EBA publishes Opinion on obstacles to the provision of third party provider services under the Payment Services Directive

The European Banking Authority (EBA) published today an Opinion on obstacles to the provision of third party provider services (TPPs) under the Regulatory Technical Standards (RTS) on strong customer authentication (SCA) and common and secure communication (CSC).

The Opinion aims to support the objectives of the revised Payment Services Directive (PSD2) of enabling customers to use new and innovative payment services offered by TPPs by addressing a number of issues regarding the interfaces provided by account servicing payment service providers (ASPSPs) to TPPs.

Today’s Opinion clarifies when mandatory redirection is an obstacle to the provision of TPPs’ services and the authentication procedures that ASPSPs’ interfaces are required to support. The Opinion also provides clarifications on a number of obstacles identified in the market, including requiring multiple SCAs, the manual entry of the IBAN in the ASPSPs’ domain, or imposing additional checks of the consent given by the customer to the TPP.

The Opinion also explains that requiring re-authentication every 90 days for account information services in accordance with the RTS on SCA&CSC is not an obstacle.

With this Opinion, EBA expects that Competent Authorities (CAs) take the necessary actions to ensure compliance of the interfaces offered by ASPSPs with the PSD2 and the RTS and, where obstacles are identified, to ensure that ASPSPs remove them within the shortest possible time.

The EBA will monitor the way in which the clarifications provided in this Opinion are taken into account. Where the EBA identifies inconsistencies, despite the clarifications provided in this Opinion, it will take the actions needed to remedy them.

Background and legal basis

PSD2 entered into force on 13 January 2016 and applies since 13 January 2018. The Directive enables payment service users to use account information services and payment initiation services offered by TPPs, and requires ASPSPs to establish the access interfaces through which TPPs can access the customers’ payment accounts in a secure manner.

Article 32(3) of RTS on SCA &CSC requires ASPSPs that have implemented a dedicated interface to ensure that the interface does not create obstacles to the provision of payment initiation and account information services. With today’s Opinion, the EBA responds to requests for clarification as to whether certain market practices constitute such obstacles.

The EBA issued the Opinion in accordance with Article 29(1)(a) of its Founding Regulation, which mandates the Authority to play an active role in building a common Union supervisory culture and consistent supervisory practices, as well as in ensuring uniform procedures and consistent approaches throughout the Union.

Opinion on obstacles under Article 32(3) of the RTS on SCA and CSC

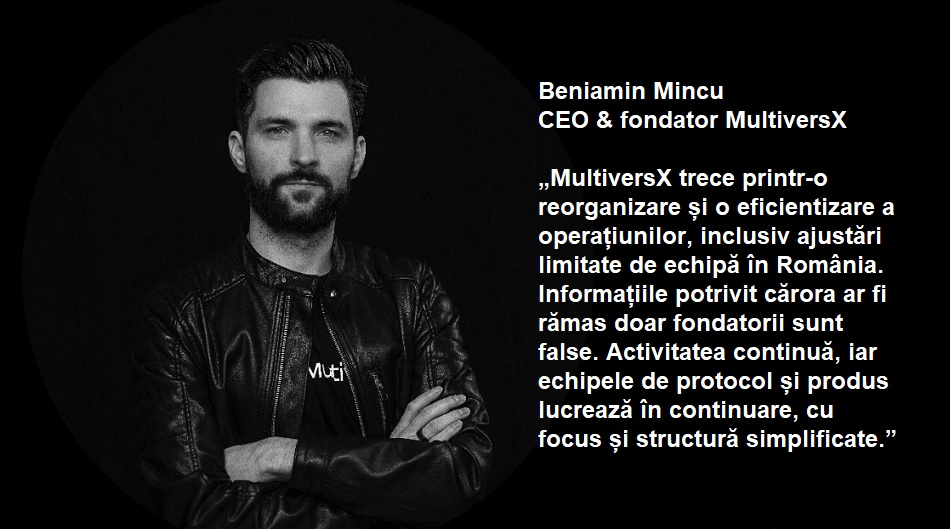

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: