, reported revenues of € 516.5 million, +8.2% Y/Y. In 1H23 9,178 million transactions were processed, +12.2% Y/Y, with value of processed transactions at € 425.4 billion, +9.3% Y/Y. Transaction volumes showed a sustained growth versus last year, mainly driven by international schemes.

In 2Q23, Issuing Solutions reached € 270.0 million of revenues, +8.2% Y/Y. In particular, the quarterly performance in Italy has been sustained by positive volume mix, acceleration of international debit, and one-off contribution related to banks’ M&A.

Digital Banking Solutions, representing approximately 11% of Group’s total revenues, reported revenues of € 174.2 million, +0.3% Y/Y, with strong volume growth broadly offset by impacts from banking consolidation in Italy in 2022.

In 2Q23, Digital Banking Solutions reached € 91.4 million of revenues, stable Y/Y.

“This first half of the year confirms a solid and profitable growth in all our businesses and in the different geographic areas in which we operate, despite the ongoing uncertain macroeconomic situation,” commented Paolo Bertoluzzo – CEO of Nexi Group. „We are progressing with our development with great rationality and discipline, investing in the areas with the greatest growth potential, increasingly focusing our business portfolio and accelerating cash generation, to the benefit of our shareholders. In an increasingly competitive digital payments market, our goal remains to strengthen our European leadership position in the industry, supporting the digital development of the countries in which we operate.„

_____________

2. 2022 and 2023 pro-forma normalised managerial data at constant FX and scope (for the M&A recently closed – i.e. ISP merchant book acquisition in Croatia).

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: