World’s first insured Bitcoin storage service launches in the UK

The world’s first insured bitcoin storage service has launched in the UK, with insurance underwritten by Lloyd’s of London. Named Elliptic Vault, the service uses advanced “deep cold storage” techniques to secure its customers’ bitcoins. Deep cold storage involves the use of both strong encryption and secure physical locations.

Tom Robinson, co-founder of Elliptic, which is based in London, said:

“Securing your bitcoins involves implementing advanced encryption and even then you are still at risk of losing them. Elliptic Vault secures your bitcoins for you and is insured against theft or loss, so our customers can have peace of mind that their bitcoins are safe.”

Demand for security

Within the past week, the price of bitcoin peaked at over $1,020. Given that the price was only £125 just three months ago, many people have amassed something of a bitcoin fortune. Unfortunately, there have been a number of instances recently of people losing their bitcoins, either due to human error, or the interference of criminals.

In November, for example, James Howells from Wales realised he had sent $6.5m worth of bitcoins to landfill after throwing out a computer hardrive that contained the wallet files and private keys required to access his coins.

Other bitcoiners have seen their digital currency hoards disappear due to hackers breaking into the wallet services they use. In early November, Inputs.io suffered two hacks, which saw 4,100 BTC emptied from user wallets. Following such developments, many people are anxious to find somewhere secure to store their bitcoins.

“We know a lot of people are concerned about the security of their bitcoin holdings,” said Robinson. ”We are providing a service that will give people peace of mind that their bitcoins are safe and secure,” he added.

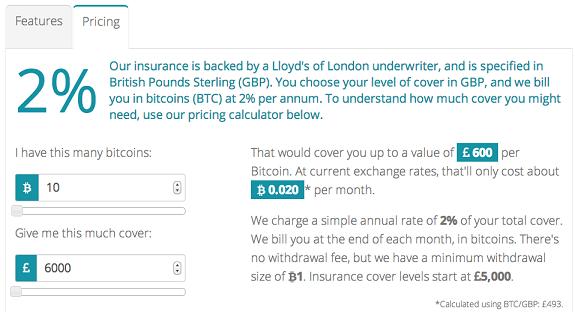

Currently, the service is aimed at those with a relatively large collection of bitcoins, with the minimum level of cover set at £5,000. However, Robinson said his company is aiming to reduce this as the product evolves.

Insurance partner

Robinson said that, as a bitcoin company, Elliptic found it difficult to find an insurance underwriter to work with.

“Insurance is a conservative industry, where relationships matter. It took a lot of time, but we are now working with an underwriter that understands and is comfortable with bitcoin,” he explained.

Lloyd’s of London is a UK-based corporate body that was founded in 1688. It made a pre-tax profit of £2.77bn on £25.5bn of gross written premiums in 2012 offering insurance, reinsurance, and now life assurance.

CoinDesk has seen Elliptic’s Lloyds of London insurance certificate, so can confirm it exists, but can’t vouch for its authenticity or applicability.

Customers can choose the level of bitcoin insurance they require, specified in pounds sterling (although this service is available to those based both in and outside the UK). Users pay an annual rate of 2%, which is paid in bitcoin, in monthly instalments at the end of each month.

The insurance offered covers loss of bitcoins, whether caused by any negligence by Elliptic or due to theft by a third party. If users have to make a claim, their bitcoins would be valued at the time of the claim, using the BTC/USD exchange rate on Bitstamp, and the GBP/USD exchange rate. Elliptic said it uses the BTC/USD exchange rate (rather than BTC/GBP), as the US bitcoin exchange market is the most liquid.

Example of calculation

Source: www.coindesk.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: