Visa is set to partner with social media platform X as the first financial services platform for its „X Money” feature.

Payments giant Visa and Elon Musk’s X are partnering to offer direct payment solutions to customers of the social media app, according to Reuters. The deal comes as the billionaire continues his efforts to transform the X platform into an „everything app”, aiming to offer a wide range of services, including messaging, social networking and payments.

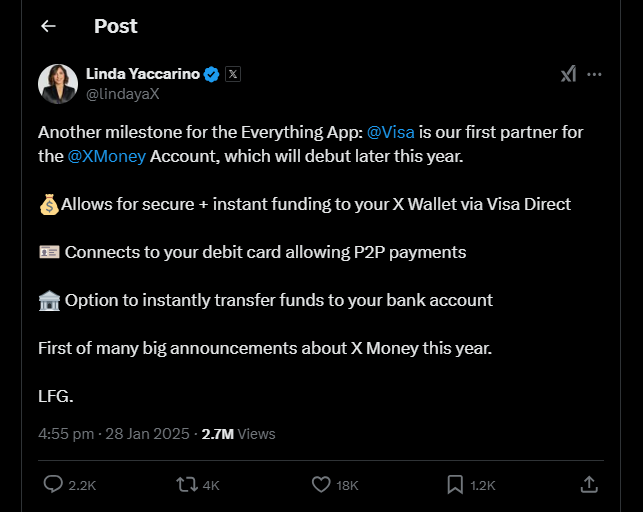

Visa will be the first partner of the X Money account, under which customers can instantly fund their X wallet and connect their debit cards for peer-to-peer payments, the source said. Customers will also get the option to instantly transfer funds to their bank account from X Money.

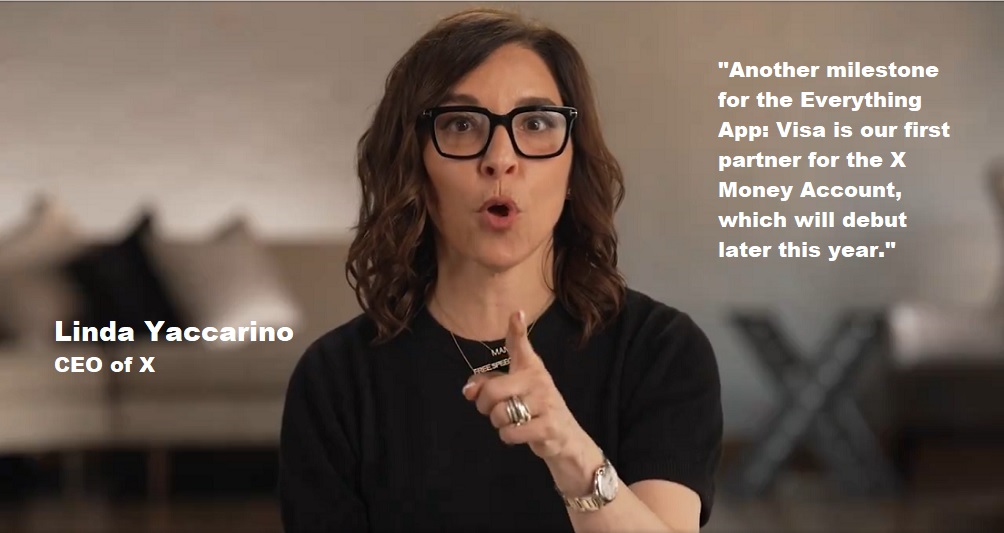

The social media company’s CEO Linda Yaccarino said in a Tuesday post on X that the accounts will start to become available later this year, and said it was the „first of many” announcements about X Money in 2025.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: