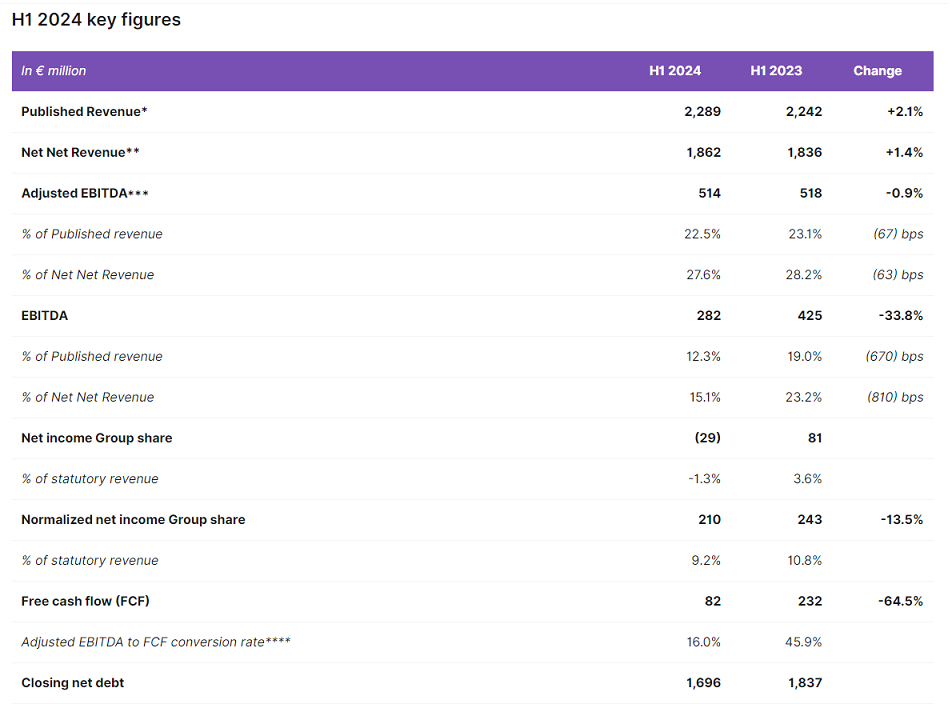

Worldline’s H1 2024 revenue reached € 2,289 million, representing +2.1% revenue organic growth (+4.2% excluding Merchants’ termination).

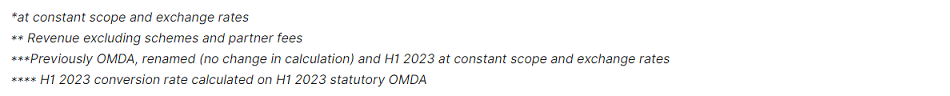

„Despite resilient activity in Italy and in verticals such as travel and gaming, Merchant Services performance (€ 1,658 million revenue, +3.2% organic growth) was impacted by softer macroeconomic conditions during the second quarter in our core geographies, less consumer spending in Europe and the termination of some of our online merchants as planned.” – the company explained.

Financial Services performance (€ 457 million revenue, 1.5% organic decline) reflected the impact of the earlier re-insourcing of certain contracts, which was partially offset by the good performance of acquiring and issuing processing. Lastly, Mobility & e-Transactional Services (€ 174 million revenue, +1.0% organic growth) achieved a sustained performance driven by good momentum in its Trusted Services division.

The Group’s Adjusted EBITDA reached € 514 million in H1 2024 (22.5% of revenue), broadly stable compared to H1 2023. The profitability in Merchant Services decreased as anticipated (driven by planned merchant terminations). It could not be fully offset by improved adjusted EBITDA margin in the Financials Services and Mobility & e-Transactional Services divisions and lower costs in corporate functions.

Net income Group share was € (29) million, mainly impacted by €174m of Power24 non-cash provision. On a Normalized basis (excluding other operating income net of tax) Net income Group share reached € 211 million.

Normalized basic and diluted EPS were both € 0.74 in H1 2024, versus € 0.86 in H1 2023.

Free cash flow was € 82 million, i.e. 16.0% cash conversion of adjusted EBITDA (free cash flow divided by adjusted EBITDA).

At the end of H1 2024, Group Net debt amounted to € 1,696 million. representing a Group leverage ratio of 1.5x on an LTM basis.

Merchant Services revenue in H1 2024 reached € 1,658 million, representing 3.2% in organic growth. Adjusted EBITDA amounted to € 386 million, 23.3% of revenue, impacted by the macro effect on transactions and driven by planned online contract terminations.

Financial Services revenues totaled € 457 million and € 126 million in Adjusted EBITDA, representing 27.7% of revenue, up 74 basis points despite decreasing revenue.

Mobility & e-Transactional Services achieved € 174 million revenue and € 30 million adjusted EBITDA during the first semester, representing 17.1% of revenue. Adjusted EBITDA margin was up 334 basis points compared to last year, driven by substantial improvement in workforce management and a strong rationalization of our infrastructure costs.

Corporate costs amounted to € 28 million in H1 2024, representing 1.2% of total Group revenue compared to € 30 million in H1 2023, benefitting from the implementation of continued cost controls in support functions.

Gilles Grapinet – CEO of Worldline, said: „Worldline delivered a good first half performance, mainly driven by our Merchant Services activities showing a robust underlying growth above 6%. This was achieved in a volatile consumer spending environment that exhibited a visible softening across many European countries in the second quarter. During the semester, we also achieved good commercial developments of registering new signatures and with the onboarding of c.30,000 new merchants on Worldline’s target platform.

As witnessed by many companies in consumer-driven industries, the European domestic consumption trends have slowed down during the second quarter and the speed of a potential recovery remains uncertain at this stage. As a result, we adapt our financial expectations for the rest of the year considering this uncertain macro environment with a strong focus on free cash flow generation that we intend to keep in line with our initial ambition.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: